In the social media era, where attention spans are measured in seconds, and 300-500 words are considered a “readable” article length, our articles can be too much for some readers at three to four times “readable” length. Instead of writing another 1,500-to-2,000-word diatribe on why we like bonds, we present a “readable,” sub-500-word elevator pitch for U.S. Treasury Bonds.

Our Simple Elevator Pitch

Our view of the attractiveness of bonds can be honed into an elevator pitch. It essentially boils down to a straightforward question – Is this time different?

Have the forty-year pre-pandemic economic trends reversed, and the economy’s inner workings changed permanently over the last three years?

More specifically, are slowing productivity growth, weakening demographics, and rising debt levels about to reverse their prior trends and become a tailwind for economic growth.

If you think, as we do, that the last three years are an economic, fiscal, and monetary anomaly, then the opportunity to earn 4% or more on a longer-term bond is a gift. We think yields will revert to extremely low levels when the pre-pandemic economic and inflation trends reemerge. Negative interest rates are not out of the question.

Is This Time Different?

If you believe this time is different. Ergo, the last three years will be like the next three years and beyond, then bonds will likely be a poor investment. For that to be true, the fiscal, monetary, and behavioral actions we witnessed in 2020 and 2021 are not one-off events related to the pandemic.

Fiscal deficits are high but normalizing and well off the pandemic amounts. The Fed is forcibly reversing its excessively easy pandemic policies. Revenge spending is still occurring, but consumer spending behaviors are slowly reverting to normal levels. Further, the excess savings from the pandemic will evaporate in the coming months. Lastly, high credit card interest rates will keep a lid on the recent extreme credit card usage.

Inflation Adjusted Yields Are Tempting

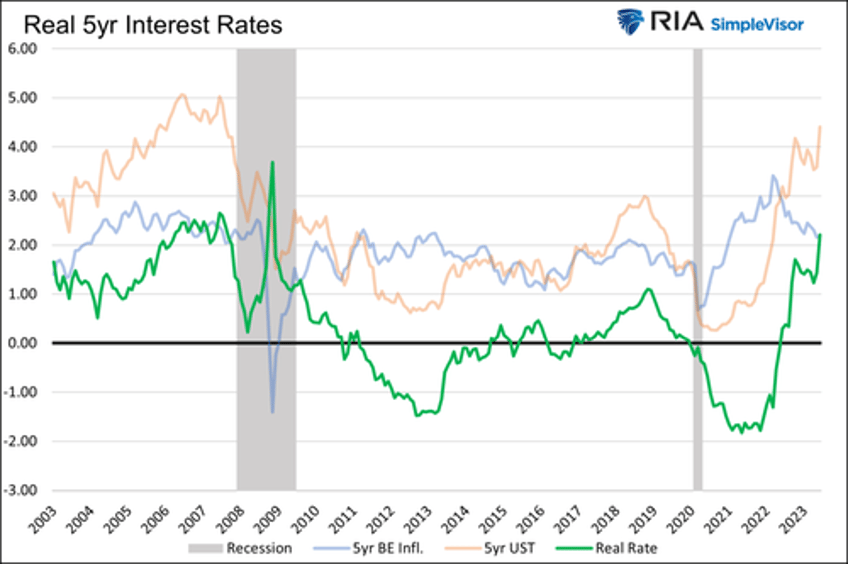

Real yields, the yield after deducting implied inflation rates, are tempting if you believe the trends of the pre-pandemic years stay intact. Today, investors can buy a risk-free 5-year Treasury note and earn a real yield of over 2%. That is generous compared to the .55% average of the last 20 years and the -.20% average rate since 2010.

Summary

To keep this “readable,” we reiterate our simple elevator pitch question, is this time different? Is a continuation of the economic, fiscal, and monetary activity of 2020 and 2021 more likely? Or is a resumption of the trends of the prior 40 years more likely?

At 471 words, we hope we succinctly informed you that we do not believe the trends of the last forty years will reverse. Consequently, we consider bond yields well above implied inflation rates and inflation rates of the prior decade a great opportunity.