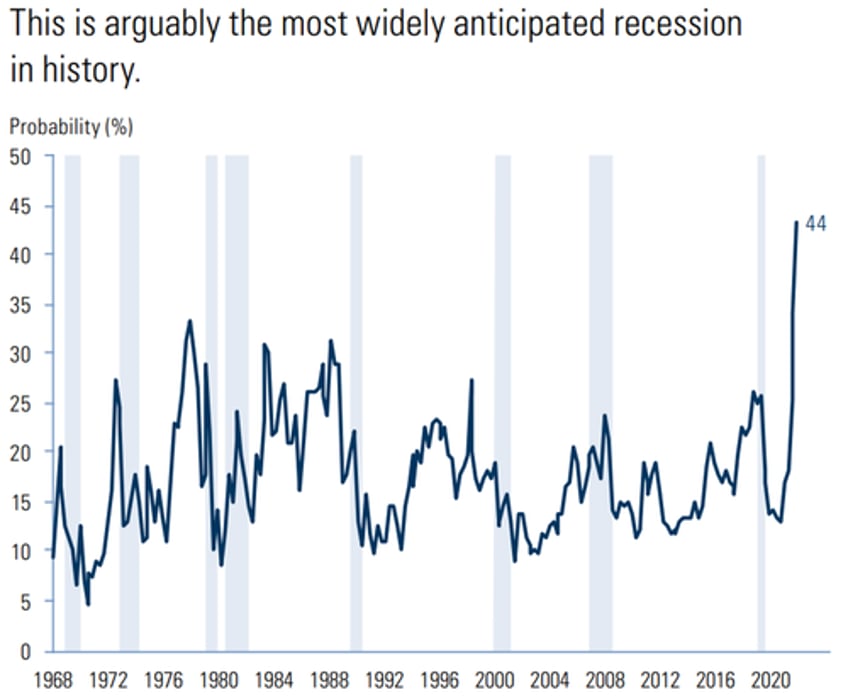

It was exactly one year ago, when consensus was convinced the US would enter a recession in 2023 and stocks - already in a painful bear market especially for tech names - would continue their downward slide. Boy, was everyone wrong.

Some of those same analysts pretend like they comments are not on the tape; others like DB's Jim Reid are more honest, and in his year to remember review note, he admits that "looking back at 2023, I did think we would have moved into a US recession in the last few months of the year but that hasn't materialised to date." However, Reid does note that back on October 27, in his "chart of the day", he showed that the seasonal low point for the average year occurred on that date. Little did he know at the time that this date in 2023 marked the start of one of the most aggressive rallies over the last few decades. Or, as we put it later, the seasonals worked a charm last year and "if you had ignored all the news and noise and just traded the calendar, you would have outperformed 99% of all investors."