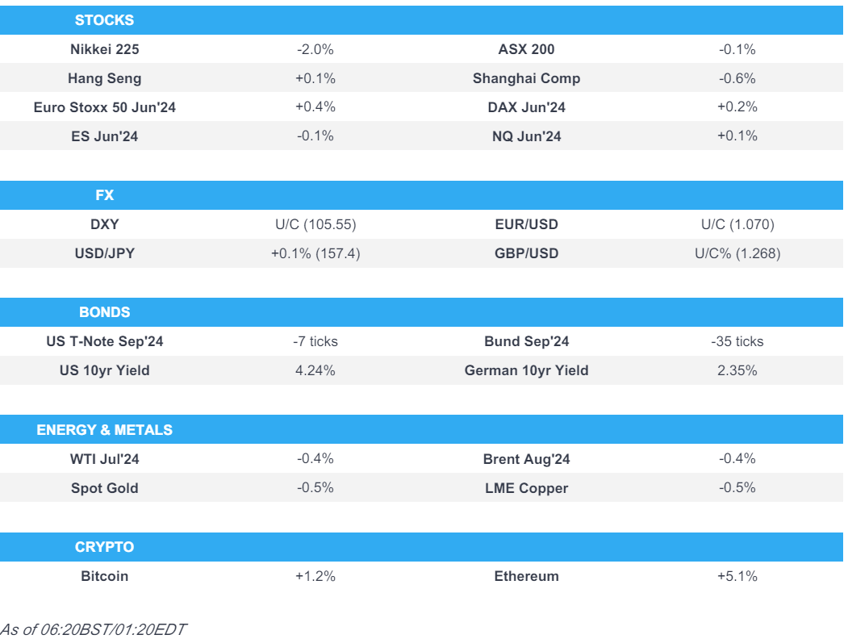

- APAC stocks took impetus from the gains in the US where the S&P 500 and the Nasdaq notched record highs

- DXY steady, AUD unreactive to RBA while the JPY was unphased by Ueda

- RBA rate decision where the central bank kept rates unchanged and reiterated the Board remains resolute in its determination to return inflation to the target and it is not ruling anything in or out.

- Fixed benchmarks nursed some of Monday's pressure but were largely rangebound into numerous Fed speakers

- Crude paused for breath after its geopolitical rally

- Looking ahead, highlights include German ZEW, EZ HICP (F), US Retail Sales & Industrial Production, NBH Policy Announcement, Comments from RBA’s Bullock, RBNZ's Conway, ECB’s Cipollone & de Guindos, Fed’s Barkin, Collins, Logan, Kugler, Musalem & Goolsbee, UK, German & US supply.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were firmer to start the week with gains led by outperformance in the large-cap sectors of Consumer Discretionary and Technology in which the latter was buoyed by strength in Micron (MU) (+4.5%) after BofA and Susquehanna raised PTs for the stock ahead of earnings next week, while there was no specific headline driving the upside in stocks which also shrugged off higher yields ahead of a deluge of Fed commentary.

- SPX +0.77% at 5,473, NDX +1.24% at 19,903, DJIA +0.49% at 38,778, RUT +0.79% at 2,022.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed Chair Powell is to give semi-annual monetary policy testimony at the Senate Banking Committee on July 9th.

- Fed's Harker (non-voter) said if his economic forecast plays out, he thinks one rate cut would be appropriate by year-end but added that two cuts or none are also quite possible and it depends on data. Furthermore, Harker said that more data is essential to come to a decision on rate cuts given the choppiness so far this year and noted the latest inflation data is quite promising, but falls short of the confidence needed and has not quite dissipated uncertainty.

- WSJ's Timiraos posted on X that with PPI and import price data in hand for May, the inflation modellers who map the CPI/PPI into the PCE now expect the core PCE index rose around 0.08%-0.13% in May which would translate to a 2.6% year-on-year core PCE inflation rate and is down from 2.8% in April. Furthermore, he said this would hold the 6-month annualised core PCE rate around 3.2% (or 3.3%) in May and the 3-month annualised rate would drop back below 3% for the first time since January.

APAC TRADE

EQUITIES

- APAC stocks took impetus from the gains in the US where the S&P 500 and the Nasdaq notched record highs once again despite the lack of any major fresh macros drivers and as a deluge of Fed rhetoric looms.

- ASX 200 was underpinned with financials and defensives front-running the broad advances seen across sectors, while attention turned to the RBA decision where the central bank provided no surprises and kept the Cash Rate target unchanged at 4.35%.

- Nikkei 225 recovered some of the prior day's notable losses amid the rising tide across global equity markets and was unfazed by the latest comments from BoJ Governor Ueda who suggested the potential for a July rate hike depending on the data.

- Hang Seng and Shanghai Comp. were ultimately mixed as the Hong Kong benchmark later deteriorated after failing to sustain the 18,000 level, while the mainland conformed to the positive mood after the PBoC upped its liquidity efforts.

- US equity futures plateaued and traded sideways following the prior day's rally.

- European equity futures indicate a positive open with Euro Stoxx 50 futures up 0.4% after the cash market closed higher by 0.9% on Monday.

FX

- DXY traded steadily overnight and partially atones for Monday's weakness but with trade kept to within a thin range ahead of US retail sales and an incoming deluge of Fed rhetoric, while comments from Fed's Harker had little impact on markets as he noted that one rate cut would be appropriate by year-end if his economic forecast plays out but added that two cuts or none are also quite possible.

- EUR/USD lacked direction after EU leaders failed to reach an agreement on the top jobs at an informal summit, but will continue to work in the coming days on a deal ahead of next week's formal European Council meeting.

- GBP/USD was rangebound amid light pertinent catalysts and ahead of Wednesday's CPI data and Thursday's BoE decision.

- USD/JPY slightly trickled lower but retained a firm footing at the 157.00 territory, while comments from BoJ Governor Ueda failed to garner much of a reaction despite suggesting the potential for a hike at the July meeting.

- Antipodeans were contained with a lack of fireworks seen from the RBA rate decision where the central bank kept rates unchanged and reiterated the Board remains resolute in its determination to return inflation to the target and it is not ruling anything in or out.

FIXED INCOME

- 10-year UST futures nursed some of the prior day's losses but with the rebound limited as a plethora of Fed speakers loom.

- Bund futures recouped some lost ground after recently pulling back from the 133.00 level, while the focus turns to data and supply.

- 10-year JGB futures were lacklustre despite the BoJ's presence in the market, while comments from Governor Ueda who opened the door to a July rate hike had little effect on prices.

COMMODITIES

- Crude futures took a breather after recently rallying on a softer dollar and geopolitical uncertainty.

- Spot gold edged marginal gains in a gradual continuation of yesterday's intraday rebound.

- Copper futures lacked firm direction although remained afloat alongside the mostly constructive risk tone.

CRYPTO

- Bitcoin was pressured with prices down by around USD 1,000 and briefly dipped beneath the USD 65,000 level.

NOTABLE ASIA-PAC HEADLINES

- Hong Kong will start to permit trading through typhoons from September 25th.

- BoJ Governor Ueda said underlying inflation is to gradually accelerate and they must be vigilant to financial market moves and the impact on the economy, while he added that they need to scrutinise data a bit more to judge whether underlying inflation will heighten on a firm note and if they become more convinced that underlying inflation will accelerate towards the price target, they will adjust the degree of monetary easing by raising the short-term policy rate. Furthermore, Ueda said they cannot say now how much the BoJ will trim bond buying and they will not send a strong policy message by cutting JGB purchases, while he added that depending on economic, price and financial data and information available at the time, there is a chance we could raise interest rates at July meeting.

- RBA kept the Cash Rate Target unchanged at 4.35%, as expected, while it reiterated that the Board remains resolute in its determination to return inflation to the target and inflation remains high and is above target which is proving persistent. RBA said inflation is easing but has been doing so more slowly than previously expected and the Board expects that it will be some time yet before inflation is sustainably in the target range, while it added the path of interest rates that will best ensure that inflation returns to the target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out.

DATA RECAP

- Singapore Non-Oil Exports MM (May) -0.1% vs. Exp. 1.7% (Prev. 7.6%, Rev. 7.3%); YY (May) -0.1% vs. Exp. -1.0% (Prev. -9.3%, Rev. -9.6%)

GEOPOLITICAL

MIDDLE EAST

- Israeli negotiator said tens of Gaza hostages are alive with certainty, according to AFP News Agency.

- US National Security Adviser Sullivan said they need to give and take in negotiations, as well as bridge the differences between Hamas and Israel, while he added that the current proposal represents a roadmap for a ceasefire in Gaza.

- Top US Democrats approve massive arms sales to Israel including 50 F-15 fighter jets, according to Washington Post.

OTHER

- US National Security Adviser Sullivan said their approval of Kyiv's use of US weapons inside Russia extends to any place used by Russian forces to strike Ukraine, according to Al Jazeera.

- Russian President Putin said Russia and North Korea will develop trade and mutual settlements mechanism uncontrolled by the West and will jointly resist sanctions, while he added that Russia highly appreciates North Korea's support in Moscow's special operation in Ukraine and that the West is pushing Ukraine to strike Russia's territory, according to TASS.

- South Korea's military fired warning shots after North Korean soldiers crossed the military demarcation line, while the North Korean military suffered multiple casualties due to the explosion of land mines within the demilitarized zone, according to Yonhap.

- US condemned escalatory and irresponsible actions by China in the South China Sea on Sunday and reaffirmed support for the Philippines in a statement.

- Chinese spokesperson criticised the Philippines' submission on its undersea shelf in the South China Sea, claiming it infringes on China's sovereign rights, violates international law and contradicts the Declaration on Conduct of Parties in the South China Sea.

EU/UK

NOTABLE HEADLINES

- EU officials said the French vote puts Europe's defence push at risk and French President Macron is seen as weakened by the European election defeat, while joint EU defence spending and Macron's Ukraine plans are seen at risk, according to Bloomberg.

- EU leaders concluded their summit with no agreement on key political positions, while EU's Michel said EU leaders will continue to work in the coming days for a deal on top jobs and that they need to agree on a program for the next five years at EU summit next week.