Anheuser-Busch's emergency relief program for beer distributors has been extended by the brewer to keep Bud Light on store shelves after its disastrous 'woke' advertising with trans-TikTok star Dylan Mulvaney earlier this year. The move certainly looks like a 'bribe.'

The New York Post revealed while quoting a report from Beer Marketer's Insights that Anheuser-Busch has offered as much as $150 million in relief to distributors since Mulvaney's Bud Light TikTok video on April 1 sparked nationwide boycotts.

Some of the financial relief distributors have received are reimbursements for freight and fuel surcharges, as well as an additional week to pay bills to the brewer.

"I imagine for those that are having some cash flow concerns, this would help somewhat," one distributor told The Post.

The report mentioned that the financial aid package to distributors that started in June will be expanded through next spring. That includes sales incentive payments.

NYPost explained that the "market share recovery incentives" come as beer and liquor stores prepare to "revamp their shelf space in the spring when they look at the last 12 months of sales and determine which products are hot and deserve more space - and which will lose space."

Last month, former AB executive Anson Frericks warned that shelf space is "the single largest determinant of sales in a store," and said there will be a "dramatic shift" for Bud Light following the nationwide boycott.

Dave Williams, vice president of analytics and insights at Bump Williams Consulting, said retailers closely watch sales figures to determine what brands are given the best shelf space.

"There's explosive growth on one side and sharp decline on the other," Williams said, adding, "This does have that ripple effect where if Bud Light loses space on the shelf, that could make it a longer-term endeavor to claw back to where they were if they're ever able to do that in the first place."

Several months ago, Deutsche Bank analyst Mitch Collett said Bud Light was expected to lose about 25% of its business.

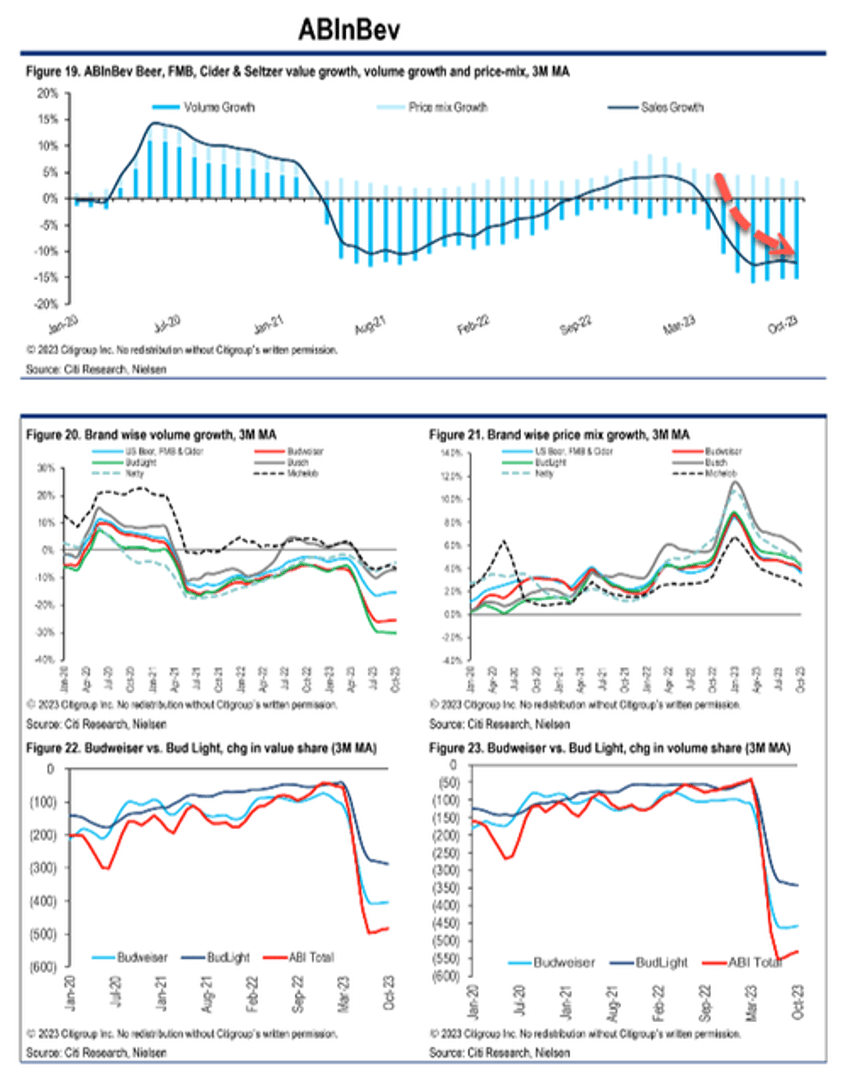

The latest data from Citi Bank shows AB's hemorrhaging has continued in the last four weeks (pro subs can find the report in the usual place):

ABInBev’s beer volumes fell 15.5% in the latest 4 weeks, notably worse than the market at -4.3% as the fall-out from the Bud Light social media campaign persists. Beer price/mix grew 3.0% to leave total dollar sales down 13.0%, deceleration vs last month’s -10.9%. Total value share for ABInBev fell - 489bps and beer value share decreased 534bps. We estimate Bud Light accounts for a little over 30% of the group’s US revenues (c.8% of group). Bud Light volumes fell 30.2% and Budweiser volumes fell 25.6%, compared to -29.9% and -25.3% respectively in the previous 4-week period

They will never forget:

— zerohedge (@zerohedge) October 20, 2023

"ABInBev’s beer volumes fell 15.5% in latest 4 weeks, notably worse than the market at -4.3% as the fall-out from the Bud Light social media campaign persists. Beer price/mix grew 3.0% to leave total dollar sales down 13.0% vs last month’s -10.9%" - Citi

Meanwhile, Mexican lager Modelo Especial dethroned Bud Light as the number-one-selling beer in America, while some beer drinkers have gravitated to brewers operating in the parallel economy, such as "Conservative Dad's Ultra Right 100% Woke-Free American beer."