This market faces a lot of problems, but I don’t think that the Fed is one.

Yes, we get a Fed meeting this week.

Yes, the SEP (Summary of Economic Projections) will:

Highlight higher for longer – there is almost no possibility of anyone lowering their dots from the last SEP given some of the inflation projections.

Nudge the terminal rate higher? They certainly cannot lower the terminal rate given the economic data released since the last meeting, but will they raise it? Possibly.

Yes, Powell will try to hammer home several points during the press conference:

Higher for longer. This has been (and will continue to be) the main message that he wants to drive home.

Not (necessarily) done with hikes. I don’t expect a hike, but if he is going to try to hammer home the “higher for longer” message, he needs to keep more hikes on the table.

Inflation concerns with a hat tip to “sticky” inflation. I can’t ignore the recent data, though it won’t be enough to hike this time.

Still has a 2% target. Not sure anyone really believes that. Yeah, he would like it to keep moving to something “two-ish”, but he isn’t desperate to get it down to 2% anytime soon. The message will be tough, but will anyone really believe him?

Wow, that all sounds like the Fed will be a problem!

The 2-year went from 4.85% after the July 26th meeting to 5.04% as of Friday’s close. The 10-year did even worse, jumping from 3.87% to 4.33%! Almost a 50 bps move in 10s!

There are many reasons that yields have been moving higher (supply, less foreign buying, a huge corporate calendar, etc.) but yields are much higher than they were, and I don’t think that Powell can sound hawkish enough to push yields significantly higher!

Yields Are a Problem

To say that yields are a problem probably understates the number of problems that higher yields are causing (and will cause). Let’s say yields (nominal and real) are 90 of the 99 problems.

We touched on what we are seeing and hearing about yields impacting smaller companies in Real Yields are the Real Story. Since we published that on Wednesday, I’ve had to explain that the only reason I’m not super bearish is because the Fed is aware of these issues, and at least behind the scenes they have to be getting more cautious.

Somehow, we started talking about the “birthday paradox” this week. If you survey 23 people, there is a 50/50 chance that two people share the same birthday! With 365 (or 366) days to choose from, that seems insane! Yet, the math backs that up! It led me to start thinking about another area where the math doesn’t match people’s intuition.

Let’s say that the Fed immediately hiked us to 5.33% from 0.08% in March 2022 (they didn’t, but this keeps it easy). In this “extra” hawkish world, the Fed immediately hiked 5.25%.

Now, let’s assume that the average consumer and corporation borrowed out to 5 years with 20% of their debt maturing every year. The Bloomberg Corporate Bond Index average maturity rose from 7.8 years to a high of 8.9, so using an average of 2.5 years is insanely conservative. I don’t have the data in front of me for consumers, but my understanding is that individuals did a great job of locking in mortgage rates and that even auto loans got longer during ZIRP. So, saying that they roll 20% of their debt and are done in 5 years is extremely conservative (in a rising rate environment).

The average yield on the 5-year Treasury was 1.59% during the 5 years prior to March 2022.

Under this scenario, the average cost of carry has “jumped” from 1.6% to 2.34% - a bit over 70 bps. The one part that might not be conservative in this assessment is that higher coupon debt rolls off first, and I assumed that the new debt is at 5.33%.

In January of next year, the cost of debt will increase to 3.8% (ok, that is starting to look serious).

While not as counterintuitive as the “birthday paradox”, I think that we tend to forget how long it takes for the average cost of debt to increase (especially when companies and individuals did a good job of locking in “lower for longer”).

I think that we are just seeing the pressures from the rate hikes hit the economy and it is going to accelerate in the coming months. The Fed (and all the inflation bulls) need to be cognizant of that.

If the Fed doesn’t acknowledge these issues, it will get worse for the economy and risk, but I don’t think that they will ignore this.

The College Football Transfer Portal

I’m not sure it is a problem or not. It certainly helped Deion Sanders make Colorado interesting in a hurry. That fact (and NIL) are changing the shape of college football. It is something that people are talking about, though “bad coach” hiring decisions are the focus here in East Lansing this weekend. I cannot seem to get anyone excited that Vanderbilt has a better record coming into this weekend than Alabama, but it hasn’t stopped me from trying. Hopefully the season continues to be exciting as we head to Baton Rouge soon for Hurley-Walkerfest XXIX (ask no questions, get no lies).

Oil

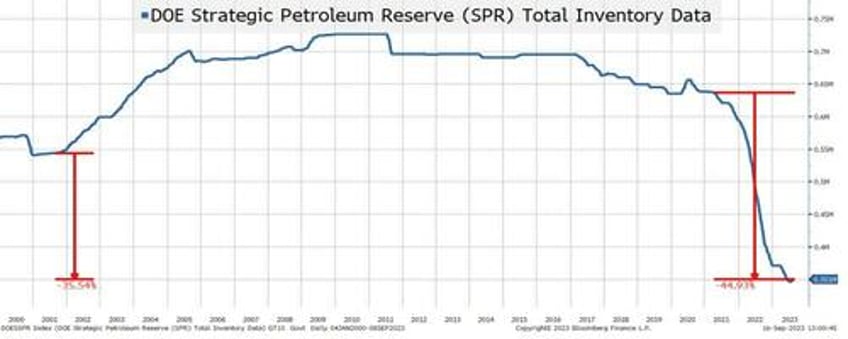

This is increasingly popping up on my radar screen. WTI has been on a tear, going from $79 in late August to over $90 on Friday. It was $95 last September but it was on its way down. At least we can release oil from the SPR if it gets too high?

What if the world has figured out that the U.S. “Achilles heel” is inflation?

We asked “pariah” states to increase output.

We engaged with Venezuela (after leaving them to work with China and India) and I don’t know whether we kept up the work or relented once the “emergency” was over,

“We” (and I use that term extremely loosely) slammed the energy industry for “excessive profits” rather than encouraging long-term strategic growth.

While we’ve seen the CHIPs Act, I don’t think that we’ve seen a “refinery” act or anything to really ensure national energy security for decades to come. Yes, sustainable energy will help, but that can only be part of a well-thought-out transition.

We’ve discussed in the past that the Russians seemed to do a better job of commandeering ships to transport their fuel as the world’s arrangement of “who buys what from whom” in the energy space changed drastically following the Russian invasion of Ukraine.

I don’t think that is being “orchestrated”, but it does seem that as a nation we have let inflation become an enemy that we have little control over.

The real reason for oil price gains seems to be demand rather than supply (though constrained supply isn’t helping anything). Domestic use (including more driving as work from office gets traction) and foreign use are key drivers. A recovery in China is often mentioned, but I can’t help but wonder if it isn’t growth in India that is contributing to this. I’m still “only” seeing a 25% chance of a commodity bubble shock coming from the growth that India could experience. Maybe I’m completely off base to mention India in the same sentence as China with respect to being the marginal buyer of commodities (and it is always the marginal buyer that shifts price), but I don’t think so. This is something that I will be doing a lot more work on in the coming weeks.

Of all the “problems” that are out there, oil has caught my attention as it might be out of our control in the near-term. It won’t change the Fed outlook for this meeting but it is something that I’m watching.

Strikes

I am still waiting for a late-night talk show to ask for my help in writing their “economic” jokes as the writers’ strike continues. The UAW announced strike action late last week. That seemed to spook markets as the auto sector is so important to our economy and it increases the potential for raises, which could in turn increase concerns about future expectations.

Friday’s reaction seemed overdone, but we will get more on that front as the strike and responses evolve.

Abysmal Liquidity?

Anyone waiting for summer to end and liquidity to return was sorely disappointed. Nothing about the recent price action indicates deep/liquid markets.

Bottom Line

I still like rates and equities, but I am worried that I’m threading the needle too closely. I am betting that the Fed and some “bad news is good news” reports will spark a rally as the problems facing risk assets start to mount. In the meantime, football is fully back in swing and I’m going to enjoy it!