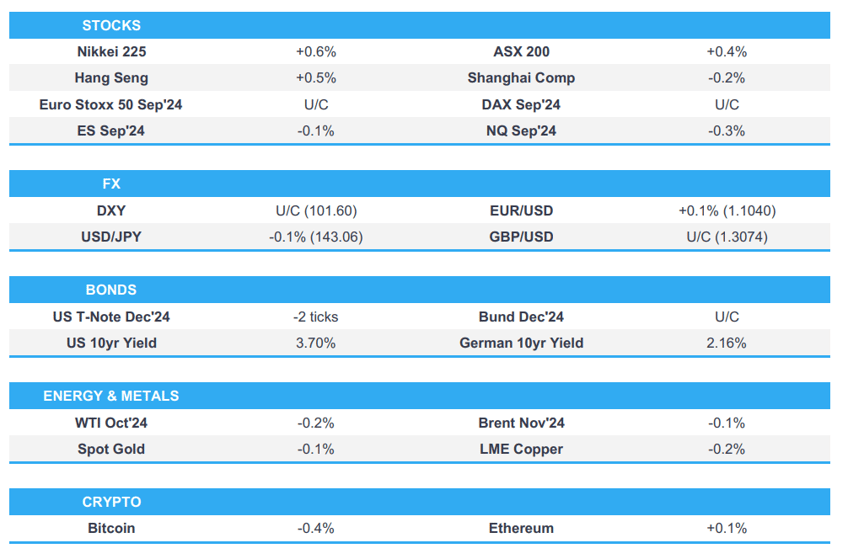

- APAC stocks mostly took impetus from the gains on Wall St where the major indices rebounded (S&P 500 +1.2%)

- Chinese trade data in USD terms was mixed; larger surplus than expected, exports beat, imports missed

- European equity futures are indicative of a flat open with the Euro Stoxx 50 future unchanged after the cash market gained 0.9% on Monday

- DXY is steady above the 101.50 mark, the USD's major counterparts have been unable to regain much lost ground.

- Looking ahead, highlights include German CPI (F), UK Unemployment/Wages, Norway CPI, EIA STEO, OPEC MOMR, Comments from BoC Governor Macklem, Supply from UK, Germany & US

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

EQUITIES

- US stocks were firmer to start the week in light newsflow amid a lack of tier-1 releases and the Fed on a blackout period. Nonetheless, all sectors aside from Communication Services gained with Financials, Industrials, and Consumer Discretionary as the best performers as the latter two were buoyed by Boeing (BA) and Tesla (TSLA), respectively, while Apple (AAPL) shares were flat after its Glowtime Event, where the tech giant announced the new iPhone 16 with Apple Intelligence, alongside a new Watch and AirPods, proved to be a damp squib.

- SPX +1.2% at 5,471, NDX +1.3% at 18,661, DJIA +1.2% at 40,830, RUT +0.3% at 2,097.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Largest US banks’ capital hike was reduced in half under the latest plan by regulators in which banks would face a 9% increase in capital requirements instead of the 19% that was originally called for by the Fed, FDIC and the Office of the Comptroller of the Currency, according to Bloomberg citing sources familiar with the matter.

- US VP Harris is ahead of former President Trump at 49%-46% in a North Carolina poll by Quinnipiac, while Trump is ahead by 3 points in a Georgia poll by Quinnipiac.

APAC TRADE

EQUITIES

- APAC stocks mostly took impetus from the gains on Wall St where the major indices rebounded amid light newsflow ahead of looming key events, although Chinese markets lagged amid mixed Chinese trade data.

- ASX 200 was led higher by strength in financials and utilities but with gains capped after weak consumer and business surveys.

- Nikkei 225 edged higher albeit with trade contained in the absence of any major pertinent catalysts.

- Hang Seng and Shanghai Comp were mixed as the former was indecisive with Alibaba the biggest gainer after its Stock Connect inclusion, while WuXi AppTec was at the other end of the spectrum after the US House passed the Biosecure Act which would prohibit the US government from contracting with certain biotech firms. Conversely, the mainland lagged behind regional peers amid mixed Chinese trade data and after protectionist measures by the US House which also voted to pass the Countering CCP Drones Act that would bar new drones by DJI from operating in the US.

- US equity futures (ES -0.1%) were little changed amid tentativeness ahead of looming risk events.

- European equity futures are indicative of a flat open with the Euro Stoxx 50 future unchanged after the cash market gained 0.9% on Monday.

FX

- DXY traded rangebound after Monday's advances and amid thin newsflow with participants now awaiting the US Presidential Debate on Tuesday and the latest US CPI data on Wednesday.

- EUR/USD languished near the prior day's lows and firmly beneath the 1.1100 handle ahead of a widely expected ECB rate cut this week.

- GBP/USD remained lacklustre after having recently trickled to a sub-1.3100 level, while the focus turns to UK jobs and earnings data.

- USD/JPY eked mild gains after snapping a four-day losing streak but with price action contained by a lack of pertinent catalysts.

- Antipodeans were flat after weaker Australian business and consumer confidence surveys, while participants also reflected on the mixed trade figures from Australia and New Zealand's top export partner.

- PBoC set USD/CNY mid-point at 7.1136 vs exp. 7.1140 (prev. 7.0989).

FIXED INCOME

- 10yr UST futures marginally softened with demand constrained by a lack of catalysts as participants await key events and supply.

- Bund futures held on to the majority of yesterday's spoils but with upside capped ahead of today's bobl and bund issuances.

- 10yr JGB futures traded flat amid a lack of tier-1 releases while mostly improved results from the 5-year JGB auction did little to spur prices.

COMMODITIES

- Crude futures took a breather after the prior day's rebound as Francine disrupts production and refining along the US Gulf Coast.

- NHC said Francine is expected to become a hurricane soon with storm surge and hurricane warnings in effect for the Louisiana coast.

- US Coast Guard ordered the closure of Brownsville and other small Texas ports, while the port of Corpus Christi remained open under vessel traffic restrictions, according to an advisory.

- Chevron (CVX) announced to evacuate all staff and shut in oil and gas production at two US Gulf of Mexico platforms.

- Shell (SHEL LN) announced to shut oil production at Perdido offshore platform in US Gulf of Mexico citing downstream impacts.

- Goldman Sachs said strong production and disappointing demand pose a downside risk to their US gas price forecast, while it added that Tropical Storm Francine is expected to further reduce power demand and potentially impact LNG exports out of the Gulf.

- China oil industry researcher said China oil products demand is projected to fall by an average of 1.1% annually between 2023-2025.

- Spot gold was rangebound and just about held on to the USD 2,500/oz status as markets await the US CPI data mid-week.

- Copper futures were subdued as Chinese markets lagged amid mixed trade data and US protectionist legislation.

CRYPTO

- Bitcoin weakened overnight following a pullback beneath the USD 57,000 level.

NOTABLE ASIA-PAC HEADLINES

- US House passed the Biosecure Act with broad bipartisan support which would prohibit the US government from contracting with, or providing grants to, companies that do business with a “biotechnology company of concern”, while it specifically named five Chinese companies which were BGI Genomics, MGI Tech, Complete Genomics, WuXi AppTec, and Wuxi Biologics.

- US House voted to bar new drones from Chinese drone maker DJI from operating in the US, according to Reuters.

DATA RECAP

- Chinese Trade Balance (USD)(Aug) 91.02B vs. Exp. 82.05B (Prev. 84.65B)

- Chinese Exports YY (USD)(Aug) 8.7% vs. Exp. 6.5% (Prev. 7.0%)

- Chinese Imports YY (USD)(Aug) 0.5% vs. Exp. 2.0% (Prev. 7.2%)

- Chinese Trade Balance (CNY)(Aug) 649.34B (Prev. 601.90B)

- Chinese Exports YY (CNY)(Aug) 8.4% (Prev. 6.5%)

- Chinese Imports (CNY)(Aug) 0.0% (Prev. 6.6%)

- Australian West Consumer Confidence MM (Sep) -0.5% (Prev. 2.8%)

- Australian Westpac Consumer Confidence Index (Sep) 84.6 (Prev. 85.0)

- Australian NAB Business Confidence (Aug) -4.0 (Prev. 1.0)

- Australian NAB Business Conditions (Aug) 3.0 (Prev. 6.0)

GEOPOLITICS

MIDDLE EAST

- Israeli military detained a convoy of UN vehicles in the northern Gaza strip and has intelligence indicating a number of 'Palestinian suspects' are in the convoy.

- Israeli military said it conducted an air strike which targeted a Hamas command centre in Khan Younis, while Hamas media reported the death toll from the Israeli strike on a Gaza tent encampment was at least 40.

- US President Biden was reported to convene his national security team to discuss the impasse in negotiations on the hostage deal, according to Axios’s Barak Ravid citing sources.

OTHER

- Moscow's Vnukovo and Domodedovo Airports stopped flights after reports of nearby drone attacks, while it was separately reported that a fire broke out at a multi-storey residential building in Moscow's Ramenskoye district as a result of a drone attack.

- White House said it cannot confirm the report of an Iranian missile transfer to Russia, while it also stated that China holding naval air drills with Russia is a sign of deepening cooperation.

- North Korean leader Kim said they must prepare North Korea's nuclear capability and readiness to use it properly at any given time, while they are implementing a nuclear force construction policy to increase the number of nuclear weapons exponentially, according to KCNA.