Unlike GOOGL and AAPL, Amazon is a name which according to UBS investors are more active in, particularly as fears around operating margin headwinds have dissipated. The Swiss bank notes that investors remain bullish "with multiple shots on goal that the company has for margin expansion heading into 2025 driven by positive synchronous developments across its key business segments." This includes:

- ongoing ecommerce fulfillment network regionalization as units growth continues to outpace shipping cost at 12% versus 8% in 3Q24;

- secular growth driven by ongoing transition from on-prem to cloud given 85% of global IT spend remain on-prem; and

- significant runway ahead for Prime Video with ads which continues to ramp across its global markets.

In terms of bogeys, this is what UBS expects:

- Q4 AWS Growth: 18% now versus 19% post Microsoft

- Q4 EBIT: $21 bn versus guide $16-$20 bn

- Q4 Total Sales: small beat at the high end at $188.5 bn+ versus guide $181.5-188.5 bn (FX impact)

- Q1 AWS: small acceleration around 20.5%

- Q1 EBIT: $17.5 bn at the high end (FX and seasonality of retail)

- Q1 Total Sales: roughly in line with Street at $158.5-$159 bn (post Microsfot, hearing this might come down to about $157 bn at the high end)

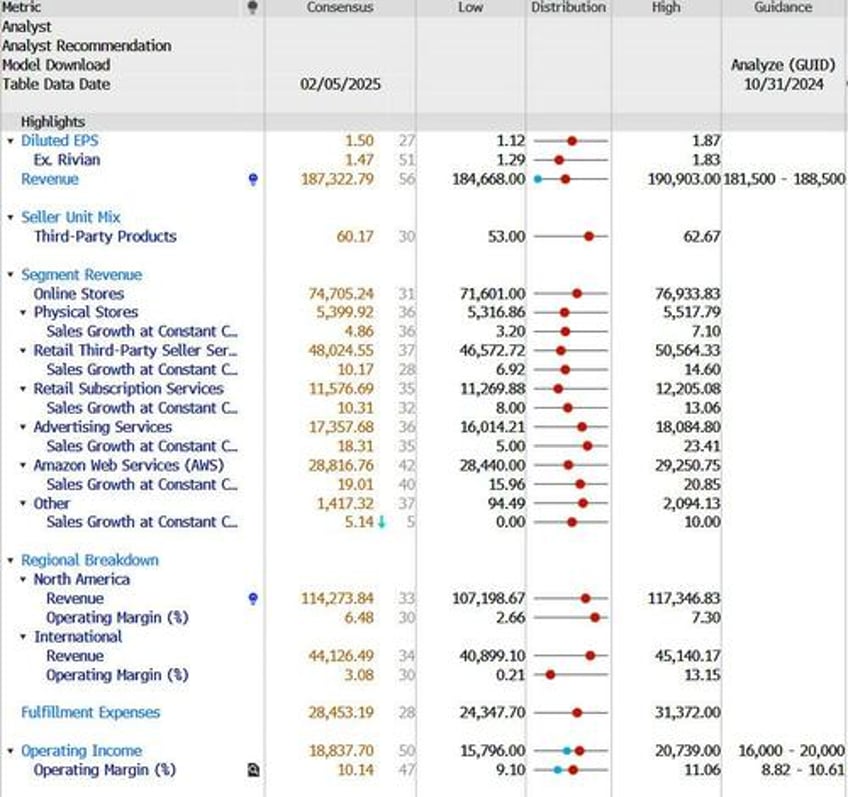

And here is the sellside consensus courtesy of BBG:

UBS adds that price targets are still around that $250-$280 range, and the most important things during the call will be:

- directional commentary on capex for both AWS and ecommerce;

- progress on fulfillment regionalization and declining cost to serve;

- state of the consumer; and

- prime video advertising uptakes.

JPMorgan agrees with UBS and notes that Amazon is probably "the cleanest Mag7 name to own into Q4 prints with much less controversy than 3 months ago."

Most importantly, confidence in margins/EBIT has improved significantly: change in message around AWS margins, Kuiper very rarely discussed, sustained retail/logistics efficiencies. Most are broadly expecting ~stable AWS growth for 2025 (~20%) so no more acceleration requirements which also helps the setup. There is less of a clear valuation framework here vs other MegaCaps, but Doug’s $280 PT is based on 34x 26e FCF ($83B).

Some more specifics ahead of earnings:

- Positioning Score (1 = max short/UW, 10 = max long/OW): 8

- Buyside Bars: Investors looking for AWS growth of ~20% for both Q4 and Q1.

- JPM's buyside survey points to expectations of Q4 net sales ~$189B (guide $181.5-188.5B) and EBIT $20B+ (guide $16-20B); Q1 guidance of net sales $160B+ & EBIT ~$19B (both high-ends).

Implied after hours Move: 8%