- APAC stocks traded mostly lower despite the gains seen on Wall Street on Friday, with the mood in the APAC region dampened by the continued decline in Chinese NBS Manufacturing PMI ahead of key risk events including US NFP on Friday.

- DXY resided in a tight range, NZD lagged after last week’s strong performance, while CNH weakened post-PMIs.

- The far-right German AfD will claim a clear victory in state parliamentary elections in the German state of Thuringia

- ECB policymakers increasingly at odds on the outlook for growth, with some fearing a recession, others focusing on lingering inflation pressures, via Reuters

- China reportedly warns Japan of retaliation over new potential new chip curbs, via Bloomberg

- Looking ahead, highlights include EZ, UK Final Manufacturing PMI

- US Labour Day Holiday: The desk will open as usual at 22:00BST/17:00EDT on Sunday 1st September and run until 18:00BST/13:00EDT on Monday 2nd September, upon which the desk will close and then re-open at 22:00BST/17:00EDT.

- Click here for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks saw two-way price action but ultimately closed well in the green with outperformance in the Nasdaq after a slew of strong tech updates. There was also a wave of buying into heavyweight stocks into the closing bell, likely related to month-end flows on the last trading day of the month which saw the S&P 500 close out at intraday highs.

- SPX +1.01% at 5,648, NDX +1.29% at 19,575, DJIA +0.55% at 41,563, RUT +0.67% at 2,218.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Super Micro Computer (SMCI) said it filed a non-timely 10-k with US SEC. Parties working diligently to complete review. Does not anticipate form 10-k NT will contain any material changes to results for FY and quarter ended June 30th, 2024.

- Microsoft (MSFT) backed OpenAI is considering changes to its corporate structure amid latest funding talks. OpenAI named political veteran Chris Lehane as head of global policy, according to NYT.

- Intel (INTC) CEO is to present a plan to the board to sell off assets, according to Reuters source. CEO and executives will present plans at the mid-September board meeting, and plans could include selling Altera programmable chip unit, sources say. Sources added capital spending cuts may include a German factory which is expected to cost USD 32bln, but Intel has no current plans to sell its manufacturing business.

- Hospitality union Unite Here said about 10k hotel workers across US are on strike at 24 hotels in eight cities, according to Reuters.

- Goldman Sachs raised Q3 US GDP estimate to 2.7% Q/Q Annualized (Prev. 2.5%).

APAC TRADE

EQUITIES

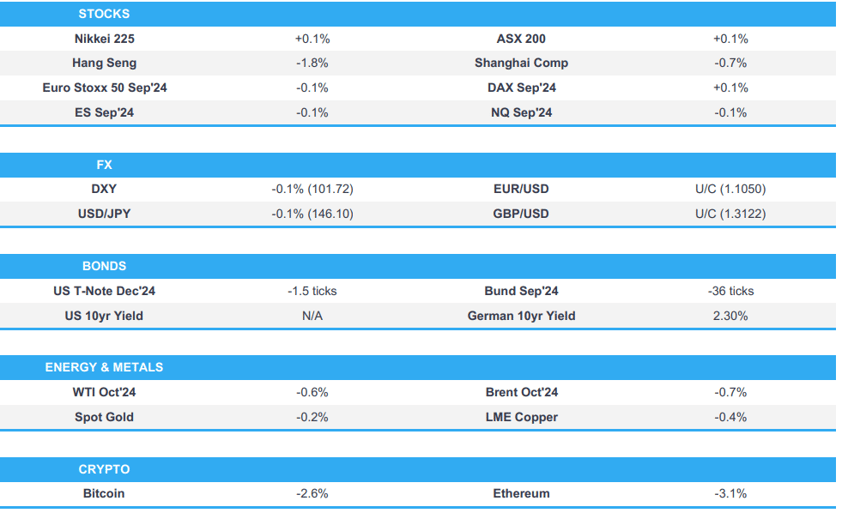

- APAC stocks traded mostly lower despite the gains seen on Wall Street on Friday, with the mood in the APAC region dampened by the continued decline in Chinese NBS Manufacturing PMI whilst traders look ahead to key risks this week including the US jobs report amid the Fed's shifted focus on employment.

- ASX 200 opened with modest gains but quickly fell into the red, with the gold miners seeing the deepest losses following the USD-induced losses in the yellow metal on Friday.

- Nikkei 225 initially outperformed and was underpinned by the weaker JPY, although gains gradually faded throughout the session.

- Hang Seng and Shanghai Comp fell in which Hong Kong was the regional laggard with property name New World slumping double-digit percentages after it said on Friday it is to post its first annual loss in two decades. Furthermore, auto stocks are slipping after earnings. Meanwhile, the mainland was lower after seeing mixed PMI data in which the NBS manufacturing fell to a six-month low whilst the Caixin Manufacturing saw a revision to above 50.0.

- US equity futures took a breather from Friday's price action and traded subdued amid the mood in APAC, and with the contracts observing the absence of US traders on Labor Day holiday.

- European equity futures are indicative of a modestly softer open with the Euro Stoxx 50 future -0.1% after cash closed -0.2% on Friday.

FX

- DXY resided in a tight 101.64-79 range after Friday's rise from 101.24 lows to 101.78 highs, with the next level to the upside the 21 DMA (102.02).

- EUR/USD was trading in tandem with the USD in a 1.1040-55 range vs Friday's 1.1043-94 parameter, with the pair finding support near its 21 DMA (1.1042)

- GBP/USD saw movement in-fitting with Dollar action, with the pair caged in a 1.3117-38 parameter and well within Friday's bounds between 1.3106-1.3199.

- USD/JPY experiencing modest upside as APAC traders react to Friday's USD and bond movement. Little reaction was seen to Japanese data which included higher-than-prior Q2 Capex and a revision higher in August manufacturing PMI. USD/JPY resided in a 145.89-146.59 range after rising above its 21 DMA (145.97) on Friday

- Antipodeans eventually fell with the NZD lagging and giving back some of last week's gains, whilst the AUD fell in tandem with base metals but recovered off worst levels.

- Yuan was weaker following the Chinese NBS Manufacturing figure over the weekend, with little reaction seen to the Caixin metric.

- PBoC sets USD/CNY mid-point at 7.1027 vs exp. 7.1030 (prev. 7.1124); strongest CNY fixing since May 16th

FIXED INCOME

- 10yr UST futures experienced uneventful trade after Friday's selloff, with price action today likely to be limited amid the absence of US traders on account of the Labor Day holiday.

- Bund futures was slightly softer and catching up to some of the UST losses on Friday, with sentiment across German bonds also somewhat dampened by German regional elections in which the AfD's projected win in Thuringia "would mark the first time since the defeat of Nazi Germany in World War II that a far-right party has won a statewide election in the country", dpa said.

- 10yr JGB futures was subdued following price action in USTs on Friday with the contract in a 144.51-76 range thus far vs Friday's 144.49-80 parameter.

COMMODITIES

- Crude futures traded lower amid a lack of major geopolitical escalations over the weekend coupled with the Chinese NBS Manufacturing PMI data falling to a six-month low, not boding well for the China-related demand side of the equation. Furthermore, APAC players reacted to OPEC sources from Friday which suggested OPEC+ is likely to proceed with a planned gradual oil production increase from October.

- Spot gold gradually edged lower in-fitting with broader price action across commodities and dipped under the USD 2,500/oz mark.

- Copper futures were subdued with upside capped by the disappointing Chinese NBS Manufacturing data which showed a decline to a six-month low.

- Baker Hughes Rig Count: Oil unchanged at 483, Natgas -2 at 95, Total -2 at 583.

- Libya's NOC said recent oilfields closures have caused loss of approximately 63% of total oil production.

- Iraq to offer 10 gas exploration blocks for US firms, according to the Iraqi oil minister.

- Russian President Putin says preparatory works on construction of Russia's gas pipeline to China via Mongolia are proceeding as scheduled, according to Reuters.

CRYPTO

- Bitcoin weakened over the weekend but found overnight support just over USD 57k.

NOTABLE ASIA-PAC HEADLINES

- China reportedly warns Japan of retaliation over new potential new chip curbs, according to Bloomberg.

- China's Global Times, on the Caixin Manufacturing PMI, says "The data indicates a pickup in demand, steady employment levels, and improving business confidence."

- PBoC injected CNY 3.5bln via 7-day Reverse Repo at maintained rate of 1.70%.

DATA RECAP

- Chinese NBS Manufacturing PMI (Aug) 49.1 (Prev. 49.4)

- Chinese NBS Non-Manufacturing PMI (Aug) 50.3 (Prev. 50.2)

- Chinese NBS Composite PMI (Aug) 50.1 (Prev. 50.2)

- Chinese Caixin Manufacturing PMI Final (Aug) 50.4 vs. Exp. 50.0 (Prev. 49.8).

- South Korean Manufacturing PMI (Aug) 51.9 (Prev. 51.4)

- Japanese Manufacturing PMI (Aug F) 49.8 (Prelim. 49.5)

- Japanese Business Capex (MOF) YY (Q2) 7.4% (Prev. 6.8%)

- Australian Judo Bank Australia Manufacturing PM 48.5 (Exp. 48.7, Prev. 47.5).

- Australian Melbourne Institute Inflation Gauge MM (Aug) -0.1% (Prev. 0.4%); YY 2.5% (Prev. 2.8%).

- Australian ANZ Job Advertisements MM (Aug) -2.1% (Prev. -3.0%, Rev. -2.7%)

- Australian Business Inventories (Q2) 0.1% vs. Exp. -0.5% (Prev. 1.3%, Rev. 1.5%)

- Australian Building Approvals (Jul) 10.4% vs. Exp. 2.5% (Prev. -6.5%, Rev. -6.4%)

- Australian Gross Company Profits (Q2) -5.3% vs. Exp. -0.9% (Prev. -2.5%)

- Australian Business Inventories (Q2) 0.1% vs. Exp. -0.5% (Prev. 1.3%)

- Australian Private House Approvals (Jul) 0.6% (Prev. -0.5%)

- Australian Company Profits Pre-Tax (Q2) -1.7% (Prev. -8.4%)

GEOPOLITICS

MIDDLE EASTE

- US President Biden is considering presenting Israel and Hamas a final proposal for a hostage-release and ceasefire in Gaza deal later this week, according to Axios sources.

- Israel recovered the bodies of six hostages from a tunnel in Gaza, according to Sky News.

- Israeli PM Netanyahu, following the weekend death of six hostages in Gaza, said Israel will not rest until it reaches those in Hamas who murdered the hostages. He added that he and his government are committed to achieving a deal to release remaining hostages and ensure Israel's security, according to a statement.

- Hamas official blamed Israel for the death of hostages, and said Israel is unwilling to reach a deal, according to Reuters.

- Yemen's Houthis said they targeted MV Groton vessel in Gulf of Aden for second time, according to Reuters.

- UKMTO said it has received report of an incident 70NM northwest of Yemen's Saleef, according to Reuters.

- "US official: Washington will hold intensive contacts in the coming hours to see the possibility of reaching an agreement", according to Sky News Arabia.

- Israel union calls for general strike as protesters across country demand Gaza hostage deal, according to BBC.

RUSSIA-UKRAINE

- Russia will make changes to its nuclear doctrine, according to TASS citing the Deputy Foreign Minister.

- A fire caused by an drone strike at the Moscow Oil Refinery has been contained, according to TASS.

- Several blasts heard in Ukraine capital Kyiv, according to Reuters witnesses. "A series of explosions in Kyiv... as Russians attacked with a combination of cruise missiles, ballistic missiles and kamikaze drones.", according to KyivPost.

- Poland activated its aircraft to ensure airspace security, Polish Armed Forces said, following Russia's air attack on Ukraine.

OTHER

- A China Coast Guard vessel deliberately collided three times with a Philippine Coast Guard vessel exercising its freedom of navigation in the Philippines, according to US State Department.

EU/UK

NOTABLE HEADLINES

- ECB policymakers increasingly at odds on the outlook for growth, with some fearing a recession, others focusing on lingering inflation pressures, according to sources cited by Reuters. Policy decisions after September are likely to be more complicated as the Eurozone economy enters a more precarious state, conversations with close to a dozen sources suggest. The core of the debate is over how weakness in economic growth and a potential recession will impact inflation as it tries to cut inflation to 2% by the end of 2025.

- The far-right Alternative for Germany (AfD) will claim a clear victory in state parliamentary elections in the German state of Thuringia, well ahead of the second-place conservative Christian Democrats (CDU), initial exit polls show, according to dpa. "The AfD's projected win in Thuringia would mark the first time since the defeat of Nazi Germany in World War II that a far-right party has won a statewide election in the country", dpa said.

- German state of Saxony sees CDU projected to win 31.9% and AfD with 30.6%, according to public broadcaster ZDF.

LATAM

- Mexican judge ordered Congress not to discuss controversial judicial reform, according to Reuters.