- APAC stocks followed suit to the tech rout stateside owing to the recent rotation play, concerns of China tech curbs and tariff fears.

- European equity futures indicate a slightly softer open with Euro Stoxx 50 futures down 0.1% after the cash market finished lower by 1.1% on Wednesday.

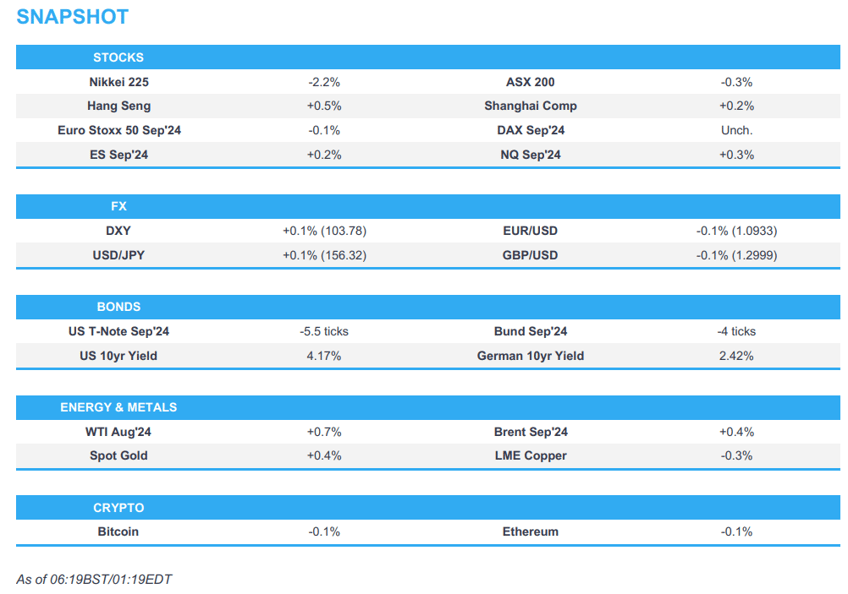

- DXY remains on a 103 handle, EUR/USD holds onto 1.09 status and Cable is testing support at 1.30.

- CNN quoted a senior adviser stating that US President Biden is now more receptive to calls for him to withdraw.

- Looking ahead, highlights include include UK Employment, US IJC, Philly Fed, ECB & SARB Policy Announcement, Comments from ECB President Lagarde, Fed’s Logan, Daly & Bowman, Supply from Japan, Spain, France & US, Earnings from Volvo AB, IDS, Ubisoft, Abbott Labs, Blackstone, TSMC & Netflix

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks mostly tumbled with tech and semis leading the declines after recent reports that the US warned allies of stricter trade rules in a China chip crackdown and after ASML (ASML NA) provided weak Q3 guidance, while Presidential Candidate Trump's warning on China tariffs (between 60-100%) and suggestions that Taiwan should pay for defence also weighed on sentiment. This pressured most US stock indices with the Nasdaq the worst hit as the losses were highly concentrated in Tech, Communication, and Consumer Discretionary, while Consumer Staples, Energy, and Financials saw decent gains and the Dow bucked the trend to print fresh record highs.

- SPX -1.39% at 5,588, NDX -2.94% at 19,799, DJI +0.59% at 41, 198, RUT -1.06% at 2, 240

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed Beige Book stated that prices increased at a modest pace overall with a couple of Districts noting only slight increases, while on balance, employment rose at a slight pace in the most recent reporting period. Furthermore, economic activity maintained a slight to modest pace of growth in a majority of Districts this reporting cycle and seven Districts reported some level of increase in activity, while five noted flat or declining activity.

- US President Biden is to consider dropping his presidential bid if a medical condition emerged, according to NY Post.

- US President Biden tested positive for COVID-19 and is experiencing mild symptoms, while he received his first dose of Paxlovid, according to the White House.

- US Senate Majority Leader Schumer told President Biden in a meeting on Saturday it would be better for the country if he ended his re-election bid, according to ABC News.

- Former House Speaker Pelosi privately told President Biden in a recent conversation that polling showed Biden cannot beat Trump and that he could destroy Democrats' chances of winning the House, according to CNN.

- CNN quoted a senior adviser stating that US President Biden is now more receptive to calls for him to withdraw, while he reportedly asked advisers if they think VP Harris can win the election, according to Al Arabiya and Al Jazeera.

APAC TRADE

EQUITIES

- APAC stocks followed suit to the tech rout stateside owing to recent concerns of China tech curbs and tariff fears.

- ASX 200 was pressured by weakness in tech and telecoms but with downside cushioned after mixed jobs data which showed higher-than-expected employment change.

- Nikkei 225 underperformed amid recent currency strength and as large tech stocks suffered similar fates to their US counterparts amid the threat of tighter restrictions to supply China, while Japanese trade data showed exports and imports missed estimates.

- Hang Seng and Shanghai Comp. were mixed and ultimately rangebound with sentiment sapped by ongoing protectionist concerns.

- US equity futures were little changed which provided some mild respite from the recent rout seen across most index futures.

- European equity futures indicate a slightly softer open with Euro Stoxx 50 futures down 0.1% after the cash market finished lower by 1.1% on Wednesday.

FX

- DXY attempted to nurse some of the prior day’s losses but remained beneath the 104.00 level after suffering from the recent strength in its major counterparts and in particular, haven currencies, while participants look ahead to upcoming Fed rhetoric and US data.

- EUR/USD took a breather after extending above the 1.0900 level with price action contained as the ECB policy announcement looms.

- GBP/USD traded little changed after giving back some of its post-CPI gains to test support at the 1.3000 level and with more releases from the UK ahead in the form of jobs and average earnings data.

- USD/JPY initially extended on yesterday’s declines and briefly dipped beneath the 156.00 handle before staging a recovery.

- Antipodeans were choppy with only brief support seen in AUD/USD following mixed Australian jobs data in which headline Employment Change topped forecasts and the Unemployment Rate unexpectedly rose but coincided with an increase in the participation rate.

- PBoC set USD/CNY mid-point at 7.1285 vs exp. 7.2587 (prev. 7.1318).

FIXED INCOME

- 10-year UST futures slightly retreated in a continuation of this week’s choppy performance and with participants looking ahead to incoming Jobless Claims and Philly Fed data, several Fed speakers, and supply including a 10-year TIPS Auction.

- Bund futures price action was contained in quiet trade ahead of the ECB policy announcement.

- 10-year JGB futures retreated at the open and dipped beneath the 143.00 level amid mild gains in yields and after mixed trade data but have since bounced off worst levels with brief support after Japan's 5-year climate transition bond auction which attracted a higher bid-to-cover.

COMMODITIES

- Crude futures remained underpinned after rallying on the back of a weaker dollar and Israel-Lebanon geopolitical tensions.

- Russian President Putin held a phone call with Saudi Crown Prince MBS, while they noted the importance of cooperation within OPEC+ to ensure energy market stability and both highly appreciate friendly relations between their countries, according to the Kremlin.

- Spot gold eked mild gains in rangebound trade after mildly pulling back yesterday from record levels.

- Copper futureswere stuck near a two-week trough with demand restricted by the mostly downbeat risk tone.

CRYPTO

- Bitcoin gained overnight but with further upside capped by resistance near the USD 65,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi will unveil his long-term vision for China’s economy with the CPC set to publish a document on Thursday offering the first glimpse of what some 400 officials discussed during the Third Plenum, according to Bloomberg. It was later reported that China's Communist Party Central Committee will hold a news conference on Friday to brief the media on the Third Plenum.

DATA RECAP

- Japanese Trade Balance Total Yen (Jun) 224.0B vs. Exp. -240.0B (Prev. -1221.3B, Rev. -1220.1B)

- Japanese Exports YY (Jun) 5.4% vs. Exp. 6.4% (Prev. 13.5%)

- Japanese Imports YY (Jun) 3.2% vs. Exp. 9.3% (Prev. 9.5%)

- Australian Employment (Jun) 50.2k vs. Exp. 20.0k (Prev. 39.7k)

- Australian Unemployment Rate (Jun) 4.1% vs. Exp. 4.0% (Prev. 4.0%)

- Australian Participation Rate (Jun) 66.9% vs. Exp. 66.8% (Prev. 66.8%)

GEOPOLITICAL

MIDDLE EAST

- US military said it is ending its Gaza temporary pier operation and that the mission is "complete", while the US is to transition from the temporary pier off the Gaza coast for aid to the Ashdod Port.

- US reportedly privately warned Iran over suspicious nuclear activities, according to Axios.

OTHER

- Russia Foreign Minister Lavrov said Russia is ready to work with any US leader who is willing to engage in 'equitable, mutually respectful dialogue'. Lavrov added there was still dialogue underway in Trump's administration despite serious sanctions.