New high-frequency data on monthly store visits and consumer sentiment metrics reveal a slowdown in activity at retail giant Target. Interestingly, when the same data is applied across the broader retail industry, similar signs of softening are far less pronounced at other retailers, raising the question: Why is Target being hit harder?

One potential explanation lies in the political composition of Target's customer base. Data from the research firm Morning Consult showed a strong tilt toward Democratic-leaning consumers, a group currently exhibiting apocalyptic views on the economy via the highly skewed and laughable UMich survey.

5Y inflation expectations: Market vs Democrats pic.twitter.com/h3o9CDHIpQ

— zerohedge (@zerohedge) April 11, 2025

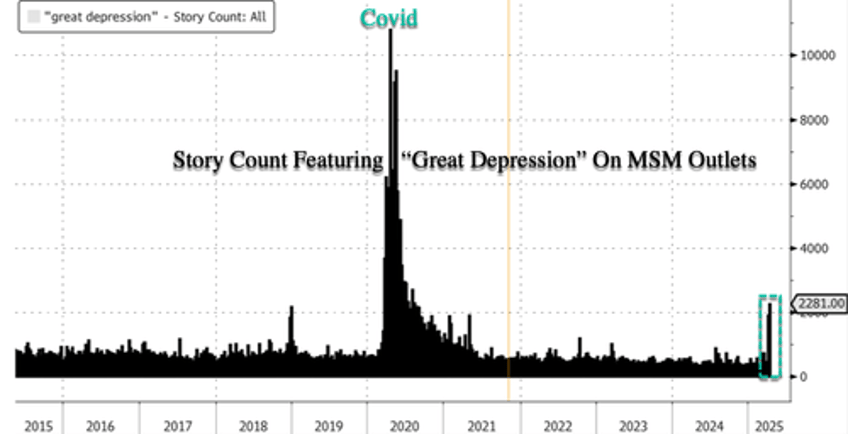

This wave of negative sentiment among Democratic-leaning consumers - driven in part by conspiracy-laden stories on platforms like BlueSky, MSNBC, CNN, and the unhinged show The View - could very well be influencing the spending habits of the rudderless party's consumer base.

Goldman analysts Kate McShane, Mark Jordan, and others published a new note on Wednesday, "downgrading TGT to Neutral from Buy given concerns around seeing a recovery in growth for discretionary categories, more downside risk in EPS than upside given possible top-line deleverage and tariff risk, and recent data from HundredX and Placer indicating that TGT's sales may be slowing."

We're taking high-frequency data from HundredX and Placer.ai a step further than the analysts, injecting Morning Consult's data to understand better who exactly shops at Target: "Walmart is more popular among Republicans, while more Democrats see Target in a favorable light."

McShane explained:

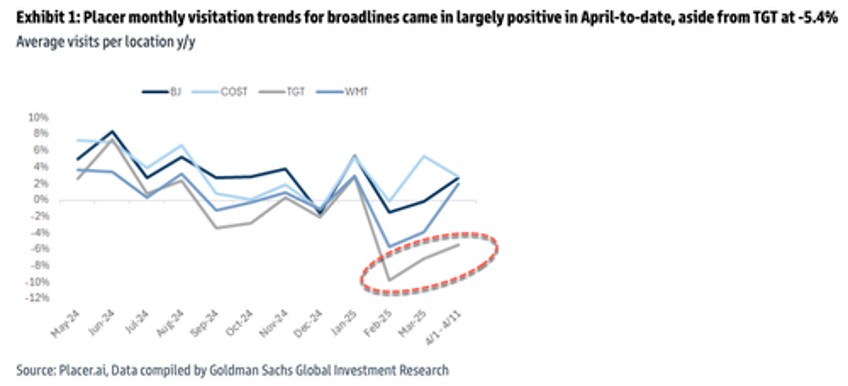

HundredX and Placer data indicate TGT's sales may be slowing. We analyzed monthly visitation data using Placer for the broadlines category, including TGT, through mid April. As shown in Exhibit 1, while average visits per location (y/y) were largely positive in Apr' 25-to-date, TGT came in at -5.4%. TGT's trends have lagged behind select peers (BJ, COST, and WMT) since Aug '24, with the gap widening sequentially in Apr' 25-to-date: Goldman

Exhibit 1: Placer monthly visitation trends for broadlines came in largely positive in April-to-date, aside from TGT at -5.4%

We must note that Goldman analysts did not blend politics into their report.

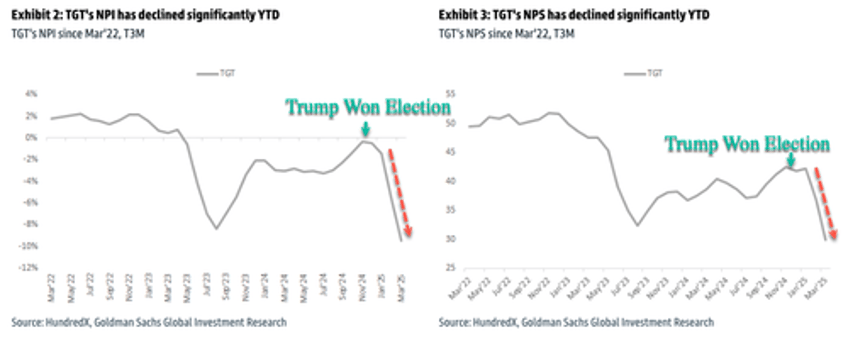

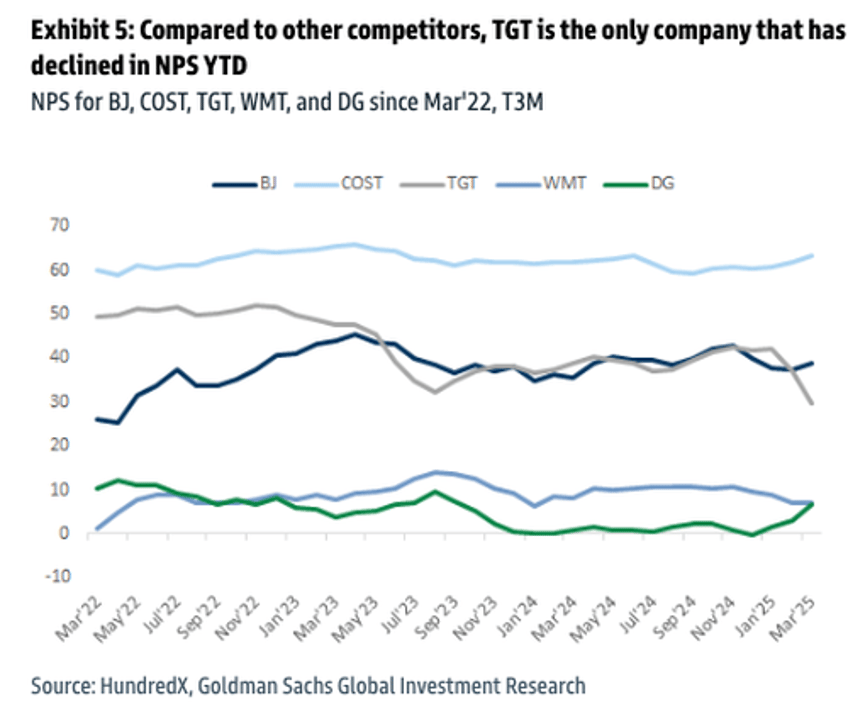

McShane then used NPI (Net Purchase Intent) and NPS (Net Purchase Score)—key consumer sentiment metrics - to find that both metrics declined significantly year over year.

"Specifically, as of Mar '25, TGT's NPI is -9%, lower than its 3-year average of -2% and Mar '24 NPI of -3%; TGT's NPS is 30, lower than its 3-year average of 43 and its Mar '24 NPS of 39," McShane said.

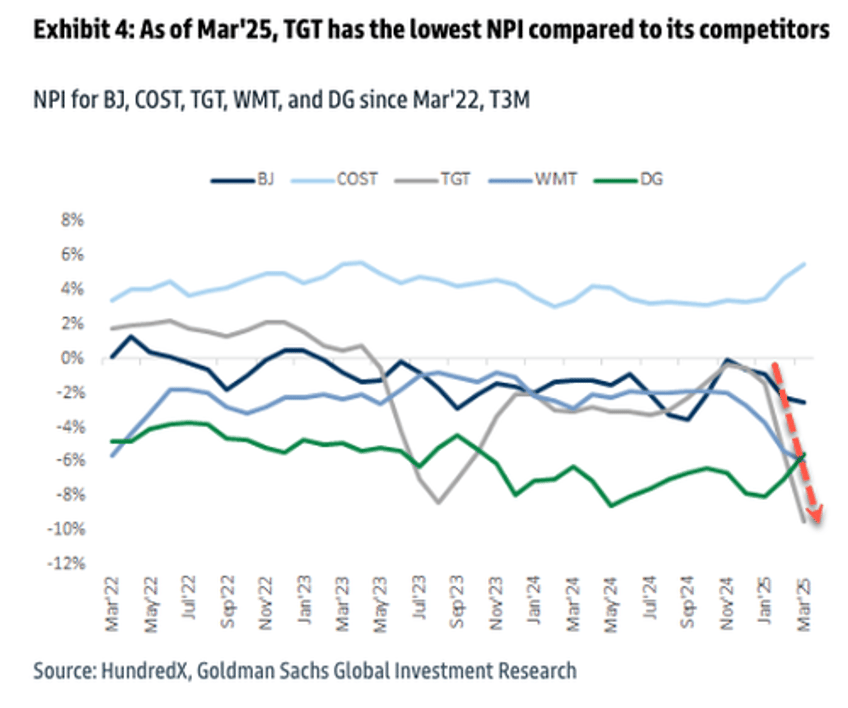

Notice HundredX's NPI measured across BJ, Costco, Target, Walmart, and Dollar General showed that consumer sentiment at Target was the worst of all retailers—and this might only make sense given that we established earlier that Democrats make up the majority of shoppers at the retailer.

Similar findings for NPS.

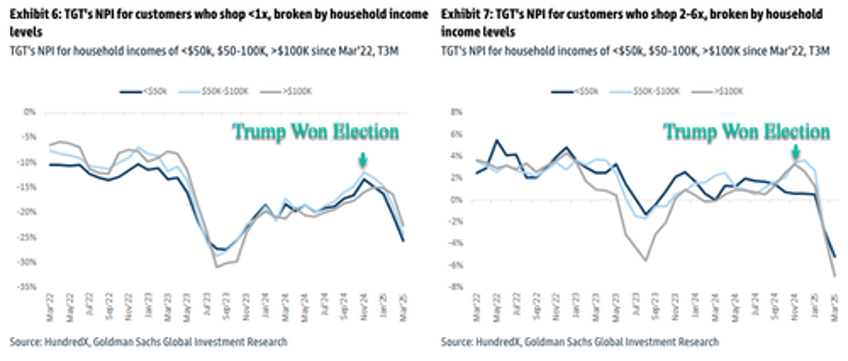

Target's NPI across three household income levels (<$50K, $50K-$100K, >$100K) aggressively tumbled, beginning with the election of Trump and into 2025.

Could the Democratic Party's infowar to sway their voter base about an imminent 'Great Depression' have an unintended consequence (dial back spending) of hitting retailers heavily frequented by Democrats?