- 67% of respondents said Trump won the Presidential debate; 81% of registered voters who watched said it had no effect on their choice, 5% said it made them change their mind, via CNN.

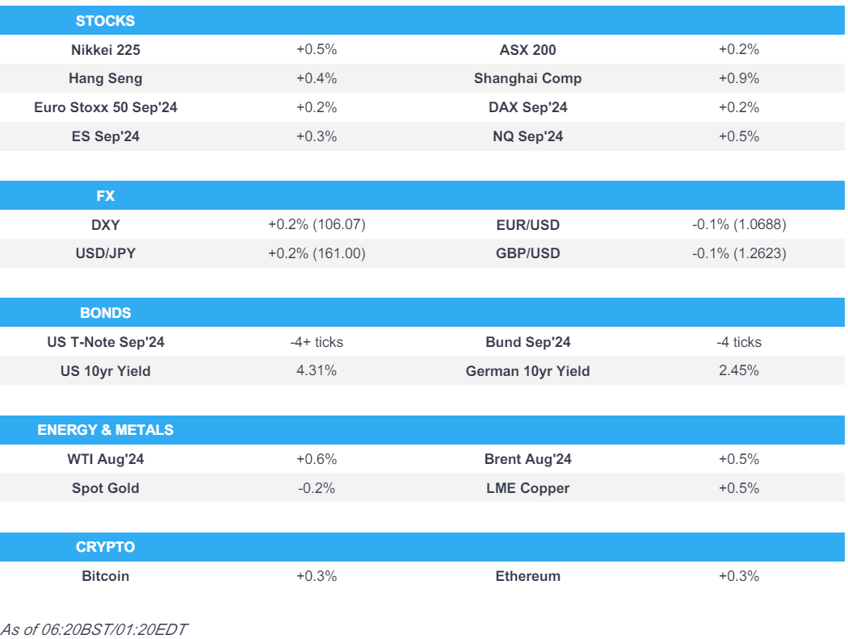

- APAC stocks mostly higher heading into month-, quarter-, & half-end and following the positive US handover as attention turns to PCE.

- DXY strengthened as the betting odds of a Trump second term got boosted marginally, support also from USD/JPY eclipsing 161.00

- Fixed income slips with yields climbing and the US yield curve steepening into PCE

- Crude extended on Thursday's gains with base metals benefitting on the risk tone while XAU eased marginally

- Looking ahead, highlights include UK Final Q1 GDP, German Import Prices, Retail Sales & Unemployment Rate, French, Spain & Italian CPI, US PCE, Canadian GDP, Comments from Fed’s Barkin & Bowman.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished with a positive bias in which the major indices eked mild gains and the Russell 2000 outperformed with sentiment helped by slightly softer yields, although price action was choppy during the session amid a slew of data releases and with participants bracing for the Fed's preferred PCE measure of inflation.

- SPX +0.1% at 5,483, NDX +0.2% at 19,789, DJI +0.1% at 39,164, RUT +1.0% at 2,038.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Bowman (Voter, Hawk) said the Fed is not at a point yet where it can consider a rate cut and if inflation moves toward 2%, an eventual rate cut is on the table. Bowman said inflation should ease with the current policy setting and monetary policy is currently restrictive, while she is still willing to raise rates again if inflation doesn't ease.

US PRESIDENTIAL DEBATE

- US President Biden said during the first presidential debate that the US economy was falling when Trump came out of the presidency and that the Trump economy rewarded the rich and raised the deficit, while he said that Trump exaggerates and lies about border security in which everything he says is a lie.

- Former President Trump said they had the greatest economy in the history of the US under his administration and had the greatest economy in the world but Biden did something disastrous by encouraging illegal immigrants, while he added that immigrants from everywhere flock to the US because of Biden and are killing US citizens. Trump also said he achieved a lot in the field of economics and that inflation is currently killing the US which became a third-world country under the Biden administration, as well as noted that tariffs will reduce deficits and check countries like China. Furthermore, Trump said there was no terror under his administration and that the world is blowing up under Biden, while he added Iran was broke and Hamas would never attack Israel under his administration, as well as claimed that he would have the war between Russia and Ukraine settled before he takes office.

- CNN poll showed about 67% of debate followers saw Trump as the winner; 81% of registered voters who watched the debate said it had no effect on their choice for President, 5% said the debate made them change their mind on whom to vote for.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher heading to month-, quarter-, and half-year end following the positive bias stateside but with gains capped as participants digest a slew of data and await the Fed's preferred inflation gauge.

- ASX 200 was led higher by tech strength but with upside limited by weakness in miners and materials.

- Nikkei 225 benefitted from recent currency weakness, while there was also a slew of data releases including mostly firmer-than-expected Tokyo inflation and a return to growth in Industrial Production.

- Hang Seng and Shanghai Comp. were positive in tandem with the gains in regional peers with catalysts light although there were comments from President Xi who reaffirmed the China opening up message.

- US equity futures edged marginal gains alongside the Trump-Biden debate where betting odds for a Trump return to the White House received an early boost as Biden struggled in some instances and Trump exaggerated.

- European equity futures indicate a higher open with Euro Stoxx 50 future +0.3% after the cash market closed lower by 0.3% on Thursday.

FX

- DXY marginally strengthened amid slightly higher yields and as betting odds of a Trump second term seemed to get a boost early in the presidential debate, with support also from the brief rise in USD/JPY north of 161.00.

- EUR/USD slightly softened in rangebound trade with the single currency back beneath the 1.0700 handle.

- GBP/USD traded little changed near its 100-DMA of 1.2640 ahead of the UK's final GDP for Q1.

- USD/JPY briefly climbed above the 161.00 level to print a fresh 38-year high but then gave back most of its gains amid reports that Japan's Finance Ministry replaced top currency diplomat Kanda with Atsushi Mimura.

- Antipodeans were pressured amid early dollar strength but then gradually rebounded off lows.

- PBoC set USD/CNY mid-point at 7.1268 vs exp. 7.2727 (prev. 7.1270).

- Mexican Central Bank Interest Rate (Jun) 11.00% vs. Exp. 11.00% (Prev. 11.00%) with the decision not unanimous as Mejia voted for lowering rates by 25bps to 10.75%, while the Board foresees that the inflationary environment may allow for discussing reference rate adjustments.

FIXED INCOME

- 10-year UST futures partially faded the prior day's advances to re-approach the 110.00 level to the downside as yields slightly edged higher and as participants braced for the incoming PCE price data.

- Bund futures mildly retreated with prices back beneath 132.00 heading into a slew of German data.

- 10-year JGB futures conformed to the lacklustre mood in global peers following a slew of data releases including mostly firmer-than-expected Tokyo CPI data which supports the case for the BoJ to continue policy normalisation, while the central bank's Rinban operation was relatively reserved at a total of JPY 710bln.

COMMODITIES

- Crude futures mildly extended on the prior day's gains alongside the mostly positive risk tone.

- Spot gold faded some of its recent advances as the dollar strengthened overnight

- Copper futures rebounded off this week's worst levels amid the constructive mood but with further gains capped as markets await the key US inflation metric.

CRYPTO

- Bitcoin was marginally positive but off today's best levels after failing to sustain a brief foray above USD 62,000.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi said China will never leave the road of peaceful development and they will continue to expand the system which will become increasingly market-oriented. Xi added that China continues to expand opening up and its door will never close, while it is willing to discuss FTAs with additional developing countries.

- Japan's Finance Ministry announced they are to replace its top currency diplomat Kanda with Atsushi Mimura and replace Vice Minister of Finance Chatani with Hirotsugu Shinkawa although the changes were said to be part of a normal personnel rotation, according to Nikkei and Bloomberg.

- Japanese Finance Minister Suzuki said he won't comment on forex levels and it is important for currencies to move in a stable manner reflecting fundamentals. Suzuki reiterated he is closely watching FX moves with a high sense of urgency and is deeply concerned about excessive, one-sided moves on forex and repeated that rapid FX moves are undesirable.

DATA RECAP

- Tokyo CPI YY (Jun) 2.3% vs. Exp. 2.3% (Prev. 2.2%)

- Tokyo CPI Ex. Fresh Food YY (Jun) 2.1% vs. Exp. 2.0% (Prev. 1.9%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Jun) 1.8% vs. Exp. 1.7% (Prev. 1.7%)

- Japanese Industrial Production Prelim MM (May) 2.8% vs. Exp. 2.0% (Prev. -0.9%)

- Japanese Industrial Production Prelim YY (May) 0.3% vs. Exp. 0.0% (Prev. -1.8%)

- Japanese Unemployment Rate* (May) 2.6% vs. Exp. 2.6% (Prev. 2.6%)

GEOPOLITICAL

MIDDLE EAST

- Israel's PM Netanyahu indicated he foresees a prolonged battle ahead in the efforts to eliminate Hamas, according to Bloomberg.

- US is to release part of suspended bomb shipment to Israel with the US and Israel discussing the release of a 500-pound bomb shipment to Israel, while the Biden administration is also reviewing another part of the shipment which includes 1,800 and 2,000-pound bombs, according to Axios.

- US official said the Pentagon is moving US military assets close to Israel and Lebanon as it prepares to evacuate Americans in Israel and Lebanon if the fighting intensifies, according to NBC.

OTHER

- US is reportedly in talks to supply Ukraine with up to eight patriot systems, according to FT.

- US Deputy Secretary of State Campbell raised serious concerns regarding China’s destabilising actions in the South Sea in a call with China's Executive Vice Foreign Minister Ma Zhaoxu.

EU/UK

NOTABLE HEADLINES

- EU leaders agree on the top EU jobs with von der Leyen given a second term as European Commission President, while Portugal's Antonio Costa is to be the new chairman of EU summits and Estonia's Kaja Kallas is to be EU's top diplomat. It was separately reported that French President Macron named Thierry Breton as the French EU commissioner.

DATA RECAP

- UK Lloyds Business Barometer (Jun) 41 vs Exp. 45 (Prev. 50)