Apple supply chain analyst Ming-Chi Kuo published a pre-order analysis report on the demand for the iPhone 16 on Sunday following last week's launch event. He found less demand for the iPhone 16 Pro and iPhone 16 Pro Max and, inversely, more demand for base models. This report contradicts the optimism of many Wall Street analysts who forecasted that new AI Siri features embedded in the new iPhone would spark an upgrade "super cycle." Apparently, that's not the case.

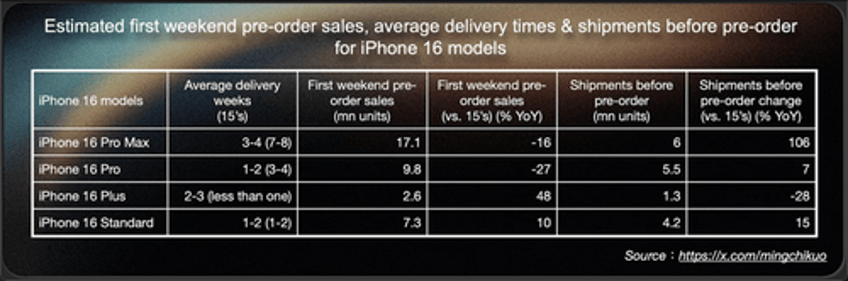

Kuo wrote in the report posted on Medium titled "iPhone 16 first weekend pre-order analysis: estimated total sales of about 37 million units; Pro series demand lower than expected," that his analysis was based on the "latest supply chain survey and pre-order results from Apple's official websites ... I've compiled key data on iPhone 16's first-weekend pre-orders for each model, including pre-order sales, average delivery times, and shipments before pre-order."

Here are Kuo's top findings:

Table item explanations:

First Weekend pre-order sales: estimated based on each model's delivery time and production plans for that period.

Average delivery time: results from Apple's official websites in major iPhone markets 48 hours after pre-orders opened.

Shipments before pre-order: Production volume before pre-orders.

Kuo's conclusion:

iPhone 16 series first-weekend pre-order sales are estimated at about 37 million units, down about 12.7% YoY from last year's iPhone 15 series first-weekend sales. The key factor is the lower-than-expected demand for the iPhone 16 Pro series.

The delivery times of the iPhone 16 Pro series are significantly shorter than those of the 15 Pro series. In addition to the shipment increase before the pre-order, the key is that demand is lower than expected, as evidenced by the YoY decline in first-weekend sales.

The significant YoY growth in shipments before pre-order for iPhone 16 Pro Max is due to improved tetraprism camera production yields and Apple's optimistic outlook for demand for this model.

One of the key factors for the lower-than-expected demand for the iPhone 16 Pro series is that the major selling point, Apple Intelligence, is not available at launch alongside the iPhone 16 release. Additionally, intense competition in the Chinese market continues to impact iPhone demand.

While first-weekend sales of the iPhone 16 Plus and standard version were up YoY, their impact on total iPhone shipments is limited.

Despite the YoY decline in first-weekend pre-order sales of the iPhone 16 Pro series, the supply chain's production plans are unlikely to change significantly in the near term. Apple still has opportunities to improve sales through the release of Apple Intelligence and peak season promotions (year-end holiday season in America and Europe and Double 11 in China). These factors will be key points to watch for changes in iPhone demand.

Strategies such as adding a tetraprism camera to the 16 Pro and maintaining iPhone 16 series pricing have had a limited help to iPhone 16 first-weekend pre-order sales. Suppose Apple Intelligence releases in 4Q24 and peak season promotions have a limited effect on iPhone 16 shipments. In that case, I believe that Apple will implement more aggressive iPhone product strategies in 2025 to stimulate market demand.

A key takeaway from the report is that consumers are more interested in the base iPhone models during this launch cycle than in the Pro series. This shift could be driven by pricing concerns in an era of elevated inflation and high interest rates, or possibly because the Pro models are too large in size. The exact reasons remain unclear.

In markets, shares of Apple are lower by more than 2%.

Let's not forget.

The whole reason AAPL stock levitated from the $170s to $240 is because AI was supposed to spark an iPhone upgrade cycle https://t.co/gnBXPTnvJD

— zerohedge (@zerohedge) September 16, 2024

Wall Street's expectations for a robust iPhone upgrade cycle driven by Siri AI now face serious doubt following this report.