Today is the busiest day of Q2 earnings season, and the highlight of today's earnings releases will be reports by tech gigacaps Amazon ($1.4TN) and Apple ($3.02TN mkt cap, world's largest), which collectively have over $4 trillion in market cap, and while they may not give a strong read-through on the broader economy, certainly every investor will be watching results.

Here is a preview of what to expect, courtesy of JPM TMT trader Jack Atherton and Goldman TMT trader Peter Callahan:

AMZN reports post close on 8/3 (conf call @ 530pm ET): From AI loser to AI winner in a matter of weeks. Not only is there a sense AI creates a rising tide for all Cloud Infrastructure players, but investors are increasingly confident that OpenAI/GPT won’t be the only LLM in town with AWS well placed as an LLMagnostic platform.

Into the print, most focus is on the AWS: buyside looking for Q2 and July update for +9-10%, and many investors are hoping for mgmt to give a Q3 guide to demonstrate accelerating trends on easy comps (the hope being that Q2/July is the bottom). At

At group level, buyside whispers are Q2 revenue ~$131B, EBIT ~$5B (guide $127-133b, $2.0-5.5b)

Q3 guidance of ~$139b, EBIT ~$4.5B (both midpoints).

Stock +52% YTD; Options implied move 6.3%.

What to focus on:

AWS growth rate (bar a bit lower post MSFT Azure print, but investors still looking for greenshoots here -- July vs June growth, Backlog, A.I. contribution);

Continued improvements in Retail Margins (e.g. beat high-end of EBIT guide.

GS desk has positing core as 8 out of 10. Stock has sold off 9 of last 11 prints T+1.

* * *

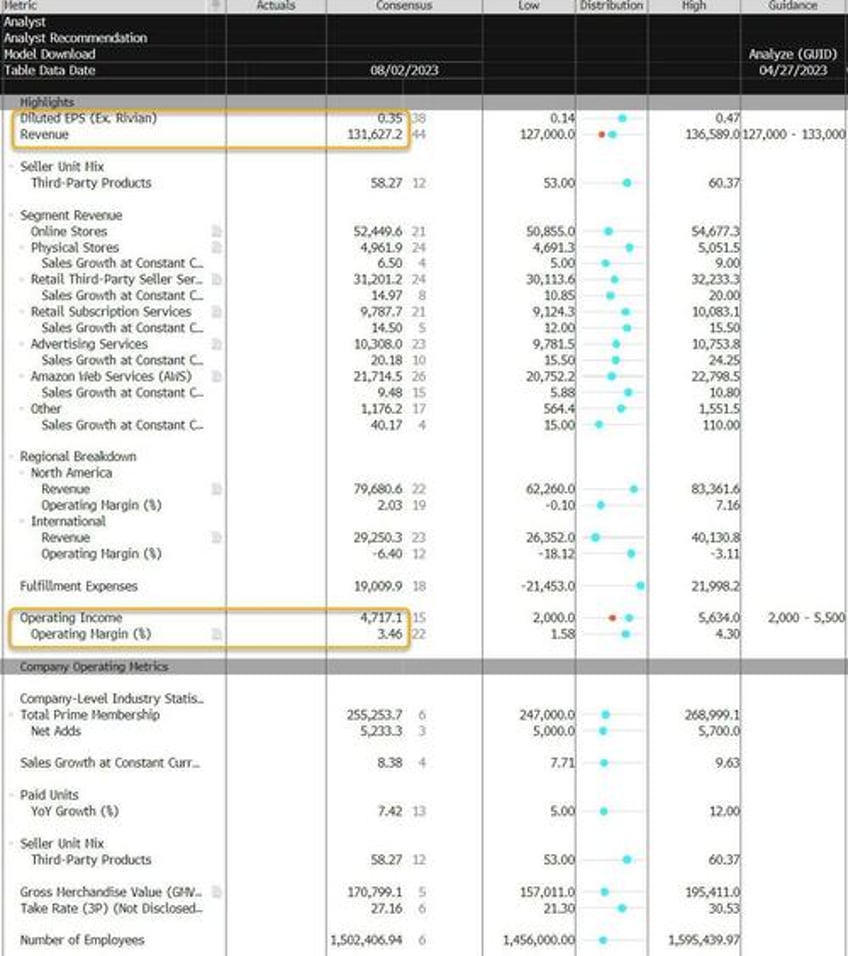

Here is what the sellside expects from AMZN, courtesy of Bloomberg:

* * *

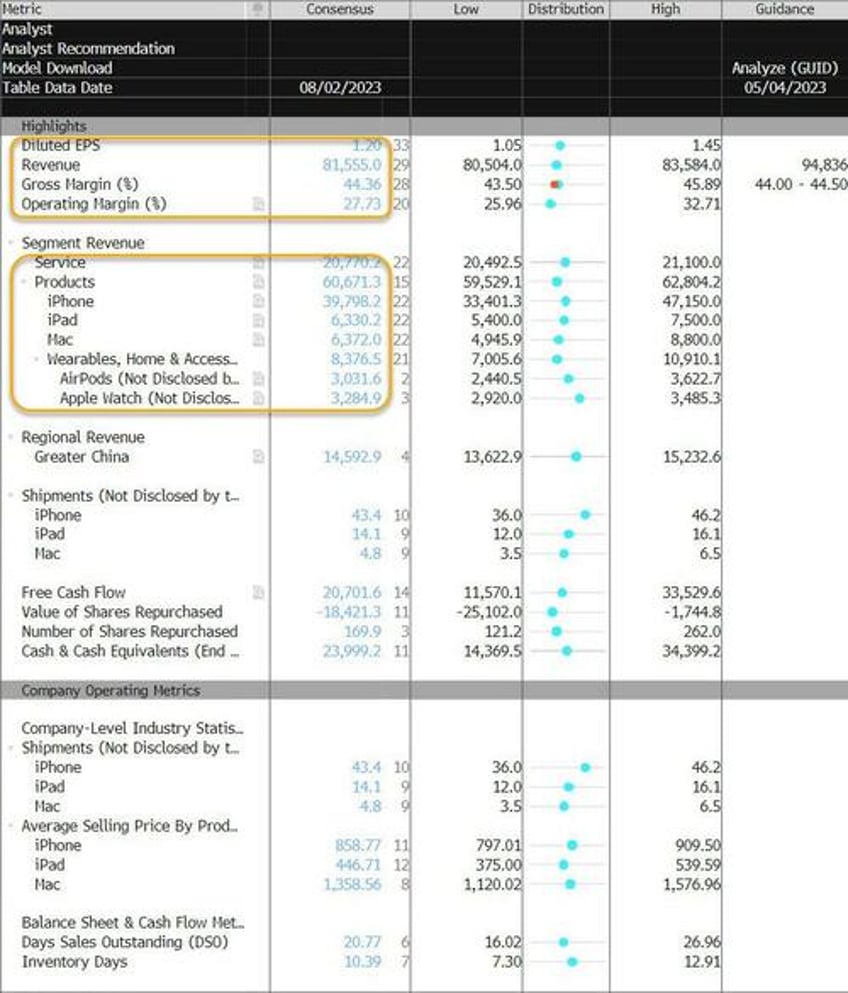

AAPL reports post close on 8/3 (conf call @ 5pm ET): There isn't any major change to in positioning in AAPL of late – it drifts largely under the radar from an AI perspective and investors remain bearish on valuation, risks around the consumer and regulatory threats to the ~$20B annual check from GOOGL.

Buyside looking for FQ3 revenue ~flat y/y (guide -2-3%) with iPhone revenue $40.6b (+2% vs consensus),

FQ4 revenue guided to +2% y/y (in line with consensus).

Stock +48% YTD; Options implied move 4%.

What to focus on:

- June quarter revenue trends (strength in Macs & Services) w/ Sept guide a bit of a moving target given it will likely be more of a reflection of iPhone launch timing, rather than end-demand trends.

GS desk has positing core as 7 out of 10. Stock has traded higher on 4 straight prints, T+1.