- APAC stocks were mixed as the initial risk-on sentiment after US President Trump refrained from imposing tariffs on day one faded.

- US President Trump said he is thinking of 25% tariffs on Mexico and Canada and thinks that they will do it on February 1st.

- European equity futures indicate a lower cash open with Euro Stoxx 50 future down 0.4% after the cash market closed with gains of 0.3% on Monday.

- DXY is attempting to recoup some of its recent losses, CAD lags, antipodeans soft, EUR/USD back below 1.04.

- Looking ahead, highlights include UK Jobs, German ZEW, Canadian CPI, NZ CPI (Q4), Supply from Germany, Earnings from Charles Schwab Corp, D.R. Horton, KeyCorp, 3M, Fifth Third Bancorp, Prologis, Netflix, United Airlines, Capital One Financial Corp, Abrdn & Ericsson.

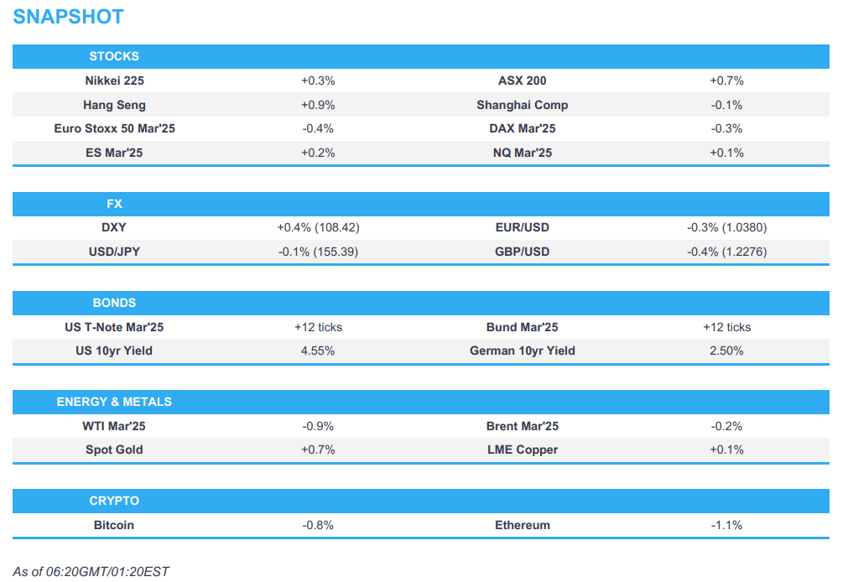

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US markets were closed for Martin Luther King Jr. Day, although US equity futures were bid with outperformance in the Russell while ES, NQ and YM saw mild gains. T-Note futures were also underpinned with morning weakness pared after reports that President Trump is to avoid day-one tariff policies, which ultimately was confirmed and largely dictated trade for the session.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Donald Trump was sworn in as the 47th US President, while President Trump said in the Inaugural Address that the golden age of America begins now and he will sign a series of executive orders as widely expected. Trump said he will direct his Cabinet to defeat record inflation and will launch astronauts to Mars, while he added that all illegal entry will be halted and he will reinstate 'Remain in Mexico' policy, as well as send troops to the southern border. Furthermore, Trump said he will declare a national energy emergency and reiterated his 'drill baby, drill' catchphrase, while he will begin an overhaul of the trade system, will tariff and tax foreign countries to enrich US citizens, as well as establish an 'External Revenue Service'.

- US President Trump said he is thinking in terms of 25% tariffs on Mexico and Canada and thinks that they will do it on February 1st.

- US President Trump signed rescissions of 78 Biden-era actions orders and memoranda, while he also signed documents on a federal hiring freeze, mandating workers to return to in-person full-time immediately and the withdrawal from the Paris Climate Treaty. Trump also revoked Biden's 2023 Executive Order on AI policy and Biden's Executive Order that set a target of 50% of new vehicle sales by 2030 as EVs.

- Draft Trump trade memo directed federal agencies to investigate and remedy persistent US trade deficits that harm the US economy and seeks to address unfair trade practices and currency manipulation by foreign countries. The trade memo also seeks to ensure trade deals including USMCA prioritise American workers, farmers and businesses, while it seeks to combat the import of counterfeit products and contraband that threaten public health and erode tariff revenues. President Trump is to assess China's adherence to the US-China trade agreement to determine if enforcement or changes are required.

- US President Trump’s administration sent a new document to Republican lawmakers detailing immediate priorities and it was stated that Trump will announce the America First Trade Policy. It was also announced that Trump will take bold action to secure the border and protect American communities, while he will unleash American energy by ending Biden’s policies of "extremism" and all agencies will take emergency measures to reduce the cost of living.

- US Senate unanimously confirmed Marco Rubio as Secretary of State and the US Senate Armed Services Committee voted along party lines to advance Pete Hegseth's nomination to lead the Pentagon, according to a source cited by Reuters

- Port of Houston Authority announced that due to the expected wintry weather conditions, all Port Houston eight public facilities will be closed on Tuesday, while container terminal truck gates closed on Monday and vessel operations were suspended.

APAC TRADE

EQUITIES

- APAC stocks were mixed as the initial broad-based risk-on sentiment after US President Trump refrained from imposing tariffs on the first day of his return to the White House, was ultimately soured after he later flagged potential 25% tariffs on Canada and Mexico which could be imposed from the start of February.

- ASX 200 was led higher as outperformance in the top-weighted financials sector and gold miners helped pick up the slack from the weakness in energy and defensive stocks.

- Nikkei 225 briefly wiped out its opening gains with price action largely influenced by tariff rhetoric and a firmer currency.

- Hang Seng and Shanghai Comp were mixed after the recent tariff-related fluctuations in asset classes, while President Trump also floated the idea of universal tariffs on anyone doing business with the US but added that they are not there yet.

- US equity futures (ES +0.1%, NQ U/C) were choppy and initially dipped after Trump's tariff rhetoric but ultimately recovered from the slump.

- European equity futures indicate a lower cash open with Euro Stoxx 50 future down 0.4% after the cash market closed with gains of 0.3% on Monday.

FX

- DXY recouped some of the prior day's losses after suffering in the absence of day-one tariffs under the new Trump administration, while the rebound was spurred by comments from US President Trump who flagged potential 25% tariffs for both Canada and Mexico from the start of February which resulted in a surge in both USD/CAD and USD/MXN.

- EUR/USD faded some of its recent gains with the single currency back below the 1.0400 level owing to the tariff rhetoric from Trump who also said that they will straighten out the deficit with the EU through tariffs or by the EU buying US oil and gas.

- GBP/USD retreated from yesterday's peak and gave back the 1.2300 status amid the dollar's resurgence, while participants now await UK jobs and wages data.

- USD/JPY swung between gains and losses with price action tumultuous owing to Trump's tariff-related commentary and as a potential BoJ rate hike looms.

- Antipodeans were pressured as risk sentiment and the greenback's major counterparts stumbled on tariff rhetoric.

- PBoC set USD/CNY mid-point at 7.1703 vs exp. 7.2888 (prev. 7.1886).

FIXED INCOME

- 10yr UST futures continued recent advances which were spurred by Trump refraining from imposing day-one tariffs.

- Bund futures climbed to above the 132.00 level as risk assets were momentarily spooked as Trump flagged potential tariffs on Mexico and Canada, although further upside in Bund futures was capped ahead of German supply and ZEW data.

- 10yr JGB futures marginally gained with risk sentiment dominated by tariff-related headlines but with upside capped after a somewhat mixed 40yr JGB auction and heading closer to the BoJ rate decision due on Friday.

COMMODITIES

- Crude futures remained subdued following the prior day's declines but were off worst levels after tariff-related comments from Trump on Canada and Mexico jolted markets.

- US President Trump signed an order on unleashing energy production and repealed Biden's 2023 memo barring oil drilling in some 16mln acres in the Arctic, according to the White House which said it will prioritise development of Alaska's LNG potential, including the permitting of all necessary pipeline and export infrastructure.

- US President Trump said they will probably stop buying oil from Venezuela and don't need their oil.

- Spot gold steadily extended on yesterday's gains after its recent return to above the USD 2,700 level.

- Copper futures retreated as risk assets were pressured following Trump's latest tariff-related rhetoric.

CRYPTO

- Bitcoin remained choppy overnight and ranged around USD 101k-103k after the prior day's fluctuations.

- Crypto was reportedly not mentioned as an immediate priority in a document sent by Republican lawmakers, according to Punchbowl.

NOTABLE ASIA-PAC HEADLINES

- US President Trump signed the order related to delaying the TikTok ban and said he may do a TikTok deal or may not, but if he does a TikTok deal, the US should be entitled to half of TikTok and if he doesn't sign, then TikTok is worthless. Furthermore, Trump said they could put tariffs on China if they make a TikTok deal and China doesn't approve it, while he floated the idea of universal tariffs on anyone doing business with the US but said they are not there yet.

- Hong Kong Chief Executive John Lee said he hopes with the new US president that there will be full efforts to promote positive relations but added that they will always prepare for the worst.

GEOPOLITICS

MIDDLE EAST

- Hamas said a second batch of hostages will be released on Saturday as planned.

- US President Trump said he is not confident regarding the Gaza ceasefire deal, while he rescinded Biden sanctions on Jewish settlers who committed violence against West Bank Palestinians. It was separately reported that Trump was expected to lift the freeze on the supply of one-ton bombs to Israel, according to Walla News.

- US presidential adviser Mike Evans said Trump will punish every country that supports Hamas, according to Sky News Arabia.

RUSSIA-UKRAINE

- Ukrainian President Zelenskiy said US President Trump's peace through strength policy is an opportunity to achieve just peace and he looks forward to active and mutually beneficial cooperation with Trump.

- US President Trump said he will meet with Russian President Putin but doesn't know when and he will try to end the Ukraine war as quickly as possible. Trump added that he could speak to Putin very soon and that Ukrainian President Zelensky wants to make a deal, while he commented that Putin is destroying Russia by not making a deal.

- Falling Ukrainian drone triggered a new fire at an oil storage depot in southern Russia's Voronezh region, according to the regional governor.

OTHER

- South Korea said the denuclearisation of North Korea must still be the goal for world peace, following a report US President Trump said that Pyongyang is a nuclear power.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves backs plans for looser limits on mortgage lending and favours proposals by the financial regulator for banks to take more risks to boost home ownership, according to FT.

- UK Chancellor Reeves reportedly intervenes in a car finance mis-selling case to protect lenders in which she launched an effort to shield car loan providers from multibillion-pound payouts, according to FT.

- ECB's Kazimir said a rate cut next week is all but certain and two to three more will probably follow, while he added that recent data suggest 25bps back-to-back rate cuts should continue although heightened uncertainty means the ECB must remain nimble in case things change, according to Bloomberg.

- EU's Commissioner Dombrovskis said the EU and US are strategic allies, while he added they need to preserve the EU-US trade relationship and they are ready to defend the EU's economic interests.

- EU finance ministers agreed to stay united in the approach to the new US administration and stated that a more competitive EU economy is the best answer to potential economic challenges from the US, while they also agreed it is in the EU and US interests to develop a strong economic relationship.

- US President Trump said they will straighten out the deficit with the EU through tariffs or by them buying US oil and gas.