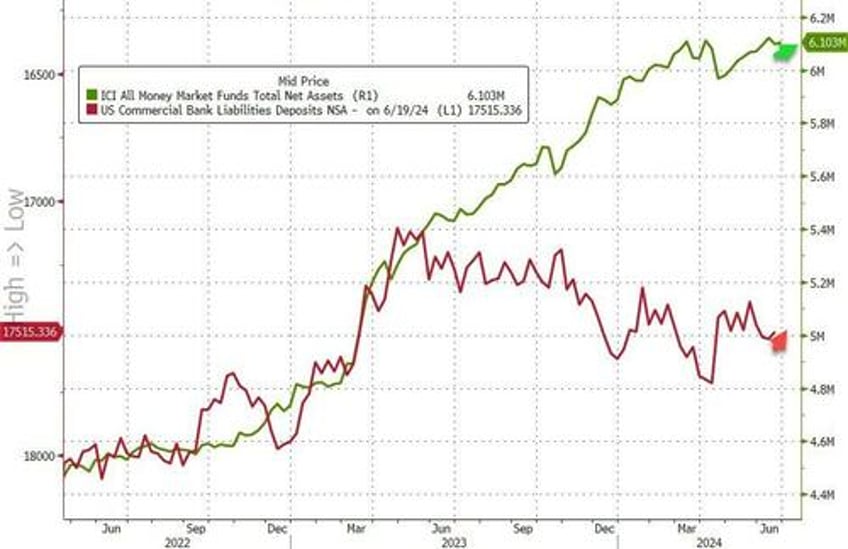

Money market funds saw modest inflows last week (up around $5BN) as bank deposits (NSA) saw $25.7BN outflows...

Source: Bloomberg

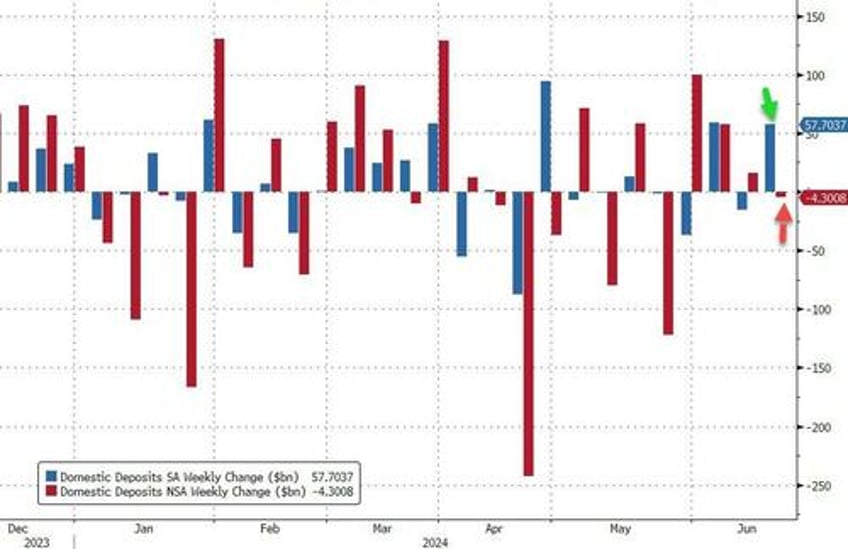

However, on a seasonally-adjusted basis, total bank deposits rose by $38BN last week to their highest since SVB's collapse...

Source: Bloomberg

And, excluding foreign deposits, domestic banks saw seasonally-adjusted deposits rise $57.7BN (large banks +$55.5, small banks +$2.2BN), while on an NSA basis, domestic deposits tumbles $4.3BN (large banks +8.4BN, small banks -$12.7BN)...

Source: Bloomberg

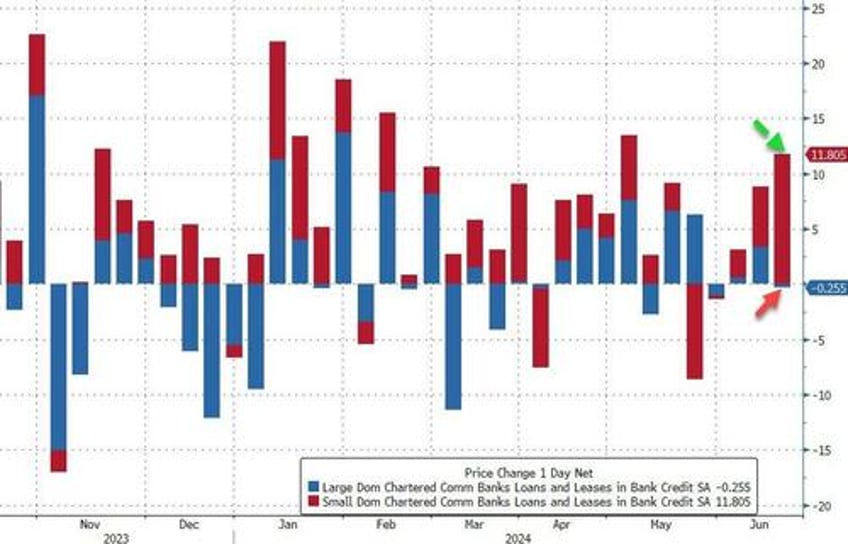

On the other side of the ledger, loan volumes increased on the week, driven by a $11.8BN rise at small banks (while large banks saw loan volumes shrink by $255MM), which is weird given the massive SA rise in large bank deposits....

Source: Bloomberg

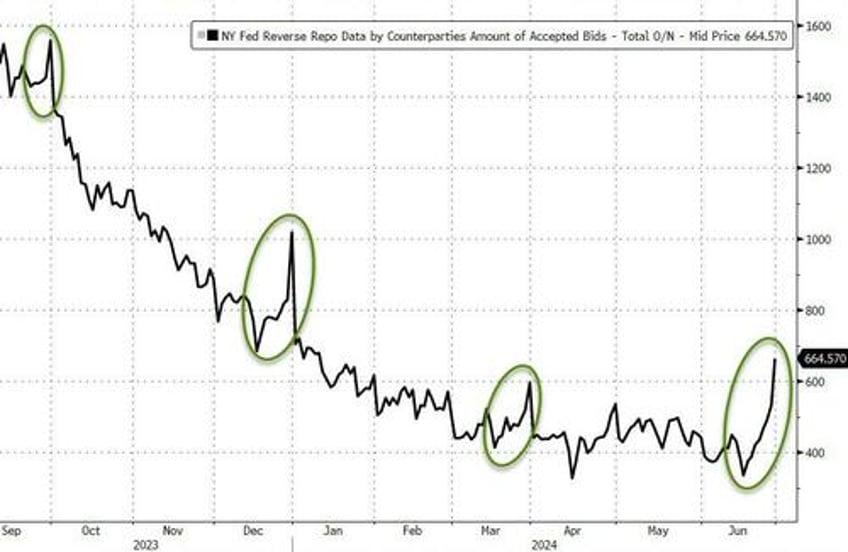

Usage of The Fed's Reverse Repo facility soared across quarter-/month-end (as it tends to do)...

Source: Bloomberg

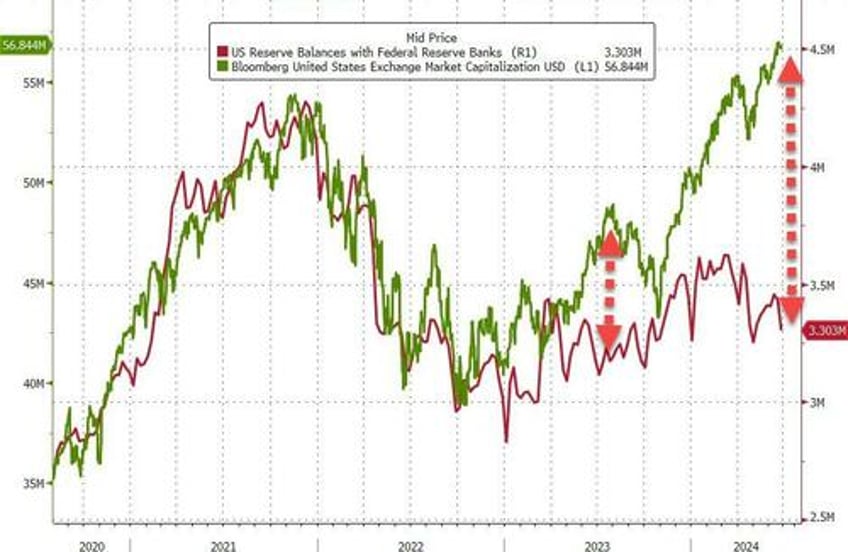

Finally, US equity market capitalization remains drastically decoupled from its historically tight relationship with bank reserves at The Fed...

Source: Bloomberg

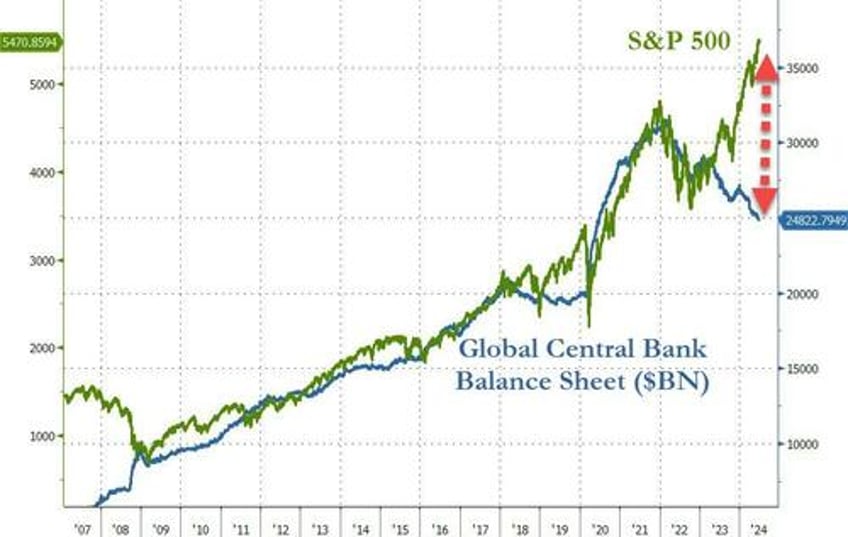

But globally, central bank balance sheet shrinkage continues as stocks soar...

Source: Bloomberg

Now that would be quite recoupling.