INTRO

It’s that time of year when market junkies start to build their list of top trade ideas for 2024. The crowd loves their trading, their predictions, and their guesswork. Although we at C&P are laser focused on a #riskfirst approach, we can stray into the guessing lane.

We are never afraid of being wrong; even the best traders are wrong 50% of the time. Our #COTY (Call Of The Year) is: BITCOIN & GOLD. AKA “fiat alternatives”. There are other cryptos and precious metals, but for simplicity’s sake, we’ll stick with the biggies.

We have compiled a top ten list of reasons why we favor fiat alternatives, but let’s first set the table. The seeds of inflation have been sown for decades, and 2021 and 2022 was when the inflation genie came out of the bottle.

Both bitcoin and gold underperformed in 2022, to say the least. Where gold had a flat 2022, Bitcoin was down roughly 65% in 2022 and traded down almost 80% from the 2021 peak. With the world off-sides and confused, 2023 was supposed to be a recession year. We did witness the CPI fall from 9% (mid-2022) to 3%, yet the fiat alternatives surprised to the upside. Mr. Market threw another curve ball.

This is a good time to highlight a chart that shows a truer inflation picture. As the CPI has fallen below 4%, Shadow Stats inflation rate has only pulled back to 12%.

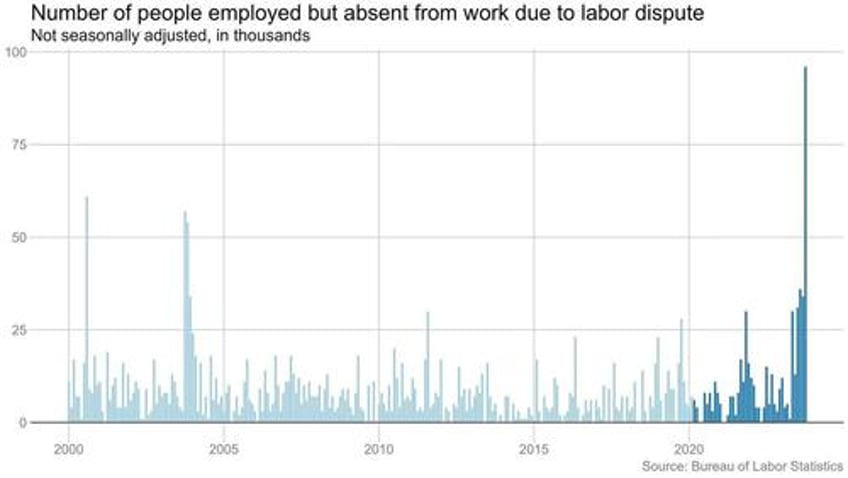

KEY CONCEPT: Now we have inflation gauges turning up again and wage pressure at record levels. CAN THE INFLATION GENIE BE TAMED, OR DOES IT TURN INTO A MONSTER?

A NEW LENS

Inflation means a lot of different things to different people. Some see inflation as growth, others see inflation as an increase in prices, and many see inflation as an increase in currency units. Today we’ll define inflation as “the destruction of money”.

A simple example is the median home price in the US. We just watched that house go up in price from $250k to $400k over the past few years. But the house did not change. The only thing that changed was the amount of currency you need to shell-out in order to own that house. Your currency lost value. The currency value was destroyed by inflation.

We supported a 20% allocation towards fiat alternatives in our Multi-Asset missive here. We believe the asset class is under-owned, and below are ten reasons to own gold and bitcoin.

TEN REASONS WE FAVOR FIAT ALTERNATIVES FOR OUR 2024 COTY

#RISKFIRST: We favor a RISK FIRST approach to asset allocation, and we got into the details in a previous post here. We feel very comfortable saying that these are uncertain times. Uncertainty can lead to outsized gains, but it comes at the price of increased volatility and decreased liquidity. Our focus on these types of market environments is not about making; it is about preserving.

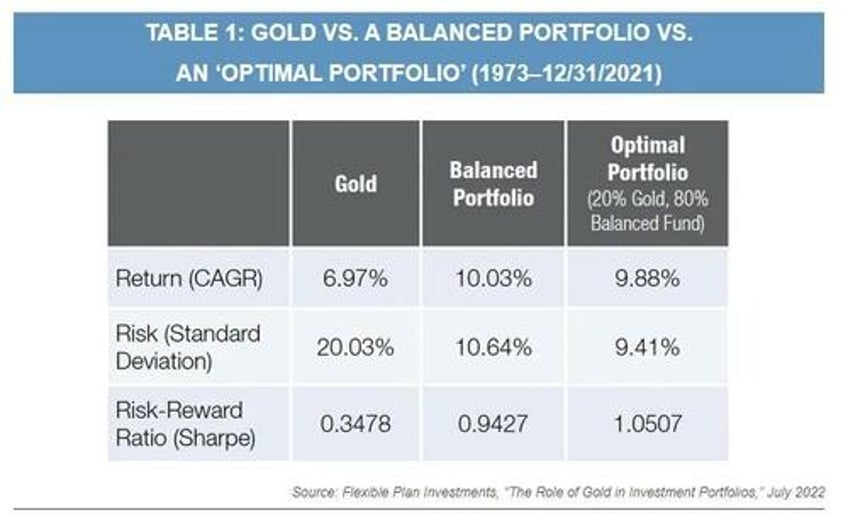

INSURANCE: We often hear gold suggested as an insurance component in a portfolio. That resonates. Gold can protect your purchasing power, and gold is an uncorrelated asset, which is hard to find these days. Uncorrelated assets offer true diversification, and can enhance the risk adjusted returns of a portfolio. We already have insurance on our autos, homes, lives, and pets, so why not insure our portfolios and purchasing power?

UNDER-OWNED: Both Bitcoin and gold are controversial assets that are not widely adopted like stocks and bonds. The lack of participation is palpable. This can be viewed as a longer-term tailwind. We will use silver to make a point. The “float” in silver (notional amount available to trade) is only $43B (https://silverseek.com/article/money-versus-metal), which could be found in the couch cushions in the Eccles Building (The Fed).

DO MORE OF WHAT IS WORKING: Bitcoin and gold both arrived late to the inflation party, and they both clocked in an impressive 2023 (so far). These under-owned assets remain an attractive hedge.

DE-DOLLARIZATION: The de-dollarization story is global, obvious, and smart (we’d do the exact same thing if we were in their shoes). And this applies to anyone trading, holding, or dealing in dollars. The bottom line is that our money system is changing. And it does not matter which comes first inflation or deflation, because 1. We will see both. And 2. The end result is the same, which is the Final Fiat Fiasco (#FFF).

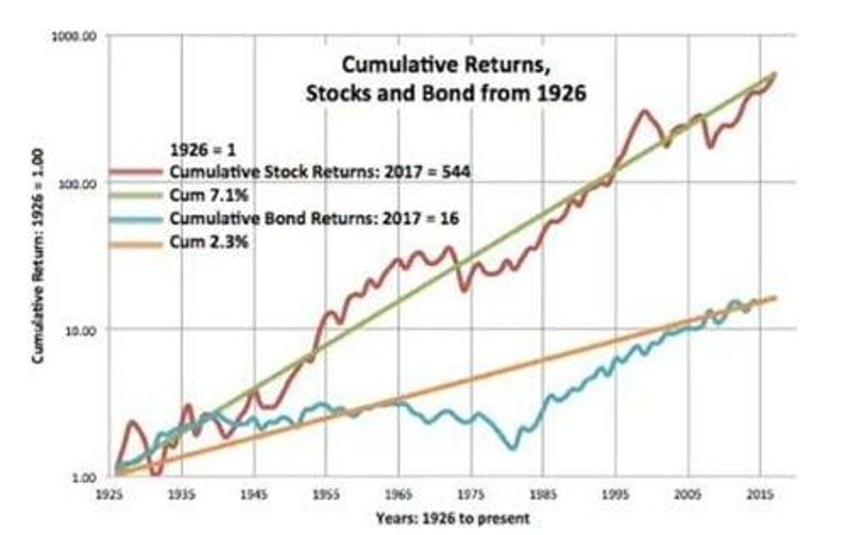

60/40 IS SHOWING SIGNS OF CRACKING: After an abysmal 2022 (worst in 100-years) the 2023 poor performance is getting masked. Strip-out the Fab-7 stock rally, and we are left with another 60/40 hiccup. Two data points worth flagging: 1. The $100 TRILLION wealth management industry has the 60/40 portfolio at its core. 2. A favorite quote from Christopher Cole, “the entire global financial system is levered to the theory that stocks and bonds are always anti-correlated.” Bitcoin and gold can offer a hedge to the traditional 60/40 portfolio. It is also well documented that adding gold to a 60/40 portfolio will increase the risk-adjusted returns of the portfolio.

Correlations can swing wildly depending on the time frames used. With a wider lens, it appears that stocks and bonds have been positively correlated the past 50-years. Enter inflation.

DEFENSE WINS GAMES: A rock-solid defense can put you in a better position to play offense and strike when you see an opportunity. We can take it a step further and say that the real/big money is made with speculation. With a strong defense, we can be patient for the high conviction ideas. We can also make a case that the cost of the speculation is cheaper with a winning defense. This is because the odds of both bets (the speculation AND the defense) going awry is lower than with a weaker defense (a more volatile portfolio).

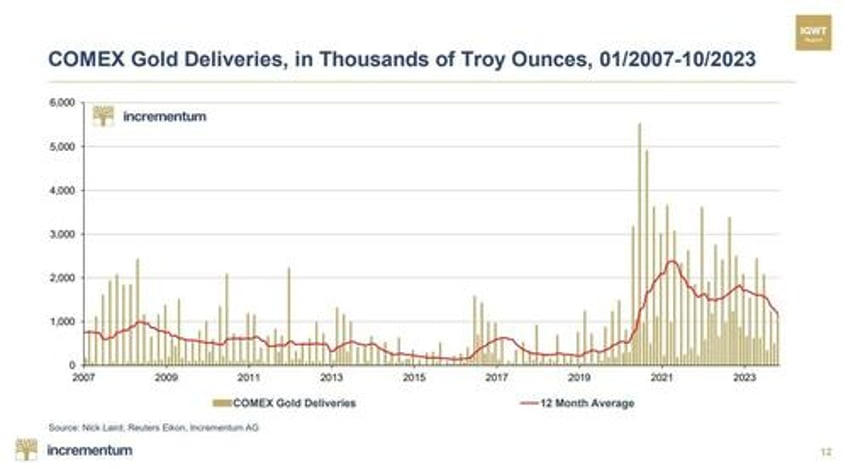

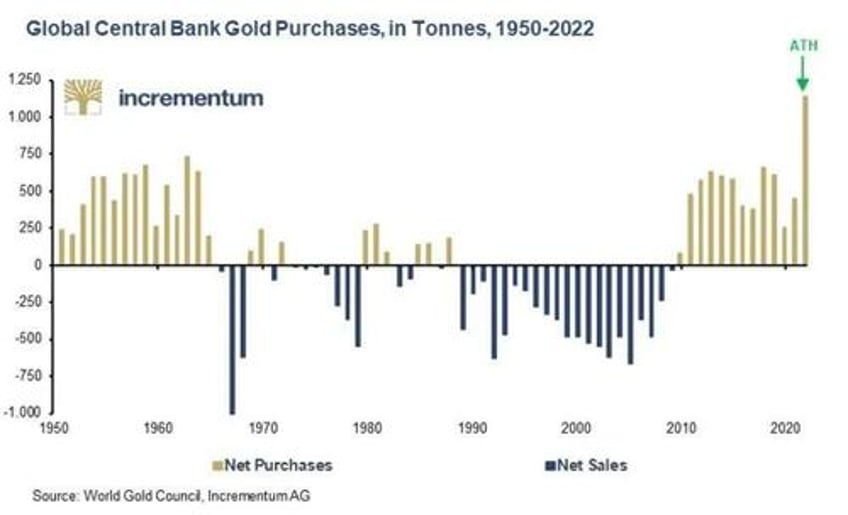

WATCH WHAT THEY DO, NOT WHAT THEY SAY: The central banks keep buying gold. They all agree on something. And 2023 is the year Larry Fink and Blackrock warmed up to Bitcoin. BlackRock’s risk management system is called Aladin, and BlackRock has almost $10T of assets under management, and their same Aladin system is also being used to manage an additional $10T outside of Blackrock.

NEW VOL: We converted our 4-part Substack series into an eBook called New Vol (Download Here). Bitcoin and gold provide an off-ramp from the system and an on-ramp towards personal resilience.

INFLATION: As the impacts and dangers of inflation become more mainstream, we may see wider adoption of our fiat alternatives. This is a global story, and the number of currency units sloshing around just doesn’t pencil out. And let’s not forget about the psychological impact of inflation, especially as we potentially enter the exponential part of the story.

IN CLOSING

Whether we call this a bet, a trade, an investment or #COTY, we believe fiat alternatives belong in a portfolio. This may not be the path of least resistance, but the strategy has math and history on its side. We favor the (dark) humor angle to cut through the chaos, and here is the “Cerealomics” we recently created:

* * *

Thanks for reading Charts and Parts! Subscribe for free to receive new posts.