- APAC stocks began the week mixed after a lack of major macro drivers from over the weekend aside from stronger-than-expected Japanese GDP.

- US President Trump said his meeting with Putin could happen very soon, according to Reuters.

- US Secretary of State Rubio, National Security Adviser Waltz and Special Envoy Witkoff are to travel to Saudi Arabia to start Ukraine-Russia peace talks.

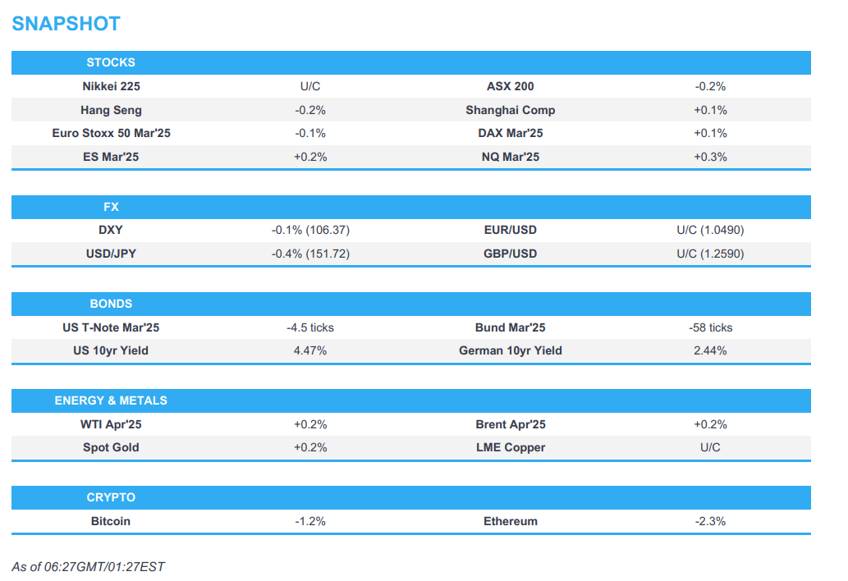

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 future -0.1% after the cash market closed lower by 0.1% on Friday.

- DXY a touch lower, JPY outperforms post-GDP, EUR/USD failed to hold above 1.05, Cable tested 1.26 to the upside.

- Looking ahead, highlights include Fed’s Harker & Bowman. Note, today is Presidents' Day (Desk Open as usual).

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were mixed on Friday with outperformance in the Nasdaq 100 as Communication and Tech names outperformed amid further gains in Nvidia (NVDA) and with Airbnb (ABNB) shares lifted after strong earnings, while the S&P 500 and Russell 2k were little changed and the Dow underperformed. T-Notes were bid in response to the weak retail sales report, which appeared to show the pre-tariff spend boom has taken a pause while cold weather and LA fires are also to blame.-SPX -0.01% at 6,115, NDX +0.38% at 22,115, DJI -0.37% at 44,545, RUT -0.10% at 2,280.

- Click here for a detailed summary.

TARIFFS/TRADE

- UK Business Secretary Reynolds, speaking to the BBC, said that if the US imposes tariffs on steel and aluminium then the UK could implement tariffs on whiskey, jeans and motorbikes. Reynolds added that no decisions have been taken and he does not believe it would occur, "believe there's a basis for constructive engagement.

- The European Commission will reportedly agree this week to explore greater import limits of foodstuffs, via FT citing sources; soybeans grown in the US with pesticides banned in the EU could be an early target. Plan will be part of the Vision for Agriculture roadmap, which reportedly references a requirement to stick to international rules.

NOTABLE HEADLINES

- Fed's Logan (2026 voter) said on Friday that the next couple of months of inflation data will be pretty important and even if they get better data on inflation, they should be cautious on rates if the labour market stays strong and stated that better inflation data doesn't necessarily mean Fed can cut. Logan said that they are also focused on geopolitical and policy changes, while she added they are taking their time to see how these affect the economy.

- US National Economic Council Director Hassett said he has been having regular meetings with Fed Chair Powell but denied the meetings were intended to influence interest rates and emphasised the Fed's independence is respected, although it was noted that the President’s views can still be voiced, according to an interview with CBS's Face The Nation.

- Broadcom (AVGO) and TSMC (2330 TT) eye possible Intel (INTC) deals that would split the latter with Broadcom interested in Intel’s chip-design business and TSMC eyeing the Co.’s factories, according to WSJ.

- Elon Musk said Grok 3 release with a live demo on Monday night at 20:00PST (04:00GMT/23:00EST).

APAC TRADE

EQUITIES

- APAC stocks began the week mixed after a lack of major macro drivers from over the weekend and ahead of upcoming central bank activity, while participants also digested a slew of earnings and stronger-than-expected GDP data from Japan.

- ASX 200 was led lower by underperformance in gold miners and the top-weighted financial sector with the latter pressured alongside losses in Westpac after its earnings results.

- Nikkei 225 was choppy after stronger-than-expected GDP data and a firmer currency, while there was a recent slew of earnings.

- Hang Seng and Shanghai Comp saw two-way price action with early notable strength seen in some tech names including Tencent as its Weixin app launched beta testing with DeepSeek and as Chinese President Xi met with Chinese tech entrepreneurs, while financing data last week topped estimates and PBoC Governor Pan renewed the pledge to adopt proactive fiscal policy and accommodative monetary policy, as well as strengthen counter-cyclical policy adjustments in China. However, Chinese stocks slipped in the second half of trade as the mood in tech deteriorated with Baidu shares slumping amid reports of its absence at Xi's tech symposium and amid disappointment by the lack of policy announcements so far from the meeting.

- US equity futures (ES +0.2%) traded with mild gains with the upside gradual amid the extended weekend in the US for Presidents' Day.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 future -0.1% after the cash market closed lower by 0.1% on Friday.

FX

- DXY marginally softened in rangebound trade with little fresh macro catalysts from over the weekend as geopolitical commentary dominated newsflow, while price action is also constrained with US and Canadian markets on an extended weekend.

- EUR/USD traded flat and briefly reclaimed the 1.0500 handle with European leaders set to meet for a summit on Ukraine.

- GBP/USD remained afloat and retested the 1.2600 level after its recent mostly one-way moves to the upside, while there were reports that UK Chancellor Reeves is considering a stealth income tax rise in the Spring statement with "nothing off the table".

- USD/JPY retreated to a sub-152.00 level with the yen boosted by the stronger-than-expected Japanese data.

- Antipodeans edged mildly higher on the back of a softer dollar and firm yuan reference rate setting but with upside capped heading into the anticipated central bank rate cuts starting with the RBA on Tuesday followed by the RBNZ on Wednesday.

- PBoC set USD/CNY mid-point at 7.1702 vs exp. 7.2617 (prev. 7.1706).

- Iraq’s central bank will ban five local banks from dollar transactions at the request of the US Treasury and three payment services firms will also be banned, with the request made due to monetary violations and smuggling of dollars outside of the country.

FIXED INCOME

- 10yr UST futures continued to trickle down from Friday's peak after surging on dire retail sales data stateside and with price action constrained at the start of the week with US cash trade shut on Monday due to Presidents' Day.

- Bund futures resumed Friday's retreat after stalling just shy of the 133.00 level and with little catalysts to spur a bid.

- 10yr JGB futures retreated following the stronger-than-expected preliminary Japanese GDP data for Q4.

COMMODITIES

- Crude futures were uneventful amid light pertinent catalysts and with European leaders set to hold an emergency summit on Ukraine today in Paris, while US and Russian officials are also set to meet in Riyadh this week for early talks on ending the war in Ukraine.

- Spot gold regained its composure after Friday's slump and returned to above the USD 2,900/oz level.

- Copper futures lacked direction following last week's late pullback and with demand hampered by the mixed risk appetite.

CRYPTO

- Bitcoin traded indecisively in a relatively contained range at the USD 96k territory.

NOTABLE ASIA-PAC HEADLINES

- PBoC Governor Pan said will adopt proactive fiscal policy and accommodative monetary policy, while they will strengthen counter-cyclical policy adjustments in China. Furthermore, Pan said China now focuses more on consumption and offers pro-consumption policies including boosting household income and offering subsidies.

- Chinese President Xi attended a symposium on private enterprises, according to Xinhua.

- Chinese Foreign Minister Wang met his Spanish counterpart on the sidelines of the Munich security conference and said China welcomes more Spanish companies to deepen efforts in the Chinese market and share opportunities in China’s super-large market, economic transformation and development. Wang also commented that China and the West should work together to practice multilateralism, promote democratisation in international relations, as well as work together to promote equal and orderly multi-polarisation. Furthermore, Wang said China is willing to strengthen communication and coordination with Germany and told the EU’s foreign policy chief that China is ready to step up strategic communication with the EU, as well as enhance mutual understanding and jointly provide more stability to the world.

- Japan and the UK will conduct an economic 2+2 meeting in Tokyo on March 7th.

DATA RECAP

- Japanese GDP QQ (Q4) 0.7% vs. Exp. 0.3% (Prev. 0.3%, Rev. 0.4%)

- Japanese GDP QQ Annualised (Q4) 2.8% vs. Exp. 1.0% (Prev. 1.2%, Rev. 1.7%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said Hamas released three hostages on Saturday and that one of the hostages is an American.

- Israeli PM Netanyahu said US President Trump is the greatest friend Israel has ever had in the White House and he had very productive discussions with US Secretary of State Rubio in which none were more important than regarding Iran, while he added that he is working in full cooperation with US President Trump on Gaza. Furthermore, Netanyahu said Israel is determined to achieve its Gaza war objectives, will limit Hamas’s military capacity and will not allow Syria to be used as a base for hostile operations.

- Israeli PM Netanyahu told the US Middle East envoy Witkoff the Israeli security cabinet will convene on Monday to discuss the second phase of the ceasefire agreement and a negotiating team is to fly to Cairo on Monday to discuss the Gaza ceasefire deal, according to the PM’s office.

- Israeli military chief Halevi will travel to the US on an official visit from February 17th-20th.

- US Secretary of State Rubio said Iran has a regime that the people do not support, while he added there cannot be a nuclear Iran and told Israeli PM Netanyahu that he can always count on the US and President Trump.

- US Middle East Envoy Witkoff said he spoke separately with Israeli PM Netanyahu, Qatar’s PM and Egypt’s intelligence chief about a Gaza ceasefire deal and had productive, constructive discussions about the sequencing of phase 2 of the Gaza deal, while talks are to continue this week to figure out how to get to the end of phase 2 successfully.

- Hezbollah condemned an attack on a UNIFIL convoy in Beirut and expressed a firm rejection of any targeting of its forces.

- Lebanese officials have asked Iran to suspend its flights into Lebanon until February 18th citing security conditions, according to Tehran Times.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said Kyiv has clear intelligence that Russia plans to send troops to Belarus this summer, while he added that the Ukrainian army alone isn’t enough and that they need EU support and said they cannot agree to a ceasefire without real security guarantees, according to Reuters.

- Russian President Putin’s Press Secretary Peskov said the Trump call is a powerful signal that Russia and the US will be solving problems via dialogue, while Peskov added that Western sanctions will not hinder Russia-US talks and that Trump can visit Russia any moment he likes, according to TASS.

- US President Trump said he is working to make peace and sees Ukrainian President Zelensky involved, while he added Russian President Putin wants to end it soon and his meeting with Putin could happen very soon, according to Reuters.

- US Secretary of State Rubio spoke with Russian Foreign Minister Lavrov and reaffirmed President Trump’s commitment to finding an end to the conflict in Ukraine, while they discussed the opportunity to potentially work together on a number of bilateral issues and agreed to continue regular contacts including for the US-Russia summit. Russia’s Foreign Ministry also said Lavrov and Rubio agreed to maintain a channel of communication to resolve problems in Russia-US relations.

- US Secretary of State Rubio said the next few days will determine if Russian President Putin is serious about peace and one meeting isn’t going to solve the war in Ukraine, while he stated there is currently no process to end the war in Ukraine and further conversations will be to figure out what the process to talk about would look like.

- US Secretary of State Rubio, National Security Adviser Waltz and Special Envoy Witkoff are to travel to Saudi Arabia to start Ukraine-Russia peace talks. It was separately reported that Russian Foreign Minister Lavrov is likely to attend the Riyadh talks, according to Axios citing sources.

- US special envoy to Ukraine Kellogg said Russian President Putin may have to make territorial concessions and that the US wants to break Russia’s alliances with North Korea, China and Iran.

- US questionnaire sent to European allies asked what US support requirements European governments consider necessary for US participation in Ukraine security arrangements and what governments are ready to do to increase sanctions on Russia including better enforcement, while it asked if countries are willing to deploy troops to Ukraine as part of a peace settlement.

- Ukraine’s military said on Sunday that Russia launched 143 drones in an overnight attack.

- Polish PM Tusk will take part in an extraordinary summit about Ukraine in Paris on Monday, while the French presidency confirmed EU’s von der Leyen, UK PM Starmer, German Chancellor Scholz, UK PM Starmer and the leaders of Italy, Poland, Spain, Denmark and the Netherlands will attend the Monday meeting on Ukraine.

- UK PM Starmer said will work to ensure they keep the US and Europe together on Ukraine, according to BBC. It was also reported that PM Starmer said he was ready to send British troops to Ukraine as part of any post-war peacekeeping force as talks aimed at ending the war are set to begin this week.

- German Chancellor Scholz said Europeans will support Ukraine for as long as necessary, even beyond any peace settlement.

- French President Macron said he discussed Russia’s war in Ukraine with Saudi Arabia’s Crown Prince Bin Salman and how Saudi Arabia could play a role in building up a solid and lasting peace deal in Ukraine.

- NATO Secretary General Rutte said Russian President Putin would not dare attack a NATO country and would face the full onslaught of NATO.

OTHER

- China's military said its forces monitored and warned a Canadian warship in the Taiwan Strait, while it added the transit of the Canadian warship deliberately stirred up trouble and undermined peace and stability in the Taiwan Strait.

- North Korea said it expresses serious concern about the US military’s confrontational behaviour and the US should abandon military threats if it has concerns about its mainland safety, while it added that is its sovereign right to improve its self-defence power, according to KCNA.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer is seeking to act as a bridge between Washington and Europe with the PM expected to hold talks with US President Trump later this month, according to FT.

- UK Chancellor Reeves was reported to have left the door open to raising UK taxes next month with the Treasury refusing to rule out tax rises as part of the package, while an aide said Reeves was taking “nothing off the table”, according to FT.

- ECB’s Panetta said available indicators suggest prevailing risks remain that of inflation remaining below 2% over the medium-term, while he stated the greatest risks to inflation arise from energy markets and developments need to be monitored closely. Panetta added that US tariffs on European exports may weaken EUR and prompt retaliation, but the impact will be offset by the global economy slowdown and shift of Chinese goods to Europe.

- EU Trade Commissioner Sefcovic is to travel to Washington on Monday.

- Two people died and over 30 were injured after an Afghan man drove into a crowd of protestors in Munich.

- Austrian investigators believe a stabbing rampage on Saturday in the town of Villach was an Islamist attack, according to APA.

DATA RECAP

- UK Rightmove House Price MM (Feb) 0.5% (Prev. 1.7%)

- UK Rightmove House Price YY (Feb) 1.4% (Prev. 1.8%)