Longtime readers know I have written about cycles from the start of the blog 18 years ago.

Many commentators dismiss financial cycles as cherry-picked illusions. Natural cycles such as sunspot activity are based on observations and are verifiable facts.

The effects such cycles have on our world are not as predictable as the cycles themselves, as Nature is a self-organizing system of feedback loops that interact, strengthen or weaken other dynamics. Society and the economy are also self-organizing systems, which means that they have the potential to veer from predictable linear trends to unpredictable nonlinear dynamics.

This is often described as "small events can trigger large consequences," with the butterfly's wings precipitating a hurricane. Another way of understanding this potential to consider the difference between linear 3+3+3=9 and geometric 3X3X3=27.

I've often described the role of buffers in absorbing crises / rapid changes in systems, and the hidden fragility of systems in which buffers have been thinned by repeated stress, poor maintenance, incompetence, etc. On the surface, the system looks robust but beneath the surface it's one shock wave from collapse.

We can think of cycles as waves of varying intensity and consequence. Waves have different dynamics, a point elucidated by historian David Hackett Fischer in his book The Great Wave: Price Revolutions and the Rhythm of History, which was gifted to me 15 years ago by longtime correspondent Cheryl A., a work that profoundly influenced my thinking and that I have often recommended to readers.

Recently, longtime correspondent Stuart L. shared some of his takeaways from the book, starting with the difference between cycles and waves. Stuart begins by quoting Fischer:

"Cyclical rhythms are fixed and regular. Their periods are highly predictable. Great waves are more variable and less predictable. They differ in duration, magnitude, velocity, and momentum. One great price wave lasted less than ninety years; another continued more than 180 years. The irregularities in individual price movements make them no more (or less) predictable than individual waves in the sea.

Even so, all great waves had important qualities in common. They all shared the same wave-structure. They tended to have the same sequence of development, the same pattern of price relatives, similar movements of wages, rent, interest rates; and the same dangerous volatility in later stages. All major price revolutions in modern history began in periods of prosperity. Each ended in shattering world crises and was followed by periods of recovery and comparative equilibrium."

Stuart then added his own comments:

"The author then goes on to talk about how cycles often have to be 'teased' out of the data by statistical inference. For the waves, however, he says they emerge entirely based on empirical data, with no preconceived theory to arrange the facts. And he has an interesting explanation of how American academic thought since the 40s has maintained that without a theory nothing can exist or be studied, whereas in French thought no theory is necessary. Thus, it is difficult for American academics to allow the facts to emerge empirically and speak for themselves."

I replied that this reminded me of Musings 41, What Are Islands of Coherence?, which explored the system dynamics presented by Nobel Prize winner Ilya Prigogine: small fluctuations are amplified into structure-breaking waves. In my view, this aligns with Fischer's "Great Wave" of price and resource scarcities, which amplify social discord / destabilization.

In Prigogine's words, "Nature is change, the continual elaboration of the new, a totality being created in an essentially open process of development without any pre-established model." In other words, Nature isn't teleological, steering toward a set goal. Put another way, Progress (however we define it) is not guaranteed.

Prigogine also described the dynamic nature of equilibrium, and what happens when systems veer far from equilibrium: they tend to destabilize / decohere, i.e. collapse into some other state of relative equilibrium.

Islands of Coherence influence these dynamics, and hence my focus on describing Islands of Coherence.

Returning to Fischer's work:

"He describes four waves of price revolutions, each beginning in a period of equilibrium: the High Middle Ages, the Renaissance, the Enlightenment, and finally the Victorian Age. Each revolution is marked by continuing inflation, a widening gap between rich and poor, increasing instability, and finally a crisis at the crest of the wave that is characterized by demographic contraction, social and political upheaval, and economic collapse. The most violent of these climaxes was the catastrophic fourteenth century, in which war, famine, and the Black Death devastated the continent--the only time in Europe's history that the population actually declined.

Fischer also brilliantly illuminates how these long economic waves are closely intertwined with social and political events, affecting the very mindset of the people caught in them. The long periods of equilibrium are marked by cultural and intellectual movements--such as the Renaissance, the Enlightenment, and the Victorian Age-- based on a belief in order and harmony and in the triumph of progress and reason. By contrast, the years of price revolution created a melancholy culture of despair.

Fischer suggests that we are living now in the last stages of a price revolution that has been building since the turn of the century. The destabilizing price surges and declines and the diminished expectations the United States has suffered in recent years--and the famines and wars of other areas of the globe--are typical of the crest of a price revolution. He does not attempt to predict what will happen, noting that 'uncertainty about the future is an inexorable fact of our condition'."

Let's consider two cycles that could be amplified into waves that could make our lives "interesting," in the sense of unexpectedly impactful dynamics changing daily life in unpredictable ways.

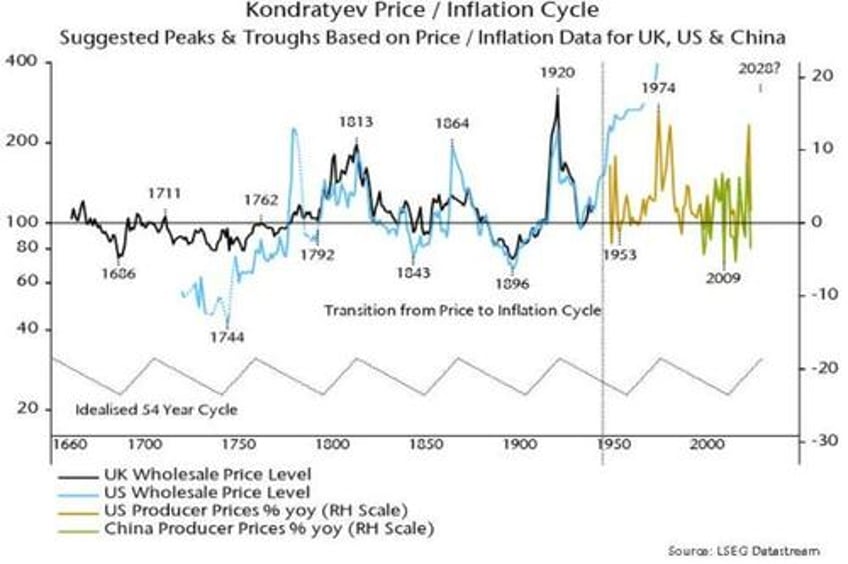

The first is the price / inflation cycle described by early 20th century Russian economist Kondratyev. The source of this chart is 1969-70 replay?

This cycle suggests an inflationary peak in 2027-28.

In my view, potential accelerants include systemic extremes of debt and speculative fever, wealth inequality and the depletion of hydrocarbon energy, topsoil and fresh water which will fuel price spikes and destabilizing scarcities.

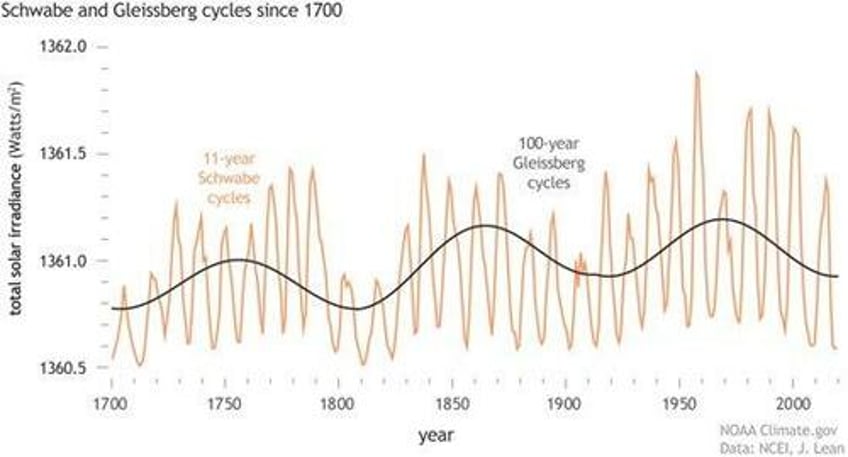

The second cycle is the Gleissberg drought cycle, in which an 88/89-year solar activity cycle corresponds with drought in various regions, including the U.S. Midwest, with a predicted start around 2025.

An extended "Dust Bowl" drought would reduce harvests of corn and soy, the primary feedstock for livestock, as well as impacting wheat production. Should this cycle play out in this way, global food prices would increase substantially, and shortages could become chronic.

Could these two cycles build into a Great Wave that disrupts the status quo globally due to price inflation, scarcities and competition for scarce essential resources? To dismiss this out of hand is to ignore the history so meticulously documented by Fischer.