- APAC stocks traded mixed following the weak handover from Wall St where tech underperformed as yields climbed after the hot ISM Services and strong JOLTS data.

- Hang Seng and Shanghai Comp were pressured with market participants underwhelmed by the latest NDRC press briefing in Beijing.

- AUD/USD choppy following the latest monthly inflation data from Australia in which the Weighted CPI printed firmer than expected but the annual trimmed mean CPI softened from previous.

- European equity futures indicate a lower cash open with Euro Stoxx 50 futures down 0.2% after the cash market closed with gains of 0.5% on Tuesday.

- Looking ahead, highlights include US Jobless Claims, Wholesale Inventory and EIA Nat Gas Change (brought forward on account of the US Day of Mourning), German Retail Sales, EZ Economic Sentiment, US ADP National Employment, Comments from Fed's Waller, FOMC Minutes, Supply from UK, Germany & US, Earnings from Jefferies.

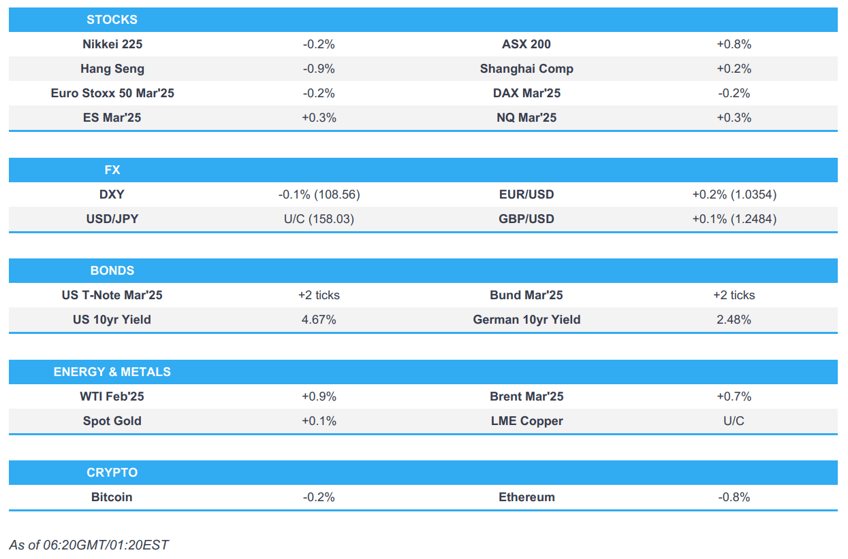

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks saw broad-based weakness on Tuesday with underperformance in the Nasdaq 100 (-1.8%) with price action drive in the wake of a hot US ISM Services and JOLTS report in which the former beat expectations and was accompanied by a notable upside in the prices paid subcomponent, while JOLTS data surpassed the top end of analysts' forecast range. The data weighed on treasuries and spurred a resurgence of the dollar which recouped its initial losses and more, to the detriment of all G10 FX peers.

- SPX -1.11% at 5,909, NDX -1.79% at 21,173, DJIA -0.42% at 42,528, RUT -0.74% at 2,250.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President-elect Trump said something will have to be done with Canada and Mexico trade and he flagged very serious tariffs on Mexico and Canada. Trump also said that interest rates are far too high and that he is ok with spending cuts, while he does not want to see a default and just wants to see an extension on the debt ceiling.

APAC TRADE

EQUITIES

- APAC stocks traded mixed following the weak handover from Wall St where tech underperformed as yields climbed after the hot ISM Services and strong JOLTS data.

- ASX 200 gained amid strength in mining stocks and the top-weighted financial sector, while participants digested mixed monthly inflation data in which the Weighted CPI reading topped forecasts, but the annual trimmed mean figure softened. Capital Economics suggested would provide greater confidence the RBA is on track to meet its inflation mandate if it the result is replicated in the quarterly figures due later this month.

- Nikkei 225 gradually nursed the majority of its opening losses and reclaimed the key 40,000 level.

- Hang Seng and Shanghai Comp were pressured with market participants underwhelmed by the latest press briefing in Beijing where the NDRC announced to expand the scope of home appliance trade-ins eligible for subsidies, while frictions lingered with China's MOFCOM voicing criticism over recent US restrictions on Chinese companies.

- US equity futures recouped some of the recent losses albeit with the recovery only modest amid the mixed risk tone in Asia.

- European equity futures indicate a lower cash open with Euro Stoxx 50 futures down 0.2% after the cash market closed with gains of 0.5% on Tuesday.

FX

- DXY took a breather after strengthening yesterday on the back of the hot ISM Services PMI data and as JOLTS data topped analysts' forecast range. There were also prior comments from Fed's Barkin which provided very little new fresh insight, while the attention now turns to the FOMC Minutes, ADP Employment and Initial Jobless Claims data.

- EUR/USD attempted to regain some composure after its slide beneath the 1.0400 level and with the single currency not helped by mixed inflation data.

- GBP/USD struggled for direction after reverting to the sub-1.2500 territory and amid a lack of fresh UK-specific catalysts.

- USD/JPY traded indecisively and on both sides of the 158.00 level amid a quiet data calendar for Japan and the mixed risk tone.

- Antipodeans was ultimately flat with AUD/USD choppy following the latest monthly inflation data from Australia in which the Weighted CPI printed firmer than expected but the annual trimmed mean CPI softened from previous, while Capital Economics noted the data increases the risk that the RBA will begin rate cuts earlier than May.

- PBoC set USD/CNY mid-point at 7.1887 vs exp. 7.3435 (prev. 7.1879).

FIXED INCOME

- 10yr UST futures remained subdued after slipping in the aftermath of the hot ISM Services and JOLTS data, while prices were also not helped by a soft 10yr auction.

- Bund futures languished near the prior day's lows beneath the 132.00 level ahead of supply and following the somewhat mixed EU inflation data.

- 10yr JGB futures tracked the recent losses in global counterparts while the BoJ also reduced the amounts in its rinban purchases as flagged in December.

COMMODITIES

- Crude futures marginally extended on the prior day's gains with upside seen after the latest private sector inventory data showed a larger-than-expected draw in headline crude and with Cushing stockpiles also at a draw, while gasoline and distillate both showed greater-than-expected builds.

- Private inventory data (bbls): Crude -4.0mln (exp. -0.2mln), Distillate +3.2mln (exp. +0.6mln), Gasoline +7.3mln (exp. +1.5mln), Cushing -3.1mln.

- Qatar set February Marine Crude OSP at Oman/Dubai + USD 0.45/bbl and Land Crude OSP at Oman/Dubai + USD 0.30/bbl.

- Spot gold traded sideways with price action contained around USD 2,650/oz as participants awaited the FOMC Minutes and further employment-related metrics.

- Copper futures lacked firm direction amid the mixed risk appetite in Asia and the subdued mood in China.

CRYPTO

- Bitcoin continued on its pullback overnight beneath the USD 97,000 level.

NOTABLE ASIA-PAC HEADLINES

- NDRC Vice Chairman announces loan discounts for equipment upgrades and expansion of trade-in program to include more consumer goods, while the number of types of household appliances eligible for recycling subsidies to increase from 8 to 12 with a maximum subsidy of 20% of the sales price for each item. NDRC said it will allocate special funds to support the recycling and treatment of waste electrical and electronic products, as well as include microwaves, water purifiers, dish-washing machines and rice cookers in the consumer goods trade-in subsidy scope. Furthermore, it will subsidise smartphones for up to 15% of the price and will support equipment upgrades of information technology, safe production and agriculture equipment.

- Chinese Finance Ministry official said the government has allocated CNY 81bln for consumer goods trade-ins so far this year, while a PBoC official stated they will step up financial support for private and small firms in equipment upgrades with the central bank allocating CNY 100bln of loans for select small technology firms.

- China condemned the US military blacklisting of Chinese companies and called on the US to immediately address its misconduct, while it said the US is endangering the stability of the global supply chain.

DATA RECAP

- Australian Weighted CPI YY (Nov) 2.3% vs. Exp. 2.2% (Prev. 2.1%)

- Australian CPI Annual Trimmed Mean YY (Nov) 3.2% (Prev. 3.5%)

GEOPOLITICS

MIDDLE EAST

- Israeli Broadcasting Corporation published some details of the document submitted by Israel to negotiate with Hamas which includes a proposal to withdraw from the "Netzarim Corridor", humanitarian aid, and release of prisoners in stages, according to Sky News Arabia. The aim of the agreement is to release all Israeli hostages held in the Gaza Strip and in exchange for the release of the hostages, Israeli forces will withdraw from the Gaza Strip and the Strip will be reconstructed, while an agreed number of Palestinian prisoners held by Israel would be released and sustainable calm will be restored, leading to a permanent ceasefire.

- US President-elect Trump’s Middle East envoy Witkoff said they hope to have good things related to the Gaza hostage talks by the January 20th inauguration.

OTHER

- US President-elect Trump said he can't assure of either of the two when asked for assurance that he will not use military or economic coercion as he tries to get control over Greenland, while he would consider tariffs on Denmark over Greenland and cannot assure not using military or economic coercion on the Panama Canal.

- Venezuelan President Maduro said two US nationals were arrested as part of a group of seven mercenaries. It was separately reported that the Biden administration is set to roll out new sanctions against Venezuelan President Maduro's regime this week ahead of the Venezuelan Presidential Inauguration, according to an Axios reporter.