The "forgotten generation," about 64 million Americans born between 1965 to 1980 and known as Generation X, are unprepared financially for retirement, according to a new study, warning about their "dismal retirement outlook."

The National Institute on Retirement Security wrote in a report that Generation X was the first generation to enter the labor market following the shift from defined benefit pension plans to 401(k)-style defined contribution accounts.

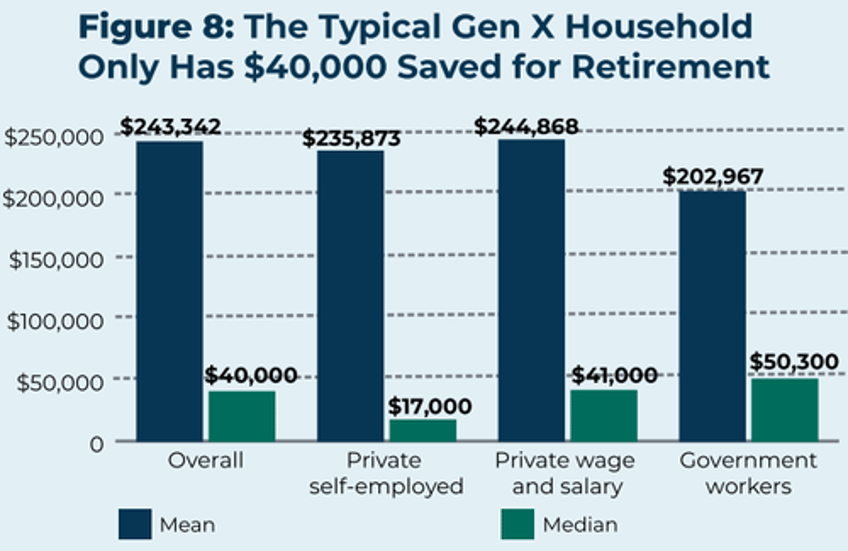

Author of the report and NIRS research director, Tyler Bond, wrote in a statement, "When looking at median retirement savings levels for Generation X, report finds that the bottom half of earners have only a few thousand dollars saved for retirement, and the typical household has only $40,000 in retirement savings." Shockingly, the study found approximately 40% of the generation have saved not even a single cent towards retirement.

The report relies upon data from the Survey of Income and Program Participation. This nationally representative survey provides income, employment, household composition, and government program participation data. Here are more key findings from the report:

- Slightly more than half (55%) of Gen Xers are participating in an employer-sponsored retirement savings plan.

- Most Gen Xers, regardless of race, gender, marital status, or income, are failing to meet retirement savings targets.

"Most Gen-Xers don't have a pension plan, they've lived through multiple economic crises, wages aren't keeping up with inflation and costs are rising. The American Dream of retirement is going to be a nightmare for too many Gen-Xers," NIRS Executive Director Dan Doonan told CBS News.

In June, we cited a separate study that called Generation X, the "Broke Generation," after a whopping 64% of respondents said they quit saving for retirement not because they didn't want to but couldn't afford to.

As for millennials...

Is the American Dream dead? pic.twitter.com/fA8PTCwKos

— Chairman (@WSBChairman) July 16, 2023