By Peter Tchir of Academy Securities

What a week! DeepSeek, Cheap AI, the Fed, some Mag 7 earnings, and now tariffs! We hope that you had your Amps Cranked to 11!

From that “Amps to 11” report, I remain somewhat confused about why Bitcoin is unable to break higher! It is below $100k as we write this report. Virtually everything we’ve seen from the Trump administration seems to point to good news for crypto. It seems that not just in D.C., but also across the globe and at various state levels, the crypto community is using their influence and contributions to shape policy to their liking. Yet, Bitcoin acts more and more like a “normal” risk asset than something revolutionary about to be bought by a variety of central banks and governments! I do like the EU’s Lagarde’s adamance that Bitcoin will not be part of any reserves within the EU!

The first wave of tariffs have been announced.

10% on China and Canadian Energy Products.

25% on everything else from Canada and on Mexico.

The assertion is that these tariffs are linked to these countries not doing enough to fight the fentanyl trade, presumably providing an off-ramp if these countries demonstrate progress on the front.

Stopping The Flow of Fentanyl

The president has gone out of his way to link these tariffs to the flow of fentanyl. That is important as it seems that if Canada, Mexico, or China demonstrate new or improved efforts to stop the manufacturing and distribution of fentanyl, the tariffs can be rescinded.

For China, I’m not sure what steps they can take, but they were only hit with a 10% tariff, and for China in particular, this is likely to be only the first step in a tariff battle or negotiation (depending on your perspective).

Presumably, Mexico can hit the cartels hard and use those efforts to get the tariffs lifted.

In Canada, the focus has been on the precursors of fentanyl. The precursors are all legal in Canada making it, apparently, a hub for sourcing and potentially manufacturing fentanyl. Ottawa (the Canadian equivalent of D.C. ) has been trying to cut the time it takes to ban something from 36 months to 6 months, with the pledge of creating a “Chemical Precursor Risk Management Unit” within Health Canada (many wonder why the RCMP isn’t more directly involved). In any case there seems to be a lot of scope for Canada to “improve” their efforts to disrupt the fentanyl trade, which could be their path out of these tariffs.

So, the first thing that we are looking for is whether these countries “up their anti-fentanyl games” and whether that satisfies the president.

If they do that, this round of tariffs may be short-lived.

Some Tariff Basics

Report after report I read seems to jump straight to either the good from tariffs (getting others to pay our taxes, advantage to American manufacturing, etc.) or to the doom and gloom of tariffs (inflation, trade wars, etc.). While we all understand the basics of tariffs, or at least I think I do, it seems worth spending a minute or two making sure that we are all on the same page.

My understanding is that the importer of a good pays the tariff to the government at the port or place of entry of the good into the country.

So, if you pay $100 for something from Canada or Mexico, you pay a $25 tariff, and your cost has increased to $125.

Which begs the question – who pays the $25 tariff?

One of the first things most importers will do is ask for a reduction in price from the exporter. If I was doing business thinking that something was only going to cost $100 and it now costs $125, I’d try to negotiate my purchase price down.

What I find “interesting” is if the exporter takes a 20% haircut, the price stays at $100. 20% off of $100 is $80. Then a 25% tariff on something for $80 is $20, getting us back to $100.

Step 1 is getting a discount, where even a 10% discount means the tariff only increases costs by 12.5%.

Now let’s look at the FX market (which maybe we should have done before step 1, but it would be a pain to rewrite stuff, and it isn’t really a step, as it is outside the control of the importer and the exporter, though no less important).

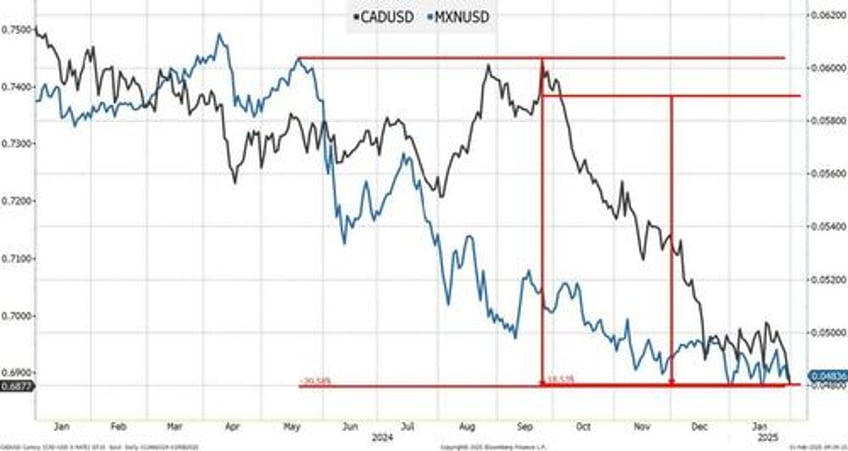

Since the summer, the Peso has declined by 20% versus the dollar and since late September, the Canadian Dollar has dropped by around 18%.

Let’s say that back in September, a Canadian exporter was happy to get paid 135 CAD. That translates into 100 USD for the importer. Let’s say that the Canadian exporter is still happy to accept the equivalent of 135 CAD. That drops the USD price to 93 for the importer. Making the “new” cost to the importer, including the tariff, “only” $116.25. This is all moving around in real time and has been a cumulative move, so this is a massive oversimplification, but still relevant.

The currency market is already helping the importer.

Step 2 is for the importer to figure out what amount of profit he is willing to forgo, if any. Assuming the importer was paying $100 it seems reasonable to assume that the price for the consumer is significantly more. For argument’s sake, let’s say the final price was $200. There is distribution and selling costs, etc. that the importer pays to sell the product on to the next leg. Maybe $200 is too high? Possibly, but I’m not sure it is that unreasonable for many finished goods. Now $25 out of $200 is “only” 12.5%. Giving up 12.5% is probably too much, but is 5% reasonable?

So, let’s look at this possibility (which as a whole, doesn’t seem too far-fetched to me).

Negotiate a 10% discount from the Canadian or Mexican exporter. Argue that it is “temporary” but crucial if you don’t want me (the importer) looking for alternative suppliers. Add in that you (the exporter) will also take a hit.

So, the Canadian exporter reduces the cost from 135 CAD to 121.5 CAD (in hopes it is temporary, and they don’t want to risk losing this customer to another provider of such goods).

Due to the big increase in the USD, the cost is only $83.40 (the importer has been making a lot of extra money in the past few months, but that is always a risk and may well have been hedged).

The 25% tariff is $20.85, bringing the total cost to $104.25.

In your planning, as of a month or two ago, you were anticipating a cost of $100. It is now just under $105. Do you raise your final prices, or leave them, at least for a little while, anticipating Canada (or Mexico) will make progress on fentanyl and the tariff will go away? That seems at least plausible, and it might depend on how easy it is for you to raise and lower prices. Is the hit to profit margin, hopefully a temporary one, worth not having to deal with a new supplier?

If the alternative supplier is Canadian or Mexican, they have the same problem.

If the supplier is from elsewhere, presumably there will be some logistics in getting their goods over in time.

The alternative, an American supplier, does look better as they were just given an effective cost benefit, but not really a 25% cost benefit. The dollar strength takes away some of the desire to shift to a domestic supplier. Presumably, the domestic supplier was already more expensive (or not as good, or there is some other reason why they weren’t being used). So, even with the indirect competitive boost, is it worth it?

Let’s circle back to the first major topic under tariffs – this round seems to have a “built-in” off-ramp, just by fighting fentanyl harder.

Bottom line is that the combination of currency shifts and the potentially short-lived nature of these tariffs seem unlikely to result in big shifts in supply chains, and with both the exporter and importer taking some short-term pain (under the assumption it will be short-lived), there could be very little impact on the consumer.

I’m prepared to be wrong about this, but I think that is the outcome, at least in the next few weeks and even months.

Some Caveats to the Rosy Outlook

There are several very real risks to the potentially rosy outlook we paint in the previous section:

- Specialty producers, whether final goods or inputs, tend to be far less likely to negotiate discounts. They typically view themselves as having some degree of pricing power.

- The currency argument works well on goods already in inventory. The issue with the currency, over time, is that the countries experiencing the devaluation often experience higher costs of production (the raw materials increase in cost in their currency). So, it may work short-term, but over time, doesn’t help as much.

- The belief that there is an actual off-ramp that will be taken by the respective governments, in regard to fentanyl may be low. We have treated it as a likely scenario and many companies might be less sure of that.

- Countries may choose to respond harshly, launching their own retaliatory tariffs. The threat of this is almost certain (and it is already being threatened) which could lead to additional rounds of tariffs, and the hope of this being short-lived and tied to fentanyl, evaporating.

The USMCA

The United States-Mexico-Canada Agreement is 1,889 pages long. Lots of “white space” in the document, legal mumbo jumbo, etc., but the document isn’t short. I suspect that a lot of lobbyists in each country were able to push their agendas through. While I’m not sure I’ve ever heard an American say they “won” the negotiations, I’ve also never seen any Canadians celebrating a big “win” with this agreement either.

It is coming due to expire and this is just a first salvo by the Trump administration to increase their power as the countries likely sit down to negotiate this deal going forward.

But anything that is almost 2,000 pages long likely has a lot of wins for everyone (and some losses) and demonstrates the incredibly difficult nature of cross-border trade, especially with two countries that you share long borders with.

The Auto Industry

We only highlight the auto industry as it is designed to work most efficiently by seamlessly shifting parts, equipment, and manufacturing steps between countries.

This is an industry that I think, in general, has found a happy medium and has been able to satisfy constituents in the countries involved while being as efficient as possible.

I do not see how blanket tariffs work well given what I know of the industry.

I think there could be some backlash from this industry in particular, as it further complicates an already complex and difficult operating environment.

Golf Clubs

In Learning to Speak Trump Again, we highlighted the complexity of international trade and the nuanced rules that seem to be important for exporters and importers to maximize profit. We used golf drivers as an example and ChatGPT confirmed that yes, the “assembled in America” label is largely an effort to reduce the cost of duties.

So, guess that is our way of saying, above and beyond all the things we have listed that can be done to mitigate the impact of the tariffs, we have likely only scratched the surface.

Some Concerns on Energy

Of all the areas that could be impacted, energy seems to be the one where we could see some immediate impact. The reasons listed below are likely why the administration chose to “only” hit

Canadian energy products with a 10% tariff. Some of the most important, unique risks to energy are as follows:

- Energy products are priced in dollars and trade in dollars, so the currency effects of a stronger dollar will not play a helpful role.

- Much of the oil that is refined in the Midwest comes from Canada. The refiners are optimized for the heavier crude that comes out of Canada, rather than the sweet/light crude that comes from the Permian Basin. There are workarounds, but this could be an issue over time.

- While the U.S. is a net exporter of gasoline, the situation is more complex. Largely due to the Jones Act, the U.S. exports a lot of fuel, largely from the Southern U.S. to South America. The Atlantic Coast actually imports a lot of fuel, primarily into New York. It primarily comes from Canada and Europe (which is my understanding). Due to the distances involved, and the types of ships required to offset any imports from Canada, it is doubtful that we will be able to offset Canadian imports quickly. Supposedly, margins are relatively thin at the moment for the Canadian fuel producers, greatly reducing their ability to cut prices. We could see a rise in fuel prices at the pump on the Atlantic Coast fairly quickly, which would be an issue.

- Just want to highlight “Shipping” as a recurring theme for Academy. In this case it is our own regulations causing potential issues, but it also highlights the fact that the U.S. has very little in the way of current shipbuilding capacity – something that is affecting the Navy’s ability not just to grow, but also to replenish its fleet. This isn’t directly related to our current work on shipping (advising clients to think about supply chains, not just in terms of countries or regions of manufacturing, but also in terms of the robustness of their shipping routes).

If there is one area that has been mentioned as being carved out, it is energy. That would make sense, as we could see some immediate inflation on the very product (the cost of gasoline at the pump) that the president has been focused on bringing down in price, not raising!

Bottom Line

At the moment, I’m not that worried:

- The lack of real concern largely stems from the view that at least Canada and Mexico can make use of the fentanyl off-ramp and reduce the lifespan of the tariffs to months, if not weeks.

- Given the view that these really will be “temporary” we should be able to see workarounds for most products, which reduce the impact.

- So far, the reactions from the other countries hint that this may devolve away from a fentanyl related issue into something more difficult to exit (in fact it may escalate given the current tone from other countries).

- What has been done so far seems to indicate that this is a “moderate” Trump (by Trump’s standards) who is listening, at least to some extent, to the people in his administration. The fact that they treated Canadian Energy differently shows a level of thought (and concern about prices at the pump) that gives some comfort that the process of potential retaliation and off-ramps can be managed.

I’m moderately concerned that we could be hit on the energy side rather soon and that could be disruptive for the economy and D.C.

In the back of my mind, I’m worried that the administration will like the revenue generated from tariffs and turn what should be a temporary package into a long-term reality, where they layer on more tariffs to more countries. Then a lot of the offsets we’ve discussed do not work well, and we should prepare for a more difficult economic environment. So far that fear is “in the back of my mind” but it is there and is a non-zero risk.

Messy but manageable. That is our theme and continues to be the theme.

I’m moderately bearish both equities and bonds, but moderate is the key word. Whether you are bullish or bearish, buy dips, sell rallies, and stay nimble. I’m beginning to think that you should “imagine the people that create the headlines are day-trading their own headlines” and you will do quite well. When things seem to be going too smoothly, expect them to reverse (and vice versa).

Good luck and welcome to February! January was full of surprises, good, bad, and tragic (fires in California and a plane crash in D.C.), and I fully expect February to keep us on our toes, though hopefully without tragedies like we saw last month