Did the Federal Reserve jump the gun on the pivot?

Last month, investors cheered after the Fed announced that interest-rate cuts are coming in 2024. Since then, the S&P 500 has powered to new record highs, and technology stocks have gone bananas.

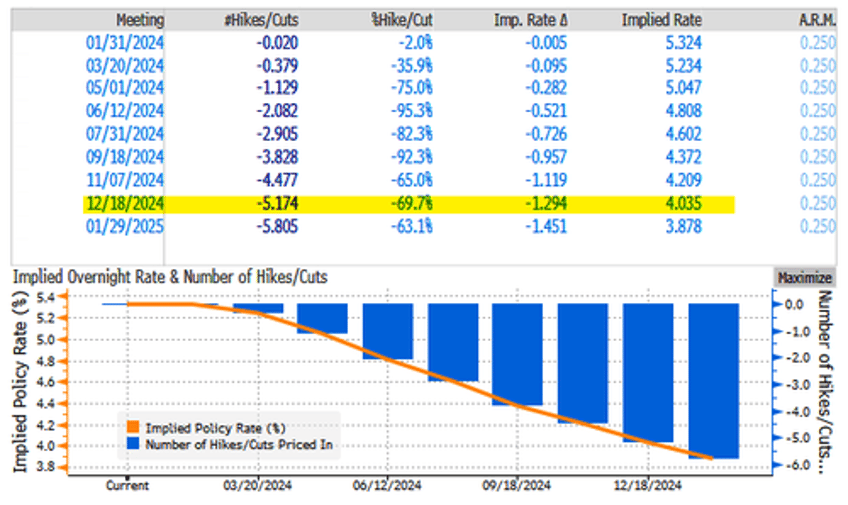

The latest swap contracts tracking Fed meeting dates for the full year 2024 showed 70% odds for 5.2 cuts.

The unexpected pivot (as outlined earlier) might be premature and may have been a gift to the Biden administration in an election year.

An example of a premature pivot and no impending economic doom could be news from Lamborghini on Tuesday that supercars are sold out until 2026.

"It's a bit early to give a prognosis, but we have no sign of weakness in the market," Chief Executive Officer Stephan Winkelmann told reporters on a call.

According to Bloomberg, the Italian supercar maker logged over 10,000 vehicle sales last year. Its first plug-in hybrid model, the Revuelto, was a massive hit with the rich, with two years of backlog orders.

The trend of ultra-wealthy elites splurging on supercars indicates that the economy isn't slowing down as quickly as thought, suggesting that an imminent need for rate cuts might be unnecessary.