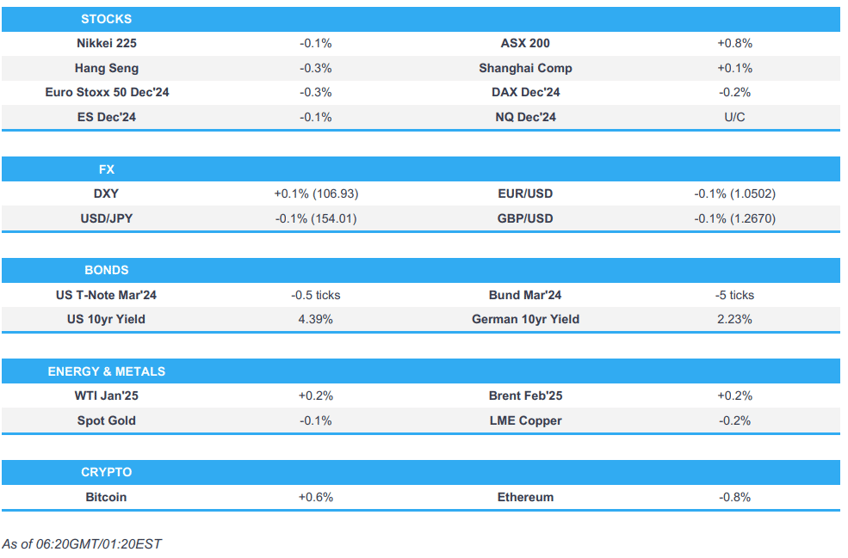

- APAC stocks eventually traded mixed after the region initially showed a positive bias, taking cues from Wall Street, and in the absence of macro newsflow with looming risk events.

- DXY fluctuated in a narrow range whilst USD/JPY was choppy on either side of 154.00 and Antipodeans were subdued.

- China is to maintain a growth target of "around 5%" for 2025, according to Reuters sources. China is to target a budget deficit of 4% in 2025 (vs 3% initially).

- European equity futures are indicative of a subdued open, with the Euro Stoxx 50 future -0.2% after cash closed -0.5% on Monday.

- Looking ahead, highlights include UK Jobs, German Ifo, German ZEW Survey, US Retail Sales, Canadian Inflation, US Industrial Production, Japanese Trade Balance, NBH Policy Announcement, ECB’s Elderson, Supply from the UK and the US.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were bid throughout the session with notable outperformance in the Nasdaq amid further upside in Broadcom (AVGO) and Micron (MU) supporting the move.

- Consumer Discretionary, Communications and Tech outperformed thanks to the upside in the heavyweights. On the flipside, Energy, Health Care and Materials underperformed.

- SPX +0.38% at 6,074, NDX +1.45% at 22,097, DJI -0.25% at 43,717, RUT +0.64% at 2,362.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US stopgap spending bill would temporarily fund the government through March 14th and avert a partial shutdown beginning Saturday, according to Reuters, citing a source familiar with negotiations.

- US President-elect Trump said they would keep the promise to pass historic tax cuts and noted the need to reduce the deficit, according to Reuters.

- US President-elect Trump says he met recently with Pfizer (PFE) and Eli Lilly (LLY) heads, and is a big believer in the polio vaccine but does not like mandates for vaccines, according to Reuters.

- Canadian PM Trudeau reportedly considering his options as leader after Freeland quits cabinet, according to CTV News citing sources.

- Leader of opposition Canada New Democrats, when asked about a possible vote of no confidence in PM Trudeau, said all options were on the table, according to Reuters.

- BoC Governor Macklem said there were risks around its inflation outlook and that they were equally concerned with inflation coming in higher or lower than expected. He noted that elevated wage increases, combined with weak productivity, could boost inflation as businesses looked to pass on higher costs. Alternatively, the economy could continue to grow below its potential, which would pull inflation down. He also added that when using extraordinary tools to tackle a crisis, it was important to be clear about what they were trying to achieve with those tools and under what conditions they would no longer be needed.

APAC TRADE

EQUITIES

- APAC stocks eventually traded mixed after the region initially showed a positive bias, taking cues from Wall Street, and in the absence of macro newsflow with looming risk events.

- ASX 200 firmed with banks underpinning the index, with Westpac among the gainers while its CFO announced plans to retire.

- Nikkei 225 trimmed earlier upside as traders were cautious ahead of the BoJ, with the decision contingent on the FOMC's announcement hours beforehand.

- Hang Seng and Shanghai Comp traded within narrow parameters in uneventful trade amid quiet newsflow, with participants remaining non-committal ahead of major risk events.

- US equity futures were flat across the board, with the RTY initially holding a slightly more upside bias compared to peers following its December slide.

- European equity futures are indicative of a subdued open, with the Euro Stoxx 50 future -0.2% after cash closed -0.5% on Monday.

FX

- DXY fluctuated within a narrow 106.69-89 range but printed incremental fresh highs towards the latter part of the session, with market participants awaiting the pivotal FOMC on Wednesday, the accompanying SEPs, and Chair Powell's presser.

- EUR/USD held onto the 1.0500 status and rose above Monday's 1.0524 high, but price action was minimal amid a lack of drivers.

- GBP/USD was similarly uneventful as traders looked ahead to UK jobs data on Tuesday before Wednesday's CPI release and Thursday's BoE, with the FOMC and BoJ decisions in between.

- USD/JPY saw choppy price action, with the pair seeing downside in conjunction with downticks in US yields. The pair hit a low of 153.81 before rising back to test 154.00 as the Tokyo lunch break started.

- Antipodeans were subdued as risk remained non-committal overnight ahead of risk events.

- PBoC sets USD/CNY mid-point at 7.1891 vs exp. 7.2842 (prev. 7.1882)

- RBI likely sold USD via state-run banks at 84.92-84.93, according to Reuters citing traders.

FIXED INCOME

- 10yr UST futures held a mild positive bias after yesterday's weakness, but the modest upside later faded with futures flat as traders brace for the FOMC.

- Bund futures were uneventful, and trading in a tight range above 134.50 ahead of the German Ifo and ZEW.

- 10yr JGB futures traded sideways for most of the session before seeing two-way action following the JGB auction and then returning to earlier levels.

- Japan sold JPY 1tln 20yr JGBs; b/c 3.38x (prev. 3.52x), average yield 1.8790% (prev. 1.8980%).

COMMODITIES

- Crude futures saw minimal action as macro and complex-specific drivers remained light in the run-up to risk events.

- Spot gold was similarly uneventful around USD 2,650/oz, with the DXY also flat as traders kept their powder dry ahead of the Fed.

- 3M LME Copper futures resided in a very narrow USD 9,062.50-9,088.50/t amid the non-committal tone across all markets.

CRYPTO

- Bitcoin held onto most of its recent gains after briefly testing levels close to USD 108,000 to the upside, while Ethereum traded north of USD 4,000.

OTHER NOTABLE ASIA-PAC HEADLINES

- China is to maintain a growth target of "around 5%" for 2025, according to Reuters sources. China is to target a budget deficit of 4% in 2025 (vs 3% initially). More stimulus will be funded through issuing off-budget special bonds, sources added.

- New Zealand sees 2024/25 operating balance before gains, losses at NZD -17.32 bln (budget NZD -13.37 bln), according to Reuters.

- New Zealand Debt Management Office says 2024/25 gross bond issuance increases to NZD 40 bln from NZD 38 bln in May, according to Reuters.

- Alibaba Group (9988 HK/ BABA) sells Intime; Expected gross proceeds to Alibaba from Intime sale is approximately RMB 7.4bln; Alibaba expects to record losses of approximately RMB 9.3bln as a result of the sale of Intime.

- PBoC injected CNY 355.4 bln via 7-day reverse repos with the rate maintained at 1.50%, according to Reuters.

- South Korean acting President Han says South Korea is to implement the budget on Jan 1st; South Korea to allocate budget promptly for economic revitalisation, according to Reuters.

- Magnitude 7.4 quake has struck Port-Vila in the Vanuatu region, according to USGS.

DATA RECAP

- New Zealand RBNZ Offshore Holdings (Nov) 58.6% (Prev. 59.2%)

GEOPOLITICS

MIDDLE EAST

- US President-elect Trump said he had a very good talk with Israeli PM Netanyahu, according to Reuters. He added it would not be pleasant if Hamas hostages were not released before he took office.

- A senior Israeli official told Axios there were still gaps in the negotiations over the Gaza hostage and ceasefire deal "but they are all bridgeable", according to Axios.

- Proposed deal between Israel and Hamas calls for 60-day ceasefire, and for release of dozens of Israeli detainees in exchange for 700-1,000 Palestinian prisoners, via Sky News Arabia citing Israel Channel 14.

- US military said it conducted an airstrike against Houthis in Yemen, according to Reuters.

- Syria's rebel leader said factions would be 'disbanded' and fighters would join the army, according to AFP.

US-CHINA

- US President-elect Trump says he is taking a look at TikTok and has a warm spot in his heart for TikTok, according to Reuters.

- US President-elect Trump met with TikTok CEO at Mar-a-Lago club today, according to CNN.

- US President Biden's administration reportedly preparing a trade investigation into China's production of older semiconductors, according to NYT.

OTHER

- Russia may increase the frequency of missile testing as external threats grow, according to Russian state news agencies citing the commander of Russian strategic missile forces. Russia may also increase the number of nuclear warheads on deployed carriers in response to similar actions by the US. Mobile-based missile systems, the commander noted, will be decisive means of inflicting devastating enemy damage in a potential retaliatory nuclear attack. Russia’s strategic missile forces plan maximum-range launches as part of state testing of prospective new systems. Additionally, Russia and the US give each other at least a day's warning about planned launches of intercontinental ballistic missiles.

- Russian lieutenant general Kirillov and his associate killed in explosion in Moscow, according to RT sources; Kirillov is listed as Chief of Radiological, Chemical and Biological Defence of Russian Armed Forces.

- Senior US officials say Turkey and its militia allies are building up forces along the border with Syria, raising alarm that Ankara is preparing for a large-scale incursion into territory held by American-backed Syrian Kurds, according to WSJ.

EU/UK

NOTABLE HEADLINES

- ECB's Schnabel said they should proceed with caution and remain data-dependent, noting that price stability was within reach and that lowering policy rates gradually towards a neutral level was the most appropriate course of action according to Reuters. She added that once price stability had been restored, central banks could afford to tolerate moderate deviations of inflation from the target, in both directions. She also said that in the absence of such shocks, policy should be careful not to overreact. She noted that monetary policy should focus on responding forcefully to shocks that had the capacity to destabilise inflation expectations. She said that central banks could tolerate moderate deviations of inflation from the target, in both directions. She mentioned that monetary policy could not resolve structural issues that durably weighed on price pressures. She added that over the next twelve months, an economic expansion was still much more probable than a recession and that gradual removal of policy restrictions remained appropriate.

- ECB's Escriva said he could not anticipate the decision because it would go against what they do, when asked if he would be against a 50bps cut in January, via Econostream. He added that forecasting where the neutral rate will be is difficult and that he could not say in advance what the neutral rate would be.

- French Central Bank Forecasts: 2024 Growth seen at 1.1% (unchanged), 2025 seen at 0.9% (prev. 1.2% in Sept.); 2026 at 1.3% (prev. 1.5%), 2027% at 1.3%. HICP inflation 1.6% in 2025, 1.7% in 2026 and 1.9% in 2027.

LATAM

- Brazil's Lower House did not set a date for voting on the fiscal package, according to Estadao sources.