Here what to expect from what - as of Monday's Nvidia rout - is once again the world's largest company, AAPL, which reports after the close and which as we noted recently, is amidst one of its biggest months of under-performance in years. As Goldman writes, all eyes will be on the March quarter revs guide - where investors debating if a potentially below street revs guide is a clearing event (into 2H cycle) or not.

And here is a more detailed preview from JPMorgan's market intel team:

AAPL - Management set expectations into the quarter – Kevan Parekh’s first as CFO -- quite low, implying Dec-Q Products revenue only flat (5% light of consensus back in October, despite multiple new product lunches and the gradual launch of Apple Intelligence, where adoption rate has been strong); and despite continued concerns around China iPhone demand, our Asia team continues not to see any changes in iPhone EMS orders at Hon Hai or Pegatron.

The bar seems low, and institutional positioning seems balanced. Yet at 28x year-ahead earnings (near peak multiples since before the GFC), a number of folks we speak with feel comfortable treating the name as a funding short – a view mirrored in its elevated short interest (though it’s not a stand-out short in our Prime book, and the recent -11% pullback may have taken out some of that caution).

There’s no doubt AAPL finds itself well-positioned to mediate consumer AI adoption – a fact that keeps long-onlies engaged at these multiples (which, to be fair, are not worrisome for a services company like the one AAPL continues to become, notwithstanding the loss of GOOGL’s TAC fee).

- Positioning Score (1 = max short/UW, 10 = max long/OW): 5

- Buyside bogeys: Expectations for the print and the guide seem reasonable, with investors presently more focused on the extent to which AI drives product revenue in 2025~6, and AI also drives services revenue further out. JPM expects 1Q Revenue $123.7b (in-line with Factset $124.8b) and EPS $2.34 (v. $2.35).

- Implied Move: 3.6%

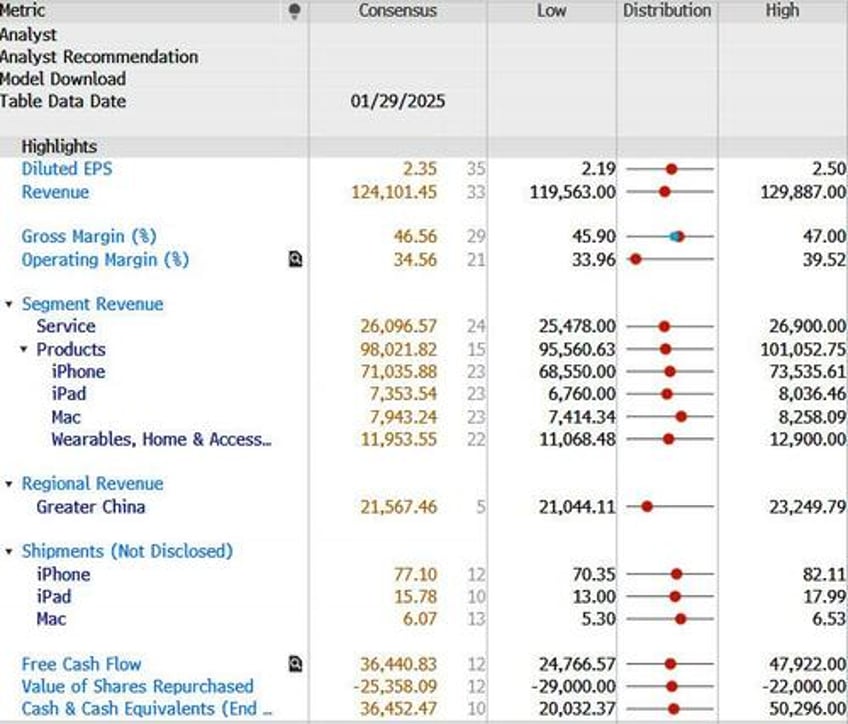

Here is a summary of consensus estimats.

d