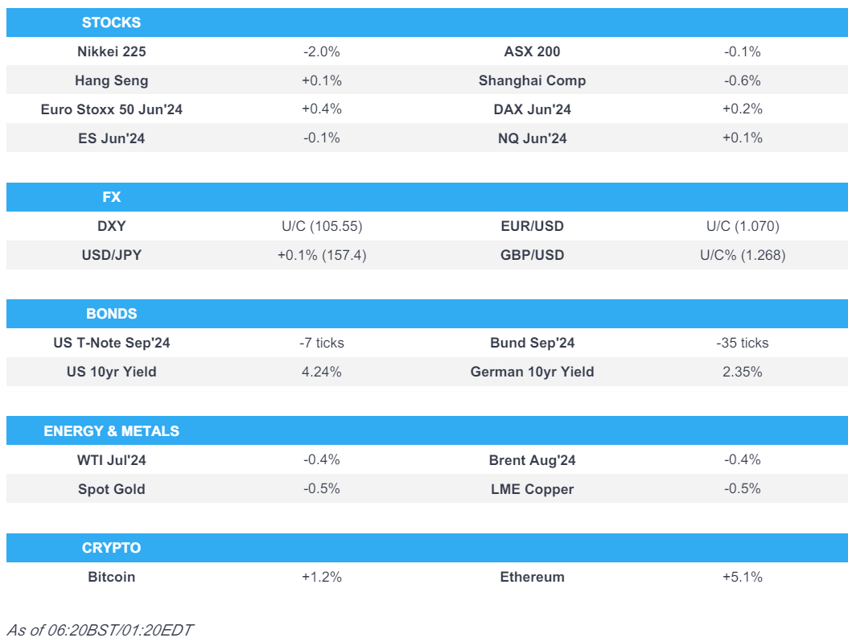

- US stocks were mixed and the major indices finished off their worst levels seen early in the session alongside the broad risk-averse conditions

- APAC stocks were mostly negative as markets reflected on the latest soft Chinese data releases; European futures point to a firmer open

- DXY steady around 105.50, EUR/USD directionless & Cable below 1.27

- EGBs eased back from Friday's marked rally; ECB sources report they are in no rush to discuss any French bond rescue

- Crude lacklustre with metals on the back foot after Chinese data

- Israel's military said it will hold a tactical pause of military activity for humanitarian purposes in some areas between 06:00BST-17:00BST daily

- Looking ahead, highlights include Italian CPI, EZ Labour Costs, US NY Fed Manufacturing, Comments from ECB’s Lagarde, Lane, de Guindos & Cipollone, Fed’s Williams, Harker & Cook, Supply from Belgium, Earnings from Lennar.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include Italian CPI, EZ Labour Costs, US NY Fed Manufacturing, Comments from ECB’s Lagarde, Lane, de Guindos & Cipollone, Fed’s Williams, Harker & Cook, Supply from Belgium, Earnings from Lennar.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks were mixed and the major indices finished off their worst levels seen early in the session alongside the broad risk-averse conditions although there was notable underperformance in the small-cap Russell 2000 which extended on its sell-off from Thursday, while the majority of sectors were pressured and closed in the red with only Tech and Communications firmer.

- SPX -0.04% at 5,432, NDX +0.42% at 19,660, DJIA -0.15% at 38,589, RUT -1.61% at 2,006.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Mester (voter, retiring in June) said on Friday that the median SEP projection is close to hers and there is still work to do to gain confidence in inflation. Mester repeated she still wants to see a few more months of similar inflation data and she does not think they will get back to the inflation target until 2026, while she added that all meetings are always in play, according to a Bloomberg interview.

- Fed's Goolsbee (non-voter) said on Friday that recent CPI data was very good and they would be feeling very good if they got a lot of months like May's CPI data, while he added they have to see more progress and his feeling was relief.

- Fed’s Kashkari (non-voter) said they need to see more evidence to convince them inflation is heading to 2% and they are in a good position to take their time and get more data before deciding on rates. Kashkari also stated it is reasonable that a rate cut could occur in December and the median projection is for one cut which is likely to be towards the end of the year, according to CBS' Face the Nation.

APAC TRADE

EQUITIES

- APAC stocks were mostly negative as markets reflected on the latest soft Chinese data releases.

- ASX 200 was rangebound as weakness in tech and mining-related sectors offset the gains in defensives and financials, with trade contained ahead of tomorrow's RBA announcement and after Australia and China signed MOUs on the economy, trade and education.

- Nikkei 225 underperformed and dipped below 38,000 in the fallout of last week's BoJ meeting and press conference, while Machinery Orders for April were better than expected with surprise Y/Y growth of 0.7% (exp. -0.1%) and the M/M figure showed a narrower than feared decline at -2.9% (exp. -3.1%) although printed its first contraction in 3 months.

- Hang Seng and Shanghai Comp. were mixed as the Hang Seng attempts to buck the trend amid tech strength and with the mainland pressured after soft data releases from China including the miss on loans and financing data, while Industrial Production and Retail Sales were mixed and House Prices showed a further deterioration with the steepest M/M drop in nearly a decade.

- US equity futures were little changed after Friday's mixed performance and amid the subdued mood in Asia.

- European equity futures indicate a positive open with Euro Stoxx 50 futures up 0.5% after the cash market closed lower by 2.0% on Friday.

FX

- DXY traded steadily around the 105.50 level after a lack of pertinent headlines stateside over the weekend aside from comments from Fed's Kashkari who pointed to a December cut and noted the median projection is for one cut which is likely to be towards year-end.

- EUR/USD struggled for direction with price action stuck around the 1.0700 level ahead of EU wages/labour cost data and ECB speakers, while there were source reports over the weekend that the ECB is in no rush to discuss a French bond rescue.

- GBP/USD languished beneath the 1.2700 handle as polls continued to suggest PM Sunak's Tories face a wipeout at next month's election, while the focus for the UK this week is on inflation data on Wednesday and BoE rate decision on Thursday.

- USD/JPY traded on both sides of 157.50 ahead of BoJ Governor Ueda's parliamentary appearance.

- Antipodeans were subdued amid the mostly weaker data releases from both Australia and New Zealand's largest trading partner.

FIXED INCOME

- 10-year UST futures faded Friday's gains as Fed rhetoric continued to suggest more work was needed on inflation including from Kashkari who noted they need to see more evidence inflation is heading to 2% and it is reasonable that a rate cut could occur in December.

- Bund futures mildly eased back after its recent firm rally and prices reverted to a sub-133.00 level.

- 10-year JGB futures remained afloat although were off last week's best levels amid the absence of BoJ purchases and as participants digested somewhat ambiguous Machinery Orders data.

COMMODITIES

- Crude futures lacked demand amid quiet energy-specific newsflow and the absence of major geopolitical escalation.

- US President Biden is ready to reopen US oil stockpile if petrol price surge again, according to FT.

- Ukraine planned record power imports on Saturday after significant energy infrastructure damage. In relevant news, US Vice President Harris announced over USD 1.5bln to bolster Ukraine’s energy sector, according to Reuters.

- Spot gold marginally pulled back following Friday's resurgence from beneath the USD 2,300/oz level.

- Copper futures were on the back foot amid the risk-averse mood and mostly disappointing Chinese data.

CRYPTO

- Bitcoin gradually trickled lower overnight in a retreat beneath the USD 66,500 level amid the subdued risk tone.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted CNY 182bln (vs CNY 237bln maturing) in 1-year MLF with the rate kept at 2.50%.

- China's NBS spokesperson said domestic demand is insufficient despite efforts and the property market shows positive changes but is still in the middle of adjustments, while she added that more time was needed to see the effect of property measures and China's economy likely to continue to recover despite the complex external environment.

- China still has room to lower interest rates but the ability to adjust monetary policy faces internal and external constraints, according to PBoC-backed Financial News.

- China Securities Regulatory Commission announced in a statement that it'll further evaluate and refine rules for margin trading and securities lending, while it will increase regulation of "illicit" short-selling as it aims to ensure market stability.

- Australia and China signed memorandums of understanding on the economy, trade and education in Canberra, while Australian PM Albanese said they aim to strengthen the relationship with China and Chinese Premier Li announced that China will include Australia in its visa waiver program, according to Reuters.

DATA RECAP

- Chinese Industrial Output YY (May) 5.6% vs. Exp. 6.0% (Prev. 6.7%)

- Chinese Retail Sales YY (May) 3.7% vs. Exp. 3.0% (Prev. 2.3%)

- Chinese Urban Investment (YTD) YY (May) 4.0% vs. Exp. 4.2% (Prev. 4.2%)

- Chinese China House Prices MM (May) -0.71% (Prev. -0.58%)

- Chinese China House Prices YY (May) -3.9% (Prev. -3.1%)

- Japanese Machinery Orders MM (Apr) -2.9% vs. Exp. -3.1% (Prev. 2.9%)

- Japanese Machinery Orders YY (Apr) 0.7% vs. Exp. -0.1% (Prev. 2.7%)

GEOPOLITICAL

MIDDLE EAST

- Israel's military said it will hold a tactical pause of military activity for humanitarian purposes between 06:00BST-17:00BST daily along the road from the Kerem Shalom Crossing to Salah Al-Din Road and then northwards, according to Reuters. However, it was separately reported that Israeli PM Netanyahu denounced as ‘unacceptable’ the plans by Israel’s military for a limited pause in operation near a crossing into Gaza intended to help aid distribution, according to FT.

- Israel Defence Forces said intensified cross-border fire from Hezbollah on Israel could lead to dangerous escalation and is bringing them to the brink of what could be a wider escalation that could have devastating consequences for Lebanon and the entire region, according to a video statement cited by Reuters.

- Hamas leader Haniyeh said the group’s response to the latest Gaza ceasefire proposal is consistent with the principles of US President Biden’s plan, according to Reuters. It was also reported that the Palestinian Islamic Jihad armed wing said the only way to return Israeli hostages is through withdrawing from Gaza and reaching a hostages-for-prisoners deal.

- White House said Qatar and Egypt plan talks with Hamas on a Gaza ceasefire, while the White House later said that President Biden's senior adviser Amos Hochstein will be in Israel on Monday for meetings.

- US National Security Adviser Sullivan said President Biden wants to see a cessation of hostilities in Gaza and see hostages return home, while he added that they work tirelessly with Israelis to ensure unhindered humanitarian access.

- UK, France, and Germany’s governments condemned Iran’s latest steps as reported by the IAEA to further expand its nuclear program which they said is especially concerning, while they remain committed to a diplomatic solution preventing Iran from developing nuclear weapons, according to Reuters.

- Iranian Foreign Ministry spokesperson Kanaani said the G7 should distance itself from destructive policies in the past. It was also separately reported that Iran’s Foreign Ministry condemned the ‘invalid’ E3 statement on its nuclear program, according to IRNA.

- US naval forces rescued a crew from a Greek-owned ship that was struck by Houthis in the Red Sea, while Yemen’s Houthis said they carried out three military operations against an American destroyer and two ships in the Red and Arabian Seas, according to Reuters.

OTHER

- Russia’s Kremlin said President Putin is not ruling out talks with Ukraine but wants guarantees and a legitimate record of their outcome is needed, according to Russian agencies including TASS. In relevant news, Russian forces took control of the village in Ukraine’s Zaporizhzhia region, according to Ifax citing the Defence Ministry.

- Ukrainian peace summit communiqué stated that Russia’s ongoing war against Ukraine continues to cause large-scale human suffering and destruction, as well as creates risks and crises with global repercussions, while it stated that any threat or use of nuclear weapons in the context of the ongoing war against Ukraine is inadmissible.

- Ukrainian Foreign Minister said the peace summit communiqué text is complete and Kyiv’s positions have been addressed, while there were no alternative peace plans discussed at the summit in Switzerland and Kyiv won’t let Russia speak in the language of ultimatums. Furthermore, the Austrian Chancellor said there is a desire for a follow-up Ukraine conference although it is too early to say what the format will be and have to see whether Russians can be there.

- US National Security Adviser Sullivan said Russia’s latest peace proposal for Ukraine would lead to further domination of Ukraine and is a completely absurd vision.

- Swedish armed forces spokesperson said a Russian air plane violated Swedish airspace on Friday and was met by Swedish fighter jets, according to TT news agency.

- China's Coast Guard said a Philippine supply ship illegally intruded into waters adjacent to Second Thomas Shoal on June 17th and the vessel deliberately approached the Chinese ship in an unprofessional and dangerous manner which resulted in a collision, while it added that the Philippine transport and replenishment ship ignored China's repeated solemn warnings.

- China is expanding its nuclear arsenal faster than any other country but still lags behind the US and Russia, according to a report cited by SCMP.

- US, South Korea and Japan are to lock in security ties and will sign a deal this year to formalise a security partnership against threats from North Korea's nuclear weapons before the inauguration of the next US President in January, according to Bloomberg.

EU/UK

NOTABLE HEADLINES

- UK PM Sunak’s Conservative Party is headed for a historic wipeout in the July 4th general election, according to three new polls by Survation, Opinium and Savanta published in Sunday newspapers cited by Bloomberg.

- ECB President Lagarde released a speech on Friday which stated that policymakers today are grappling with new kinds of risk and although the best-case scenario would be for policymakers to work together to prevent these risks from materialising, we need to be prepared for a “second-best” world marked by higher levels of uncertainty and volatility. Furthermore, she added that it will create tensions for central banks that we will have to resolve.

- ECB is in no rush to discuss a French bond rescue and policymakers have not discussed emergency bond purchases for France, according to sources. Furthermore, sources said ECB policymakers have no immediate plan to debate using the Transmission Protection Instrument for France and some policymakers would wait until a new French government is formed before any discussion about TPI, according to Reuters.

- French President Macron said he is not worried about the impact on markets after the decision to dissolve the government.

- Germany is to reportedly endorse a second term of office for European Commission President von der Leyen at a meeting of EU leaders on Monday, according to Reuters citing government sources.

- Italian PM Meloni said G7 leaders agreed on the need for a fairer international taxation system and global minimum tax.

DATA RECAP

- UK Rightmove House Price Index MM (Jun) 0.0% (Prev. 0.8%); YY (Jun) 0.6% (Prev. 0.6%)