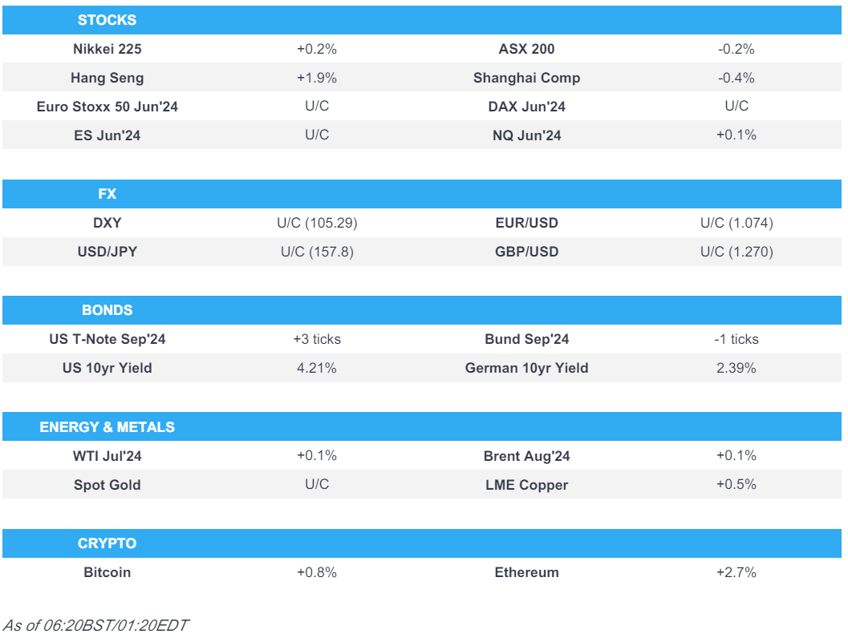

- US stocks inched higher in rangebound trade, APAC stocks mainly positive with Hang Seng outperformance

- European futures point to a contained open, after the cash market closed higher by circa. 0.7%

- DXY contained after the deluge of Fed remarks, peers rangebound

- Crude and spot gold largely sideways while base metals benefited from the constructive US tone

- Israel's military said operational plans for an offensive in Lebanon were approved and validated

- Holiday: US Juneteenth; The desk will shut at 18:00BST/13:00EDT and re-open the same day for the beginning of Asia-Pac coverage at 22:00BST/17:00EDT.

- Highlights include UK CPI, PPI, South Africa CPI, NZ GDP, BoC Minutes, Supply from Germany.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks marginally edged higher in rangebound trade amid a softer yield environment as participants digested mixed data including disappointing Retail Sales and better-than-expected Industrial Production, while price action was contained ahead of the Juneteenth holiday and the deluge of comments from Fed officials largely toed the line with what Fed Chair Powell had previously stated.

- SPX +0.25% at 5,487, NDX flat at 19,909, DJIA +0.15% at 38,835, RUT +0.16% at 2,025.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Kugler (Voter) said it is likely appropriate to begin easing policy sometime later this year if the economy evolves as expected, while she added that monetary policy is sufficiently restrictive and economic conditions are moving in the right direction. Kugler said policy has more work to do and judgement will be guided by data, as well as noted that inflation is too high but she is encouraged by renewed recent progress. Furthermore, Kugler said they have seen an increase in delinquencies indicating that households are being stretched and stated that how much they cut will be a question they continue to assess as more data comes in and is not an answer they can give today.

- Fed's Collins (non-voter) said it is appropriate for the Fed to remain patient on monetary policy and cautioned against overreacting to recent inflation data. Collins added that she remains a ‘realistic optimist’ on the economy and monetary policy but stated it is too soon to note if inflation is retreating again to 2%. Furthermore, she said the data points to an economy coming into better balance but added it is going to take some time for inflation to come down, while she can envision scenarios for both one and two cuts in 2024.

- Fed's Goolsbee (non-voter) said the inflation number that came out during last week's meeting was 'excellent' and hopefully "we'll" see more data like that, while he added they will get to 2% inflation.

- Fed's Logan (non-voter) said she is optimistic about generative AI's effect on productivity and understanding how much effect AI will have takes time to know and will have implications for monetary policy. Logan said inflation is still too high but may have made tremendous progress and that May CPI data was welcome news but will need to see several more months to have confidence leading to 2%. Logan also stated she will be watching data in the coming months quite closely and they are in a good position to be patient on policy.

- Fed's Musalem (von-voter) said he needs to observe a period of favourable inflation, moderating demand and expanding supply before he will have confidence for an interest rate cut, while he added these conditions could take months and more likely quarters to play out. Musalem said if inflation becomes stuck meaningfully above 2% or moves higher, he would support additional policy tightening although he noted potential early signs of continued progress on inflation and said the PCE price index should show a welcome downshift of inflation in May.

- CBO forecasts US fiscal 2024 federal deficit at USD 1.915tln which is up USD 408bln from the February forecast.

APAC TRADE

EQUITIES

- APAC stocks were mostly positive during the session after the mild gains on Wall St where the major indices edged higher in rangebound trade heading into the Juneteenth holiday amid softer yields after a retail sales miss which saw the S&P 500 and Nasdaq continue their run of record closes, while Nvidia surpassed Microsoft and Apple as the world's most valuable company.

- ASX 200 was lacklustre as gains in the mining-related sectors were offset by losses in industrials and utilities.

- Nikkei 225 gained but was off early highs after mixed trade data which showed stronger-than-expected exports.

- Hang Seng and Shanghai Comp. were mixed as Hong Kong outperformed with notable strength in energy and property stocks, while the mainland lagged despite another liquidity boost by the PBoC and officials' efforts to talk up the economy with headwinds amid ongoing frictions as the US pushes Japan and the Netherlands to further crackdown on China's semiconductor industry.

- US equity futures took a breather after yesterday's mildly positive but choppy performance.

- European equity futures indicate a quiet open with Euro Stoxx 50 futures flat after the cash market closed higher by 0.7% on Tuesday.

FX

- DXY was contained within a tight range with US participants away on Wednesday for Juneteenth and after a deluge of Fed comments conformed to the view that there was progress on inflation but more confidence was needed for an interest rate cut.

- EUR/USD traded little changed after giving back the spoils from the recent soft US retail sales data.

- GBP/USD just about held above the 1.2700 level which was a focal point during yesterday's fluctuations, while the attention turns to looming inflation data from the UK later followed by tomorrow's BoE announcement.

- USD/JPY lacked direction after mixed data and the prior day's failure to sustain a brief foray above 158.00.

- Antipodeans were mixed in which AUD/USD attempted to extend on gradual upward post-RBA momentum, while NZD/USD marginally retreated after New Zealand's current account data remained soft.

- PBoC set USD/CNY mid-point at 7.1159 vs exp. 7.2482 (prev. 7.1148).

- Czech National Bank Vice-Governor Frait said the discussion at this month's policy meeting will be whether to cut by 25bps or 50bps, while he still expects the main rate could drop to around 4% by year-end.

FIXED INCOME

- 10-year UST futures pulled back after climbing yesterday on the back of soft retail sales and a strong 20-year auction, while price action was contained amid the closure of cash treasuries trade for Juneteenth.

- Bund futures lacked direction ahead of a 30-year Bund auction and the Bundesbank's monthly report.

- 10-year JGB futures trickled beneath the 144.00 level with demand subdued amid a lack of additional BoJ purchases and after mixed trade data from Japan.

COMMODITIES

- Crude futures were little changed overnight but held on to recent gains after prices were underpinned by early dollar weakness and lingering geopolitical risks, while the latest private sector inventory data was mixed.

- US Private Inventory Data (bbls): Crude +2.3mln (exp. -2.2mln), Distillate +0.5mln (exp. +0.3mln), Gasoline -1.1mln (exp. +0.6mln), Cushing +0.5mln.

- Spot gold lacked direction and traded sideways after yesterday's whipsawing in the precious metal.

- Copper futures marginally extended on its rebound alongside the mostly positive risk tone.

CRYPTO

- Bitcoin ultimately gained although price action was choppy and initially oscillated around the USD 65,000 level.

- US SEC is closing its investigation on Ethereum and won't be pursuing enforcement action against Consensys, according to Cointelegraph.

NOTABLE ASIA-PAC HEADLINES

- PBoC Governor Pan said monetary policy will provide support for China's economic recovery and noted that the PBoC holds structural tools worth CNY 7tln which is equivalent to 10% of the central bank's assets. Pan said the PBoC aims to maintain policy stability and will prevent significant fluctuations in policy, while they will make flexible use of deposit reserves and other measures. Furthermore, he said they are to clarify the main policy interest rates in the next steps and will particularly focus on long-term treasury bond risk to keep a normal upward yield curve, as well as noted that the PBoC and MOF are studying to implement government bond trading but added this would not equate to quantitative easing.

- China's financial regulator said will strengthen countercyclical supervision, as well as improve the solvency and deposit reserve mechanisms, while they are studying broadening the scope of foreign shareholders in non-bank institutions.

- China securities regulator said will make every effort to promote high-quality development in the capital market and will publish measures to deepen reform of Shanghai's tech-focused STAR Market, while they will promote the investment value of listed companies and support listed companies to strengthen tech competitiveness through M&A and other capital tools.

- US senior official is set to visit Japan and the Netherlands to ask the two countries to add fresh restrictions on China’s semiconductor sector including on its ability to make the high-end memory chips needed for AI, according to Bloomberg.

- US House of Representatives is launching a bipartisan critical minerals working group to address China's dominance of key materials.

- China and EU major automakers held a closed-door meeting on Tuesday, while China automakers called on firm countermeasures and suggested the government should raise provisional import tariffs on large gasoline vehicles, according to Chinese state media.

- Japan MOF panel is to urge the government to issue shorter-duration debt to reduce interest rate risk, according to a draft proposal. Furthermore, it stated that the government could adjust the issuance size of super-long JGBs as life insurers are unlikely to significantly increase holdings and banks that have scope to increase holdings of JGBs can play a big role in ensuring smooth debt issuance.

- BoJ April meeting minutes stated consumption is likely to increase moderately and a few members said companies might become more active in raising prices and wages than initially expected, while members discussed risks associated with the impact of weak yen on inflation and shared the view that the BoJ must scrutinise how recent yen falls could affect underlying inflation. Furthermore, a few members said FX is among the key factors affecting the economy and prices, as well as noted that the BoJ must respond with monetary policy if the outlook and risks change.

DATA RECAP

- Japanese Trade Balance Total (JPY)(May) -1221.3B vs. Exp. -1313.7B (Prev. -462.5B, Rev. -465.6B)

- Japanese Exports YY (JPY)(May) 13.5% vs. Exp. 13.0% (Prev. 8.3%)

- Japanese Imports YY (JPY)(May) 9.5% vs. Exp. 10.4% (Prev. 8.3%)

GEOPOLITICAL

MIDDLE EAST

- Israel military said operational plans for an offensive in Lebanon were approved and validated.

- White House cancelled a high-level US-Israel meeting on Iran that was scheduled for Thursday after Netanyahu released a video claiming the US was withholding military aid, according to Axios.

- US President Biden's administration delayed proceeding with the F-15 sale to Israel, according to WSJ.

- US Secretary of State Blinken said the US is still trying to bridge the gaps in ceasefire talks and Hamas continues to move the line.

OTHER

- Russia is in talks with partners on the deployment of long-range weapons, according to TASS citing the Deputy Foreign Minister. In relevant news, Russia's Northern Fleet nuclear submarines launched missiles at targets in Barents Sea drills, according to TASS.

- Russian President Putin arrived in North Korea with the visit said to demonstrate the invincibility and durability of Russia-North Korea relations, while they exchanged pent-up inmost thoughts and opened their minds, according to KCNA. Furthermore, it was noted that Putin’s visit comes as relations entered a course of new comprehensive development and the visit is important in powerfully propelling the cause of building a powerful country.

- South Korean and Chinese senior officials agreed to develop relations in more mature and healthier ways, while they shared the importance of close communications between militaries amid the changing security environment, according to South Korea's government. Furthermore, South Korea asked China to play a constructive role as rising tensions due to North Korean-Russian military cooperation are against Chinese interests, while China told South Korea its policy on the Korean Peninsula hadn't changed and said it hoped Russia-North Korea exchange would contribute to stability and peace in the region.

- US State Department approved the potential sale of Altius unmanned aerial vehicles to Taiwan for an estimated cost of USD 300mln and the possible sale of a missile system for an estimated USD 60.2mln.

EU/UK

NOTABLE HEADLINES

- France, Italy and five other EU countries face reprimands from the European Commission for exceeding deficit limits in 2023.

- ECB/Bank of France’s Villeroy said they owe citizens respect and that means not running bigger deficits that cannot be financed, while he added that also means quickly clarifying economic and budget strategy.

- All but one member of the Times' Shadow BoE MPC advocated for rates being kept at 5.25% on Thursday; former BoE MPC member Goodhart (now part of the shadow MPC) said "The bar for changing interest rates in the middle of an election campaign is rather high. Present conditions suggest that we are nowhere near meeting that bar.". One member called for a 25bp cut.