Amazon’s billionaire founder Jeff Bezos has sold another $2bn worth of the company’s stock, bringing the total value of shares he has offloaded in the past week to $4bn, according to regulatory filings.

An Amazon filing on Tuesday showed that Bezos, who stepped down as the Seattle-based company’s chief executive in 2021 but remains executive chair, sold 12mn shares for about $2bn between Friday and Monday.

AMZN shares are down 4% from their highs at yesterday's open...

As we detailed last week, though the market was raging higher to end the week, following excellent earnings reports from the likes of Amazon and Meta, there was at least one person that isn't going to be a buyer: Jeff Bezos.

The Amazon founder disclosed on Friday 2nd Feb that he plans to sell up to 50 million shares over the next 12 months, according to Bloomberg. The haul will put him close to being the richest person in the world, the report says.

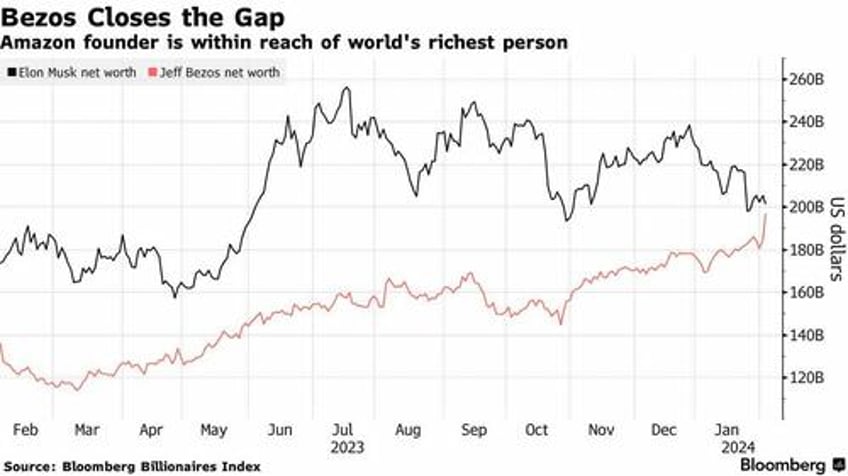

The stock's surge following its earnings on Thursday already is catapulting Bezos' wealth higher. It's up almost $13 billion on Friday, bringing him within $5.7 billion of the top spot held by Elon Musk, per the Bloomberg Billionaires Index. Bezos has not held the position of the wealthiest individual according to this index since 2021, the report added.

Bloomberg notes that the distance in net worth between Bezos and Musk is closing as Amazon and Tesla exhibit divergent trajectories. Amazon's stock has surged amidst a tech rally that propelled US stock indices to record levels, while Tesla has faced challenges from regulatory investigations, price cuts, falling margins and increasing competition.

The 60 year old Bezos will offload 50 million Amazon shares by January 31, 2025, per a recent regulatory filing. These shares would amount to approximately $8.6 billion at current market prices.

Amazon's latest 10-K detailed the impending share sales by Bezos and other directors and high-ranking officers.

Should Bezos execute this sale, it would be his initial divestment of Amazon shares since 2021. Notably, he acquired a single share in May, marking his first purchase since 2002, though the reason remains undisclosed.