- White House Press Secretary said the CPI report is welcome news, and the Trump administration is focused on driving down costs; White House Economic Adviser Hassett said he expects US GDP growth to be 2.0%-2.5% in Q1, according to a Fox News interview.

- US Senate Democratic Leader Schumer said Senate Republicans do not have the votes to approve the House-passed government spending bill without amendments.

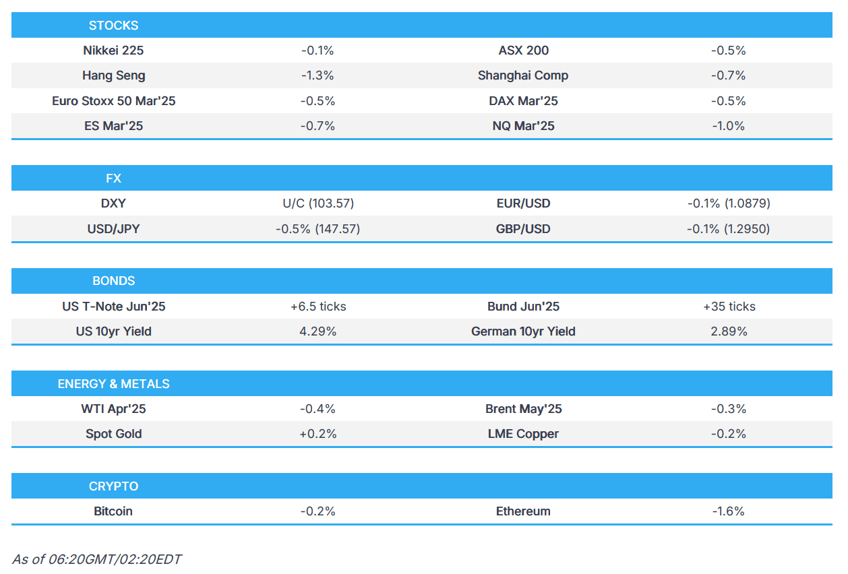

- APAC stocks were subdued as risk appetite soured despite the mostly positive handover from Wall St where sentiment was underpinned after softer-than-expected CPI data but with the upside capped as concerns lingered.

- DXY struggled for direction after yesterday's choppy performance and brief post-CPI wobble with price action contained overnight as a lack of fresh catalysts kept trade muted across the FX space.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.5% after the cash market closed with gains of 0.9% on Wednesday.

- Looking ahead, highlights include EZ Industrial Production, US Initial Jobless Claims, US PPI, IEA OMR, Speakers including ECB’s Lagarde & de Guindos, Supply from Italy & US, Earnings from Dollar General, DocuSign, Ulta Beauty, K+S, Hannover Re, Deutsche Bank & Halma.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks mostly finished higher on what was a choppy session with the major indices ultimately boosted by a soft US CPI report, although the gains were capped as US growth concerns and tariff uncertainty continued to linger heavily in the background after the recent tariff developments and retaliatory announcements.

- SPX +0.49% at 5,599, NDX +1.13% at 19,596, DJI -0.20% at 41,351, RUT +0.14% at 2,026.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump posted on Truth Social that the US is going to take back a lot of what was stolen from it by other countries and by incompetent US leadership, while he added they're going to take back their wealth and take back a lot of the companies that left.

- Canadian Minister of Export Promotion, International Trade and Economic Development Ng said tariffs violate US obligations under the USMCA agreement and that Canada is seeking formal consultations with the US on steel and aluminium tariffs.

- US Secretary of State Rubio is to today meet with Canada's Foreign Minister Joly in Charlevoix, Canada.

- Brazil said it considers US tariffs 'unjustifiable', while it will seek to defend the interest of Brazilian companies after US steel tariffs and will consider all possible measures in reaction to US tariffs.

- US food giants including PepsiCo (PEP) and Conagra (CAG) are reportedly pushing to exempt certain imports from tariffs, according to the trade group.

NOTABLE HEADLINES

- US Treasury Secretary Bessent spoke with congressional leaders about making Trump tax cuts permanent and said that is what they will deliver, according to Fox Business's Lawrence.

- White House Economic Adviser Hassett said he expects US GDP growth to be 2.0%-2.5% in Q1, according to a Fox News interview. Furthermore, President Trump posted on Truth Social comments on the economy made by White House Economic Adviser Hassett in an interview stating economic news they are seeing is wonderful and above economists' expectations citing 10,000 manufacturing jobs, 9,000 auto jobs and the lowest core inflation in four years.

- White House Press Secretary said the CPI report is welcome news, and the Trump administration is focused on driving down costs.

- US Senate Democratic Leader Schumer said Senate Republicans do not have the votes to approve the House-passed government spending bill without amendments.

APAC TRADE

EQUITIES

- APAC stocks were subdued as risk appetite soured despite the mostly positive handover from Wall St where sentiment was underpinned after softer-than-expected CPI data but with the upside capped as concerns lingered.

- ASX 200 was dragged lower by consumer stocks, energy and financials, with the consumer sector pressured as electricity bills are to jump as much as 9% in a cost-of-living blow following the energy regulator’s price ruling.

- Nikkei 225 initially outperformed and briefly reclaimed the 37,000 level before wiping out the gains.

- Hang Seng and Shanghai Comp gradually deteriorated following a tepid PBoC liquidity operation and with participants unfulfilled by the lack of policy action so far by the central bank post-NPC, while reports that Hong Kong is mulling reducing thresholds for purchasing the most expensive stocks did little to spur a bid.

- US equity futures trickled lower after the mild tailwinds from the softer CPI data petered out.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.5% after the cash market closed with gains of 0.9% on Wednesday.

FX

- DXY struggled for direction after yesterday's choppy performance and brief post-CPI wobble with price action contained overnight as a lack of fresh catalysts kept trade muted across the FX space.

- EUR/USD was little changed following recent indecision amid the bloc's retaliation announcement to US steel and aluminium tariffs.

- GBP/USD traded rangebound after the prior day's momentum stalled on approach towards the 1.3000 level and as UK-specific news flow remained light.

- USD/JPY trickled lower following its mid-week pullback from the 149.00 level and with a recent source report suggesting that the BoJ is unwilling to step into the bond market despite the rise in yields.

- Antipodeans faded its recent gains as risk appetite gradually deteriorated overnight.

- PBoC set USD/CNY mid-point at 7.1728 vs exp. 7.2439 (Prev. 7.1696).

- BoC Governor Macklem said the BoC discussed pausing rates at 3% ahead of Wednesday's announcement and they are not ruling out an unscheduled rate move if something severe happens suddenly. Macklem said the argument for staying at 3% was that growth had been stronger than they expected and another was to wait until US trade and tariff policies are a little clearer, although given that they expect tariffs to cause economic weakness and the fact inflation is close to 2%, they felt the most appropriate course of action was to cut by 25bps, according to a Reuters interview.

- Canadian Prime Minister-designate Mark Carney will be officially sworn in on Friday and is to shrink the cabinet when he takes over with the cabinet expected to have between 15 and 20 ministers, down from the current 37, according to Bloomberg

FIXED INCOME

- 10yr UST futures lacked firm conviction after failing to sustain the knee-jerk post-CPI surge, while the improved results from the latest 10yr auction stateside did little to support prices.

- Bund futures continued the gradual rebound from contract lows but remained firmly beneath the 128.00 level with a lack of catalysts to fuel the recovery and after recent ECB rhetoric provided very little incrementally

- 10yr JGB futures initially tracked the mild gains in global peers but then faltered as yields slightly gained and with a recent source report noting that BoJ officials see several reasons against intervening in the bond market even after benchmark yields hit the highest level since 2008. Furthermore, there were also comments from BoJ Governor Ueda who said Japan’s monetary base and balance sheet are somewhat too big which is why bond buying is being slowed.

COMMODITIES

- Crude futures traded rangebound but held on to most of the prior day's spoils after gaining as cooler-than-expected US CPI supported the risk environment, while the recent inventory data also showed a narrower-than-expected build in headline crude stockpiles.

- Spot gold remained underpinned and continued the upward momentum seen post-CPI data.

- Copper futures traded sideways with demand hampered as risk sentiment in Asia gradually soured.

CRYPTO

- Bitcoin was choppy and ultimately pulled back following a brief return above USD 84,000.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said underlying inflation remains slightly below 2% but expects it to gradually accelerate as the economy recovers, while he added that the BoJ is gradually shrinking the size of its balance sheet and will take time to assess the ideal size, considering overseas examples. Ueda also said Japan’s monetary base and balance sheet are somewhat too big which is why bond buying is being slowed.

- Hong Kong mulls reducing thresholds for purchasing the most valuable stocks, according to Bloomberg.

GEOPOLITICS

MIDDLE EAST

- Hamas official said they welcomed US President Trump's apparent retreat from calls for the displacement of Gazans.

RUSSIA-UKRAINE

- US White House said National Security Adviser Waltz spoke with his Russian counterpart.

- Russian President Putin said troops should defeat the enemy in the Kursk region and completely liberate the region, while it was also reported that Russia's Chief of the General Staff said Kyiv's plans in Kursk region failed and Ukrainian forces in the Kursk region are surrounded, according to IFX. It was later reported that the Kremlin said the operation in the Kursk region is at the final stage, according to TASS.

- Ukraine's top army commander said Russia is trying to oust Kyiv troops out of the Kursk region and move fighting into Ukrainian border territories, while he added Kyiv will hold defence in the Kursk region as long as necessary.

OTHER

- Polish President Duda urged for the US to move nuclear warheads to Polish territory, according to FT.

EU/UK

DATA RECAP

- UK RICS Housing Survey (Feb) 11.0 vs. Exp. 20.0 (Prev. 22.0, Rev. 21.0)