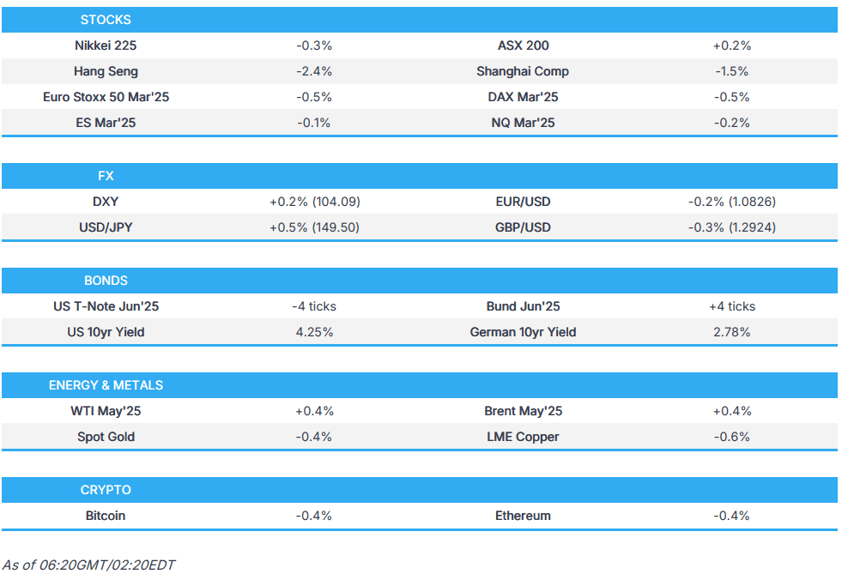

- A mixed session of APAC trade, US futures in-fitting after Thursday’s swings while European futures point to a softer open.

- DXY extended past the 104.00 mark, EUR remained subdued and GBP continued to slip, USD/JPY above 149.00

- Fixed benchmarks contained and lacked direction while crude extended on the prior sessions sanctions driven gains

- US President Trump signed an order to increase the production of critical minerals; POTUS to speak with Hegseth at 15:00GMT

- Looking ahead, highlights include UK PSNB, Canadian Retail Sales, EZ Consumer Confidence, CBR Policy Announcement, DBRS Credit Review on France, Quad Witching, Speakers including Fed’s Williams & Waller, Earnings from Nio & Carnival.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were choppy and settled lower after paring some of the strength seen in the wake of Wednesday's FOMC and with a deluge of central bank updates on Super Thursday although the decisions generally failed to move the needle by much. The data releases were ultimately mixed as initial jobless claims printed largely in line with estimates but continued claims rose above forecast, while Philly Fed beat on the headline, but the internals were more varied.

- SPX -0.22% at 5,663, NDX -0.30% at 19,678, DJI -0.03% at 41,953, RUT -0.65% at 2,069.

- Click here for a detailed summary.

TARIFFS/TRADE

- EU's von der Leyen said the impact of postponed countermeasures to US tariffs will not change.

NOTABLE HEADLINES

- US President Trump posted "Egg prices are WAY DOWN from the Biden inspired prices if just a few weeks ago. “Groceries” and Gasoline are down, also. Now, if the Fed would do the right thing and lower interest rates, that would be great!!!"

- US President Trump posted "Unlawful Nationwide Injunctions by Radical Left Judges could very well lead to the destruction of our Country!... STOP NATIONWIDE INJUNCTIONS NOW, BEFORE IT IS TOO LATE".

- US President Trump signed an executive order aimed at abolishing the Department of Education and signed an order to increase the production of critical minerals, while the White House said the critical minerals order directs federal agencies to provide a list of all mineral production project applications within 10 days and officials are ordered to submit recommendations to clarify the treatment of waste rock, tailings, and mine waste disposal under the 1872 Mining Act. Furthermore, officials are directed to create a list of all federal lands with mineral deposits and reserves within 10 days, while the order lists copper and gold along with other critical minerals.

- US President Trump and Defense Secretary Hegseth are to deliver remarks from the Oval Office today at 11:00EDT/15:00GMT, according to the White House.

APAC TRADE

EQUITIES

- APAC stocks ultimately traded mixed following the choppy performance stateside in the aftermath of the Super Thursday deluge of central bank announcements and ahead of quad witching.

- ASX 200 was just about kept afloat by notable outperformance in Consumer Staples as shares of Coles and Woolworths rallied after a report by the competition regulator which noted the supermarket retailers along with discount rival Aldi, were among the most profitable supermarket businesses in the world.

- Nikkei 225 initially traded higher on favourable currency moves but then reversed course after hitting resistance ahead of the 38,000 level and as the mostly firmer-than-expected Japanese inflation data supported the case for the BoJ to continue policy normalisation in the future.

- Hang Seng and Shanghai Comp were pressured despite the lack of fresh catalysts and as earnings results trickled in, while trade uncertainty continued to cloud over risk sentiment and NYT recently reported that Elon Musk is set to get access to a top-secret US plan for a potential war with China although President Trump later refuted this.

- US equity futures traded rangebound after the prior day's price swings and heading into the witching hour.

- European equity futures indicate a lower open with Euro Stoxx 50 futures down 0.2% after the cash market closed with losses of 1.0% on Thursday.

FX

- DXY eventually strengthened to extend on the prior day's advances which had coincided with fluctuations in stocks and despite the mixed data releases stateside. Furthermore, the slew of central bank announcements from across the pond had little sway on the greenback, while the US calendar is fairly quiet for Friday although participants will be eyeing comments from Fed's Williams and Waller, as well as remarks from President Trump and Defense Secretary Hegseth.

- EUR/USD remained subdued after the recent pullback from 1.0900 territory and with the recent slew of ECB speakers providing very little to support the currency.

- GBP/USD retreated further beneath the 1.3000 level amid dollar strength and the recent post-BoE indecision.

- USD/JPY edged higher and reclaimed the 149.00 handle despite the cautiousness in the region and with the pair also unfazed by the mostly firmer-than-expected Japanese inflation data.

- Antipodeans struggled for direction after recent losses and with price action also contained amid a quiet calendar and the mixed risk sentiment.

- PBoC set USD/CNY mid-point at 7.1760 vs exp. 7.2423 (Prev. 7.1754).

FIXED INCOME

- 10yr UST futures lacked firm direction and took a breather following yesterday's early fluctuations amid mixed US data releases and a choppy risk environment.

- Bund futures were contained by a lack of pertinent drivers and after the muted reception to a slew of ECB rhetoric.

- 10yr JGB futures marginally softened on return from the holiday closure and after mostly firmer-than-expected Japanese inflation data.

COMMODITIES

- Crude futures marginally extended on the prior day's advances after prices were underpinned following the announcement of fresh US sanctions targeting the network supporting Iran’s oil exports.

- Spot gold gradually declined following the recent pullback from record highs in the precious metal.

- Copper futures traded indecisively amid the flimsy risk environment and underperformance in China.

- China is to add cobalt and copper to its state metal reserves.

CRYPTO

- Bitcoin ultimately gained on what was a choppy session amid the mixed overnight risk sentiment.

NOTABLE ASIA-PAC HEADLINES

- Elon Musk was initially reported to get access to a top-secret US plan for a potential war with China, according to the New York Times. However, President Trump later refuted the report which he said was fake news.

DATA RECAP

- Japanese National CPI YY (Feb) 3.7% vs Exp. 3.5% (Prev. 4.0%)

- Japanese National CPI Ex. Fresh Food YY (Feb) 3.0% vs Exp. 2.9% (Prev. 3.2%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Feb) 2.6% vs Exp. 2.6% (Prev. 2.5%)

GEOPOLITICS

MIDDLE EAST

- Israel's cabinet voted to fire the head of Shin Bet Ronen Bar, according to AP.

- Israel and the US will hold strategic talks on the Iranian nuclear issue at the White House next week.

- US National Security Adviser Waltz said Israel has every right to defend its people from Hamas terrorists and the ceasefire would have been extended if Hamas released all remaining hostages, but they chose war instead.

RUSSIA-UKRAINE

- Explosions were reported in the sky of Ukraine's capital and air defences were working to counter a large-scale attack with drones, while it was also reported that Russian drones hit civilian targets in Odesa on Thursday night.

- US reportedly seeks to reopen terms of a Ukraine minerals deal, according to FT.

- Germany, Italy, Poland, UK, and Canada leaders are to meet in Paris next week to discuss Ukraine, while French President Macron said the European meeting next week is to discuss ways to accelerate immediate military support for Ukraine and will discuss plans to strengthen the Ukrainian army if an agreement is reached with Russia.

- EU's Costa said he believes EU member states will increase pledges of support to Ukraine.

- Russia's presidential security adviser Shoigu arrived in North Korea and is to meet with North Korea's leader.

OTHER

- European military powers were reported to work on a 5-10 year plan to replace the US in NATO, according to FT.

- North Korean leader Kim oversaw a test-fire of an anti-aircraft missile system on Thursday, according to KCNA.

EU/UK

NOTABLE HEADLINES

- London's Heathrow Airport said it is experiencing a significant power outage due to a fire at an electrical substation supplying the airport and will be closed until 23:59 GMT today, while it stated significant disruption is expected over the coming days and passengers should not travel to the airport under any circumstances until it reopens.

- Denmark is reportedly open to joint European projects and funding if required, via FT citing sources

DATA RECAP

- UK GfK Consumer Confidence (Mar) -19.0 vs. Exp. -21.0 (Prev. -20.0)