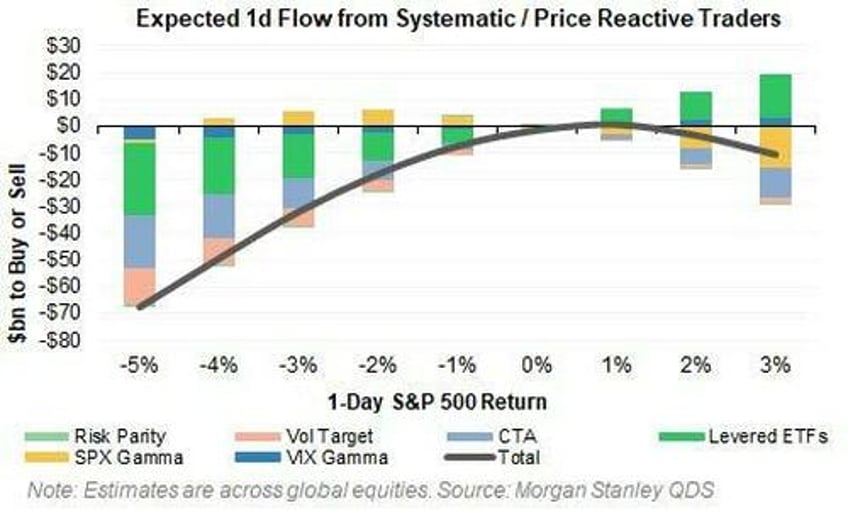

Two weeks ago, when 10Y yields were about 30bps lower (it may not sound like a lot but it is), we quoted the latest report from Morgan Stanley's iconic QDS (quant derivatives strategy) team, who warned that "the point of activating significant forced selling is getting much closer" and which calculated that "a 1-day supply in a down 1% move would be roughly $7bn, and in a down 2% move would be roughly $18bn"...

... with Goldman trader John Flood reaching a similar conclusion, and predicting that in a flat tape over the next 5 sessions, the CTA community would generate an est. $4BN of S&P supply (and $10BN over the next month), while in a down 2.5-std devs tape, this supply grows to $20BN over the next week (and $68BN over the next month).