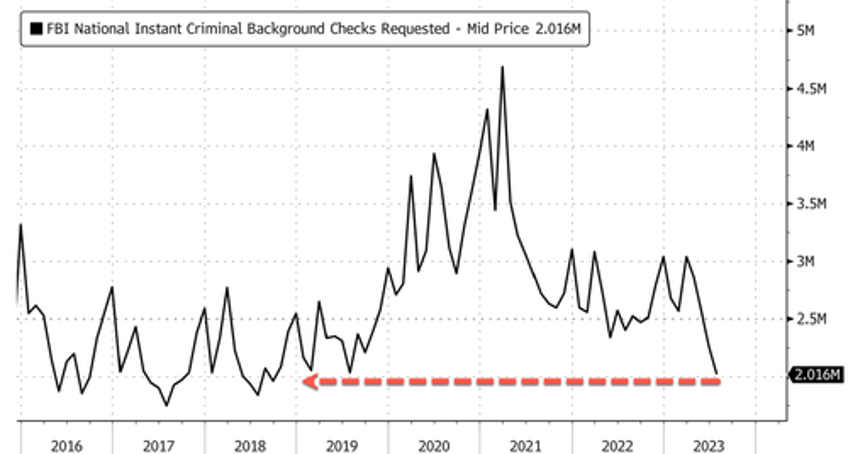

The number of monthly background checks conducted by the FBI, a necessary step to purchase a firearm, has plummeted to its lowest level in five years. We have pointed out that the gun-buying mania, sparked by Covid chaos, peaked two years ago.

According to data from the FBI's National Instant Criminal Background Check System (NICS), unadjusted criminal background checks fell 11% 2.02 million in July, the lowest since October 2018. Compared with 2022 figures, NICS checks dropped 16% from 2.4 million. And from Covid highs of 4.69 million NICS checks in March 2021, July was down 57%.

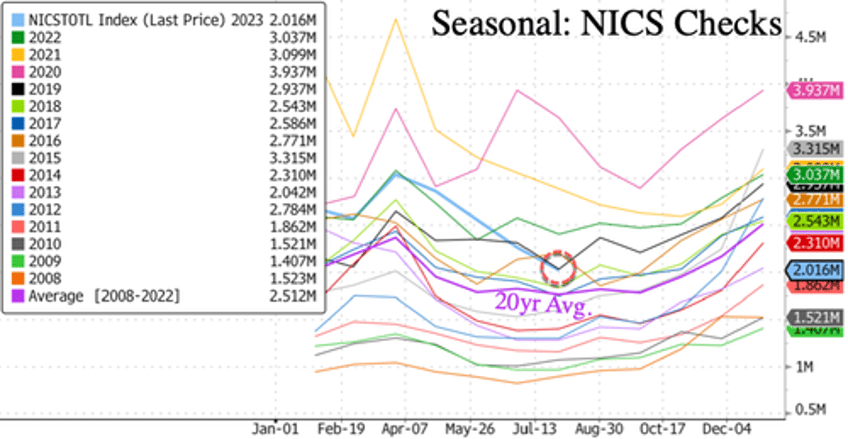

On a seasonal basis, NICS checks are still well above the two-decade average.

Recall NICS background check data is a proxy for gun sales because no national database tracks firearms purchases. The data continues to confirm the mania phase of gun buying is over (for now).

Sliding gun demand has left Smith & Wesson Brands, one of the country's largest firearms manufacturers, with elevated firearm inventory at retailers and distributors. Chief Executive Mark Smith noted in the latest earnings release that consumer promotions are helping to reduce inventory woes.

NICS data leads lead shares of Smith & Wesson Brands lower.

The latest data continues to confirm the gun bubble is deflating. We noted this trend earlier this year in a piece titled Gun Background-Checks Reveal Firearms Demand Slumped After COVID Mania and, more recently, in a note titled US Gun Demand Drops To Four-Year Low.

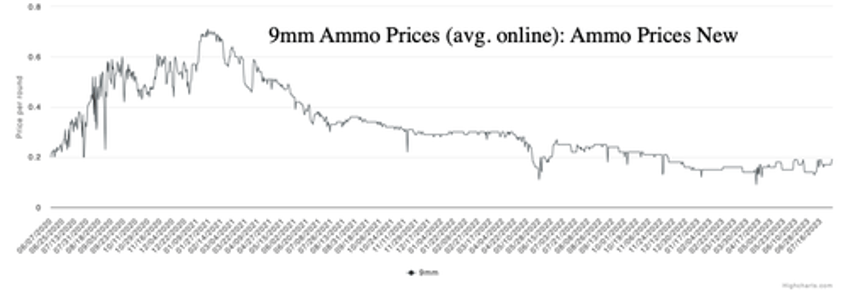

Taking a look at ammo prices, Ammo Prices Now shows the most popular caliber for home defense (9mm) trends around 19 cents per round, a far cry from 71 cents per round during the Covid peak.

Gun and ammo deflation suggests now is a good time to take advantage of sales.