Ahead of Apple's earnings later this week, and the all-important NVDA results next month, all eyes were on chip giant AMD for an advance look into what one may expect. The answer, as so often has been the case this earnings season, was one of two parts: the present situation... and the outlook.

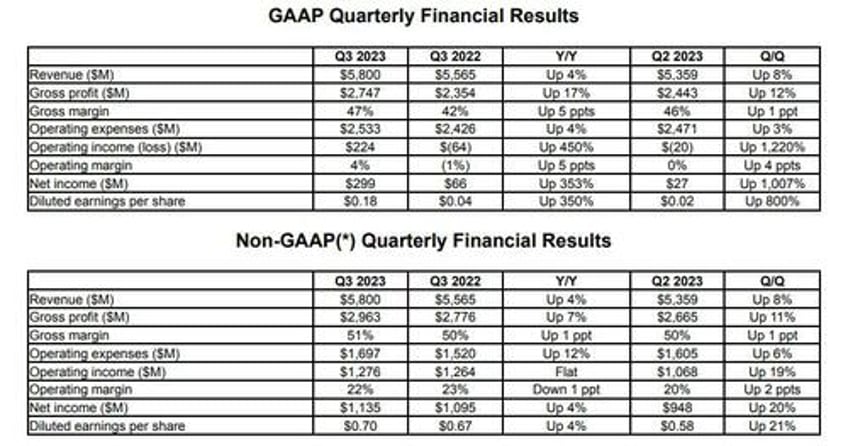

Starting with the former, the results for the just concluded 3rd quarter were not bad, with the company beating on the top and bottom line, as follows:

- Adjusted Q3 EPS $0.70, +4% y/y, and beating estimates of $0.68,

- Revenue $5.80 billion, +4.2% y/y, and beating estimates of $5.7 billion and

- Data center revenue $1.60 billion, -0.7% y/y, missing estimate $1.62 billion

- Gaming revenue $1.51 billion, -7.7% y/y, missing estimate $1.53 billion

- Client revenue $1.45 billion, +42% y/y, beating estimate $1.23 billion

- Embedded revenue $1.24 billion, -4.6% y/y, missing estimate $1.31 billion

- Adjusted gross margin 51% vs. 50% y/y, in line with estimate 51%

- Adjusted operating income $1.28 billion, beating estimate $1.27 billion

- Adjusted operating margin 22% vs. 23% y/y, beating estimate 21.6%

- Capital expenditure $124 million, +0.8% y/y, beating estimate $114.1 million

- R&D expenses $1.51 billion, beating estimates of $1.45 billion

- Free cash flow $297 million, -65% y/y, missing estimates of $1.52 billion

Summarizing the results, stronger than expected Client Revenues, which surged 42% driven primarily by higher Ryzen mobile processor sales, offset revenue misses across all other segments, including Data Center, where revenue was $1.6 billion, down 1% year-over-year, as "growth in 4th Gen AMD EPYC CPU sales was offset by a decline in adaptive System-on-Chip (SoC) data center products."

But the biggest hit took place in Gaming, where revenue tumbled 8% YoY, "due to a decline in semi-custom revenue, partially offset by an increase in AMD Radeon GPU sales."

But while the company's just completed quarter was generally solid, it was the guidance that has spooked the market, with the company forecasting Q4 revenue to be approximately $6.1 billion, plus or minus $300 million (a range of $5.8BN to $6.4BN) which is well below the Wall Street consensus forecast of $6.4BN; The company also said that Non-GAAP gross margin is expected to be approximately 51.5%, which was also below the consensus estimate of 52.1%, and also disappointed expectations.

Looking ahead, CFO Jean Hu said that in the fourth quarter, she expects to see strong growth in Data Center and continued momentum in Client, "partially offset by lower sales in the Gaming segment and additional softening of demand in the embedded markets.”

Ahead of the results, the option market was pricing in a 6.8% move after hours (down from 9.8% last quarter); and while it didn't quite get that, bulls will certainly not be happy with the 5% drop due to poor guidance, which sent the stock down about 4$ from its closing price of $98, and erasing all of the day's gains although in light of the disappointing guidance, the drop could have been far worse. The disappointing report hit both Intel and NVDA, which during regular hours managed to rebound above $400 after opening sharply lower ahead of its own earnings next week.

The good news is that unlike many of its peers, AMD remains well in the green for the full year, having started 2023 at $65 and trading about 50% higher.

The full Q3 slide deck is below (pdf link)