With AMC Entertainment and GameStop's short squeezes causing significant losses for short sellers on Monday, we noted the growing likelihood that "bankers are burning the phones at GME and AMC pitching ATM equity offerings for after the close."

You know jefferies bankers are burning the phones at GME and AMC pitching ATM equity offerings for after the close

— zerohedge (@zerohedge) May 13, 2024

Fast forward to Tuesday morning.

And there it is

— zerohedge (@zerohedge) May 14, 2024

AMC Raised About $250M of New Equity Capital in ATM Offering

Thank you retail investors https://t.co/MPu8vfEmNz

And this.

And 99% of the stock was sold yesterday bro

— zerohedge (@zerohedge) May 14, 2024

Bloomberg reports that AMC completed a previously disclosed ATM on March 28. The deal was completed through Citigroup Global Markets, Barclays Capital, B. Riley Securities, and Goldman Sachs & Co., raising about $250 million in new capital for the struggling company - at an average price of $3.45 per share - or about 72.5 million shares.

Meanwhile, AMC is up 95% in premarket trading in New York, trading around the $10 handle. In the last two days, shares are up a whopping 232%.

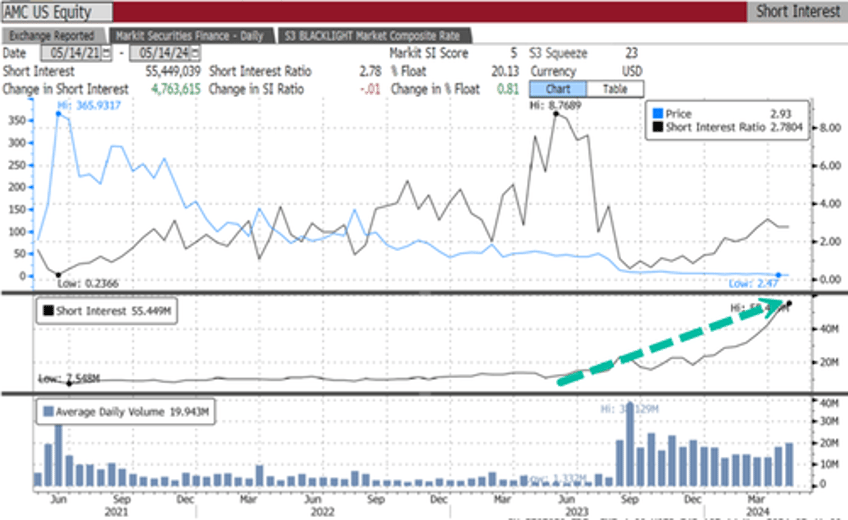

Before yesterday's ripper, AMC was a perfect candidate for a squeeze, with 55.4 million shares, or about 18.82% of the float short.

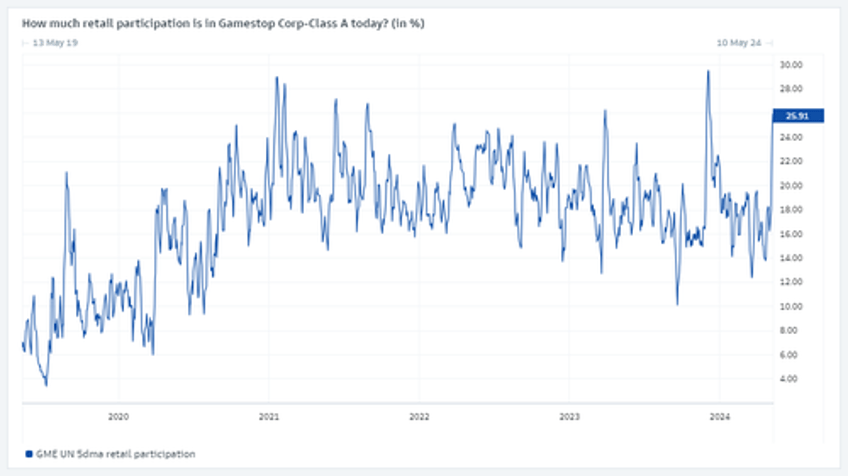

The revival of the 'Meme day trading army' - occurred oddly with a post on X from Roaring Kitty, also known as Keith Gill, on Sunday night.

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

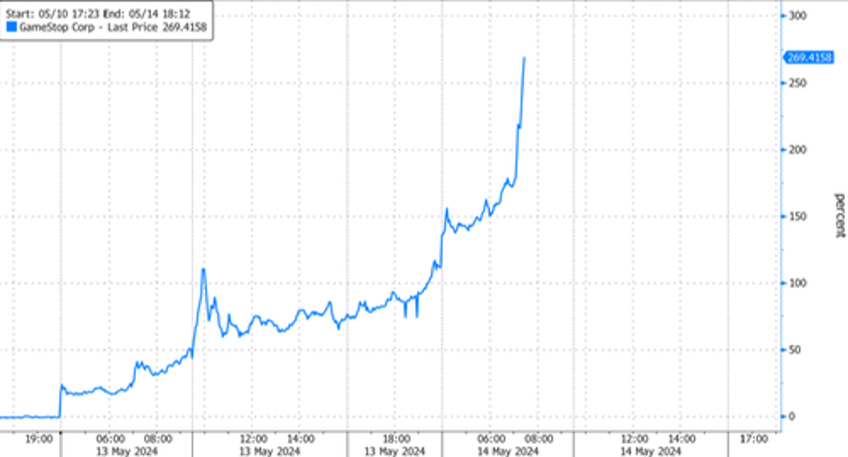

GameStop is also higher in premarket, +124% to the $68 handle, on yet another massive short squeeze. In two days, shares have squeezed over 269% higher.

Hedge funds were scorched in yesterday's Meme stock squeeze.

Hedge funds got roasted in today’s Meme Stock squeeze.

— David Marlin (@Marlin_Capital) May 14, 2024

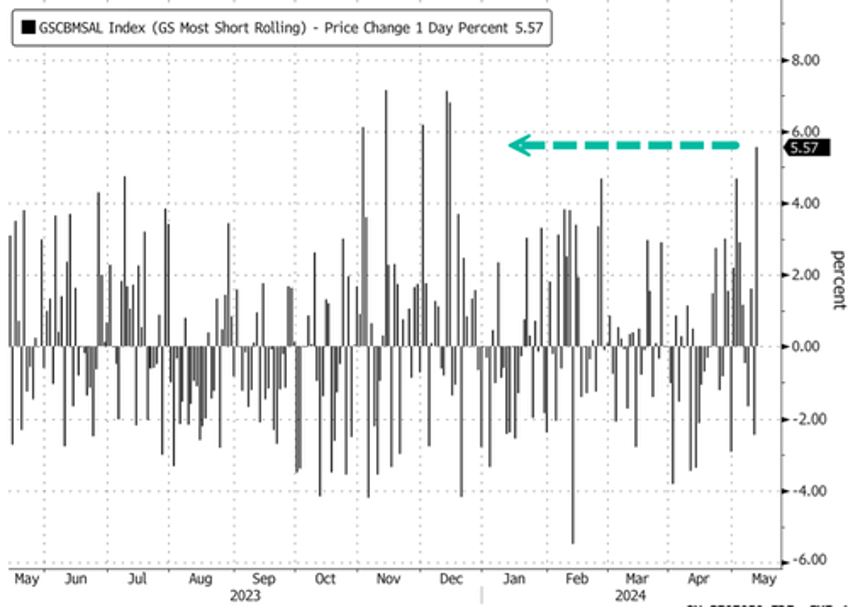

We just witnessed a 4-Sigma day in HF VIP Longs vs Most Shorted Stocks (-5.9%).

This is the 2nd worst day since the original Meme Stock Mania. $GME $AMC $NVAX $BYND pic.twitter.com/fIjZDGZieh

GS' Most Shorted Stock Index had the largest single-day increase since mid-December.

On Monday, we cited a note from Goldman Sachs flow of funds guru, Scott Rubner, who told clients, "I am starting to see some real FOMO start to develop based on incomings last week. Roaring Kitty is back, the message boards are going crazy this am. It is time for a thread."

Being a squeeze, and just a squeeze, nothing is constant - and what goes up, at some point - after the hedge funds are roasted - must come down—yet another painful lesson.