- APAC stocks traded higher as the region reacted to US President Trump's delay of tariffs against Canada and Mexico for a month.

- However, the new 10% tariff on all China exports to the US took effect after the deadline passed.

- Furthermore, China is to levy countermeasures on some US imported products with 15% tariffs on coal and LNG, as well as 10% tariff on oil, agricultural machines and some autos from the US.

- European equity futures indicate a slightly lower cash market open with Euro Stoxx 50 future down 0.1% after the cash market closed with losses of 1.3% on Monday.

- DXY was boosted by Chinese retaliatory measures, EUR/USD is back below 1.03 and Cable is sub-1.24.

- Looking ahead, highlights include US JOLTS Job Openings, NZ HLFS Jobs, Riksbank Minutes, Fed’s Bostic & Daly, Supply from UK

- Earnings from UBS, BNP Paribas, Vodafone, Diageo, Infineon, BMPS, Intesa Sanpaolo, Ferrari, AMD, Google, Snapchat, Chipotle, Amgen, Paypal, Spotify, Pfizer, Regeneron, PepsiCo, Merck, Estee Lauder, Marathon Petroleum.

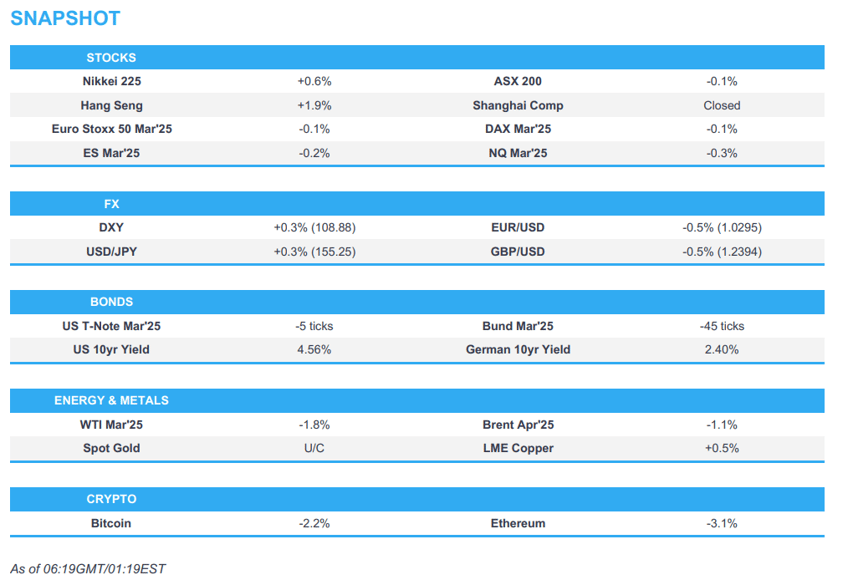

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stock indexes closed in the red, albeit well off worst levels, as Trump tariff talk dominated markets to start the week with an initial gap lower in futures after President Trump signed an order to impose tariffs on Canada, Mexico and China although stocks then rebounded after Mexican President Sheinbaum announced she had a good conversation with US President Trump and that he agreed to delay tariffs by a month and she will immediately supply 10,000 Mexican soldiers on the border. Furthermore, Canadian PM Trudeau and US President Trump also reached a similar agreement for a 30-day tariff delay.

- SPX -0.76% at 5,995, NDX -0.84% at 21,298, DJIA -0.28% at 44,422, RUT -1.28% at 2,258.

- Click here for a detailed summary.

TARIFFS

- The new 10% tariff on all China exports to the US took effect after the deadline passed.

- China is to levy countermeasures on some US imported products with 15% tariffs on coal and LNG, as well as 10% tariff on oil, agricultural machines and some autos from the US, while China's Finance Ministry said tariffs imposed are to counter 10% Trump tariff and will take effect on February 10th. China is also to probe Google (GOOGL) over alleged anti-trust law breaches and it imposed export controls on tungsten, tellurium, ruthenium, molybdenum, and ruthenium-related items.

- US President Trump said on Monday that the US will probably speak to China over the next 24 hours and China will not be involved with the Panama Canal for long. Furthermore, he said China tariffs were an opening salvo and will increase if they cannot make a deal, while he warned that tariffs will be substantial if can’t make a deal with China.

- US President Trump said on Truth that Canada agreed to ensure the US has a secure Northern Border and the tariffs announced on Saturday will be paused for a 30-day period to see whether or not a final economic deal with Canada can be structured.

- Canadian PM Trudeau said he had a good call with President Trump who will pause the tariffs for at least 30 days and Canada will send almost 10,000 troops to protect the border, while Canada will also name a fentanyl czar.

- US President Trump likes the idea of reciprocal tariffs on more countries and said that nobody is out of tariffs, while he had a great talk with Mexico but added that they have to stop fentanyl. Furthermore, he said they have not agreed on tariffs yet with Mexico and he had a good talk with Canadian PM Trudeau but added the US is not treated well by Canada.

- China's UN envoy said China firmly opposes the unwarranted increase in tariffs by the Trump administration and in violation of the WTO, China will be filing a complaint. Furthermore, the envoy said Beijing may be forced to take countermeasures against the US, as well as commented that the US should look at its own problem with Fentanyl rather than shifting the blame onto others.

- US President Trump reportedly considering plans to impose a 10% tariff on the EU, according to The Telegraph.

- EU Commission President von der Leyen said that when targeted with unfairly or arbitrarily tariffs, the EU will respond firmly.

- Ecuador President Noboa said his government will apply a 27% tariff on Mexican goods.

NOTABLE HEADLINES

- Fed's Goolsbee (voter) said uncertainties likely mean that the Fed needs to be a little more careful and prudent on cutting rates, while he added there are risks that inflation could tick back up and if fiscal choices affect prices or employment, they have to think it through. Goolsbee also said there are concerns about inflation and the Fed might have to slow the pace of rate cuts amid uncertainty.

- Fed's Bostic (2027 voter) said the current degree of uncertainty has broadened considerably, while tariffs are an aspect of uncertainty and it is challenging to figure out how to incorporate it. Bostic said because things are changing so rapidly the most important thing to do is ask questions of business contacts and look at possible other outcomes. Furthermore, he stated the emphasis is still on inflation and the Fed needs to get to 2% for the credibility of the institution. Bostic later commented that businesses are not confident in their outlook at this point and he is currently in wait-and-see mode, while he would want to see housing inflation begin to slow to cut again and does not expect clarity on inflation enough by March to move.

- NY Fed's measure of inflation persistence (the "multivariate core trend") fell to 2.3% in December which was the lowest level in four years, according to WSJ's Timiraos.

- US Treasury expects to borrow USD 815bln in privately-held net marketable debt (prev. guided USD 823bln for Q1 25), assuming end of March cash balance of USD 850bln (prev. guided 850bln).

- US President Trump signed an executive order to create a sovereign wealth fund, while Treasury Secretary Bessent said the sovereign wealth fund is to be created in the next 12 months and will be of great strategic importance.

- US President Trump advisers reportedly weigh a plan to dismantle the Education Department, according to WSJ citing sources.

- US Secretary of State Rubio says he reached a migration agreement with El Salvador's Bukele on Monday in which El Salvador has agreed to accept for deportation any illegal alien in the US who is a criminal from any nationality and house them in its jails. El Salvador's Bukele also offered to house in his jails criminals, including those with US citizenship or legal residency.

- US President Trump's nominee Chris Wright was confirmed by the Senate as Energy Secretary through 59-38 votes.

APAC TRADE

EQUITIES

- APAC stocks traded higher as the region reacted to US President Trump's delay of tariffs against Canada and Mexico for a month, while the additional 10% tariffs on China took effect and prompted an immediate retaliation by China.

- ASX 200 was initially led higher by strength in tech and miners but ultimately settled flat owing to the US-China tariff frictions.

- Nikkei 225 briefly climbed back above the 39,000 level with the biggest gainers and losers dictated by earnings releases.

- Hang Seng surged amid hopes that China would also reach a tariff deal with the US after President Trump stated that he would probably speak with China within 24 hours, but then briefly wobbled after China announced tit-for-tat tariffs against the US.

- US equity futures (ES -0.2%, NQ -0.2%) were marginally lower after China tariffs dampened the one-month tariff reprieve for Canada and Mexico.

- European equity futures indicate a slightly lower cash market open with Euro Stoxx 50 future down 0.1% after the cash market closed with losses of 1.3% on Monday.

FX

- DXY fluctuated on tariff headlines with headwinds following Mexican President Sheinbaum's announcement that US tariffs on Mexico are to be delayed by one month and that Mexico will send 10,000 troops to the US border, while President Trump and Canadian PM Trudeau also reached a similar agreement for a 30-day delay of tariffs, while the dollar was later boosted after the additional 10% US tariffs on China took effect which China immediately retaliated to with its own tariffs.

- EUR/USD initially attempted to nurse losses and briefly reclaimed the 1.0300 handle but with the rebound limited as President Trump also looks to target the EU with tariffs and is reportedly considering plans to impose a 10% tariff on the bloc, while the single currency was later pressured as the dollar strengthened on China's retaliation to US tariffs.

- GBP/USD marginally pulled back just beneath the 1.2400 level after having mostly weathered the tariff-related headwinds yesterday with the UK seemingly not on President Trump's immediate tariff radar.

- USD/JPY rebounded from yesterday's trough and returned to the 155.00 territory with the help of the mild upside in US yields.

- Antipodeans were gradually pressured with tariff-related headlines the main driver across markets.

FIXED INCOME

- 10yr UST futures lacked decisiveness after recent tariff-related fluctuations and curve flattening, while comments from Fed officials urged cautiousness and patience on monetary policy with no urgency to cut rates.

- Bund futures declined in a continuation of the pullback from Monday's peak with prices back below the 133.0 level.

- 10yr JGB futures were pressured amid the upside in Japanese yields and weaker 10yr JGB auction results.

COMMODITIES

- Crude futures declined with selling pressure seen after US President Trump delayed the tariffs against both Canada and Mexico, while the recent OPEC+ JMMC meeting was uneventful and made no recommendations as widely expected.

- Bloomberg OPEC Survey for January noted crude output fell 70k BPD to 27.03mln BPD following a fire at an Iraqi oil field.

- Kazakhstan said it will fulfil its OPEC+ obligations in 2025-2026 and will compensate for overproduction in 2024.

- Spot gold remained afloat after recently advancing back above the USD 2,800/oz level to a record high.

- Copper futures initially extended on the prior day's gains as risk sentiment improved on the one-month tariff delay for Canada and Mexico, but later faded the gains as the additional 10% tariffs on China took effect.

CRYPTO

- Bitcoin gradually pulled back overnight and steadily retreated closer towards the USD 100k level.

NOTABLE ASIA-PAC HEADLINES

- China's UN envoy said a smear campaign by the US and others on the Belt and Road Initiative is 'totally groundless' and on the whole, believes that the US and China have so much in common and can work together at the UN on many things.

- US President Trump said they will be doing something with TikTok if they can make the right deal and that TikTok could go into a sovereign wealth fund, while he later commented on Truth **"GREAT INTEREST IN TIKTOK! Would be wonderful for China, and all concerned".

GEOPOLITICS

MIDDLE EAST

- US President Trump is to host a bilateral meeting with Israeli PM Netanyahu on Tuesday, according to the White House.

- US reportedly readied a new USD 1bln arms sale to Israel, according to WSJ.

RUSSIA-UKRAINE

- US shipments of arms to Ukraine were briefly paused last week but resumed on the weekend, according to Reuters citing sources.

OTHER

- US Secretary of State Rubio said there are no talks to recognise Maduro as the legitimate leader of Venezuela and commented that they cannot continue to have the Chinese exercising control of the Panama Canal area.

- Philippine Air Force spokesperson said Philippines and US joint air patrol exercises were underway in the South China Sea.

EU/UK

NOTABLE HEADLINES

- Polish PM Tusk said all 27 EU leaders confirmed readiness to minimise the negative effects of Brexit for both sides, while he noted EU leaders' unanimity in support of Denmark's territorial integrity was very important.