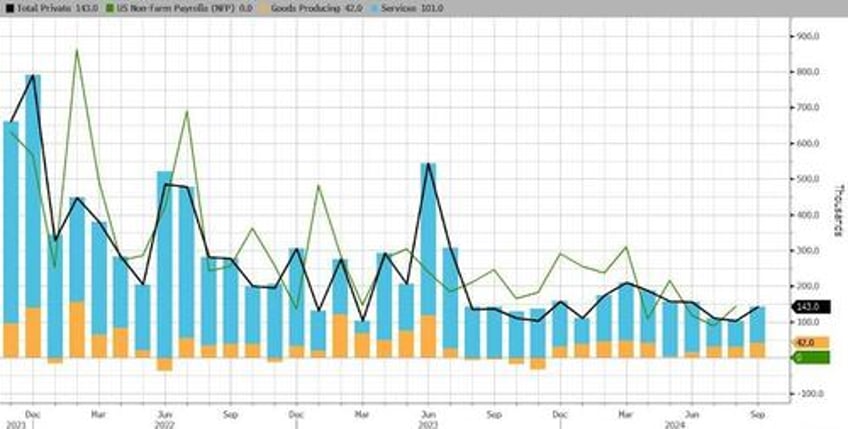

In the first major labor market indication since The Fed slashed rates by 50bps (because the economy is doing so well?), ADP's Employment report showed a much bigger than expected increase in jobs (+143k vs +125k exp vs +103k prior)...

Source: Bloomberg

That was above all but one of the economists' estimates...

Source: Bloomberg

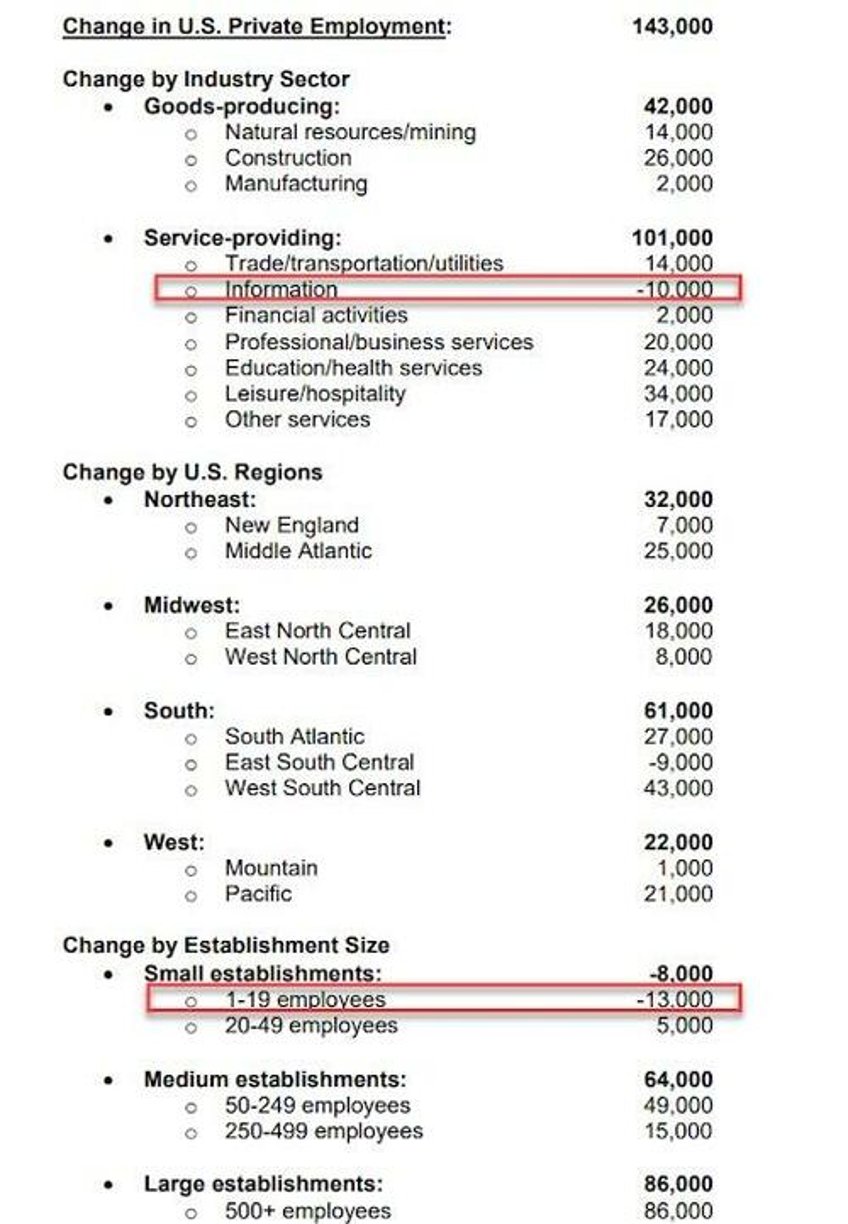

Job creation showed a widespread rebound after a five-month slowdown. Only one sector, information, lost jobs. Manufacturing added jobs for the first time since April.

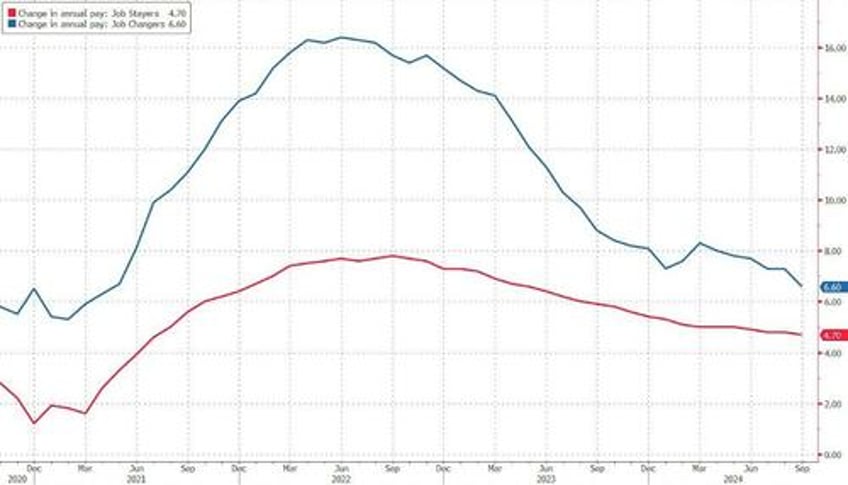

Wage growth continues to slow...Year-over-year pay gains for job-stayers fell slightly in September to 4.7 percent. For job-changers the decline was greater, falling from 7.3 percent in August to 6.6 percent.

“Stronger hiring didn't require stronger pay growth last month,” said Nela Richardson, chief economist, ADP.

“Typically, workers who change jobs see faster pay growth. But their premium over job-stayers shrank to 1.9 percent, matching a low we last saw in January."

So how will The Fed explain their next rate cut if jobs are re-accelerating?