Heading into today's 2pm Fed announcement, conventional wisdom is binary: if the Fed cuts 25bps, it will be ugly for risk assets (which have already priced in as much as 70% odds of a 50bps rate cut), and if the Fed cuts 50bps instead, it will be - for lack of a better word - good, and risk (i.e., stocks, bonds, gold, commodities, etc) will shoot higher.

But what is conventional wisdom, as so often happens, is dead wrong?

That is the argument of one of Goldman's top derivatives trades, Brian Garrett, who - in somewhat cautious response to an earlier take from Goldman's global head of trading Jeff Schiffrin (who said a 50bps cut is coming, disagreeing with Goldman's chief economist Jan Hatzius who still sees 25bps, and which is available here), laid out the following thoughts on how the market will react:

- They go 50, we knee-jerk rally 60-70 handles within striking distance to all time highs, and its then sold and finish flattish or down small on the day... street gets very long gamma on a rally (futures supply)

- They go 25, we sell off 70 handles which ultimately gets bought. i don’t necessarily see SPX outrealizing the 1 day straddle @ 1.1% despite the wide bid offer between 25 and 50

In other words, the kneejerk reaction will be the expected one... and will then be aggressively faded all day after the announcement.

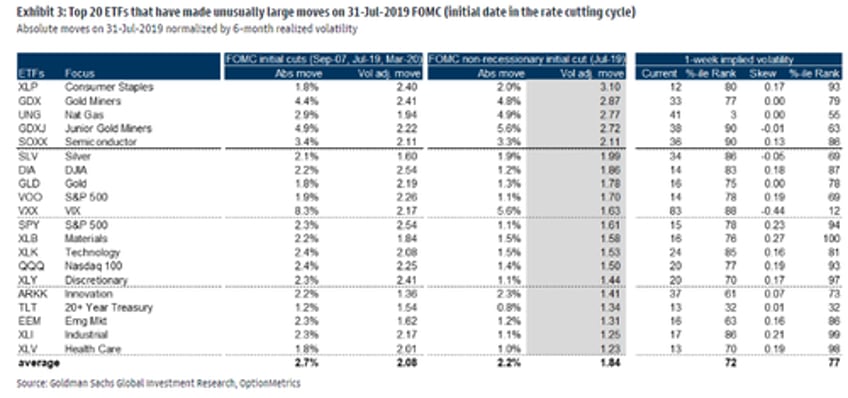

Garrett also shows the following table in response to client questions “how do ETFs / sectors trade on the DAY of the initial cut?”, urging to look at the moves in gold proxies for non-recessionary cut (GDX +4.8%, GDXJ +5.6%)...

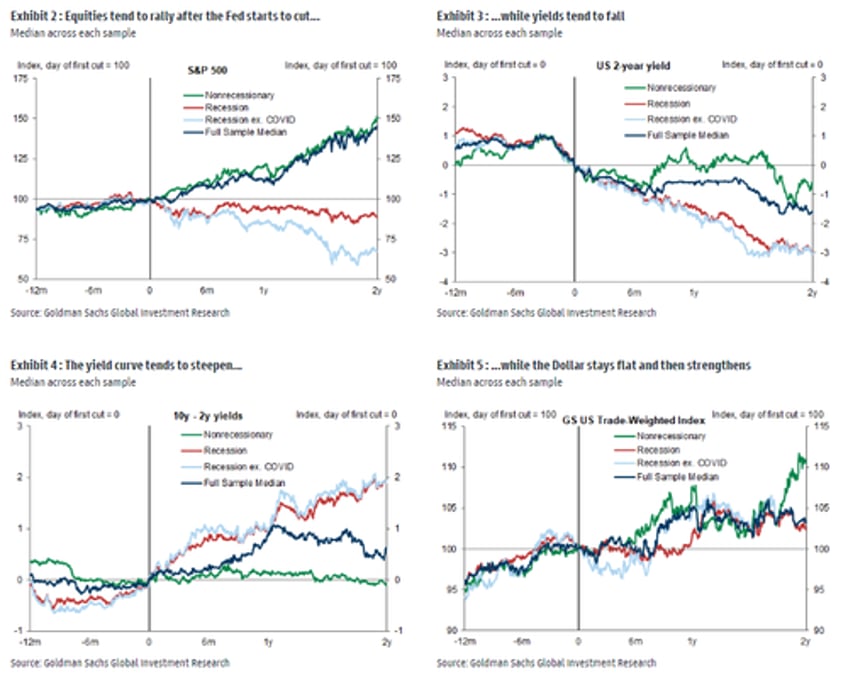

And here is “how equities and bonds trade post start of a cutting cycle?”: as we have noted previously, if “no recession” then stocks ramp and dollar strengthens. And, obviously, vice versa.

Former Lehman trader and current Bloomberg commentator Mark Cudmore agrees, and warns that traders should prepare for a counterintuitive response to the Fed actions today. His thoughts below:

If officials reduce interest rates by 50 basis points, it’s a strong reiteration of the committee’s very dovish reaction function, and where its priorities lie on its dual mandate of promoting both maximum employment and stable prices.

It will extend the economic cycle and send a message of complacency on inflation. US 10-year yields will climb in the subsequent months as a result, just like what happened in the wake of the Fed’s surprisingly dovish pivot in December 2023. The dollar will remain in a volatile downtrend overall, undermined by the Fed’s dovish reaction function, the hit to policy credibility and upcoming political noise, but intermittently supported by a steeper yield curve and bouts of risk-aversion

The stock rally will broaden out, with the rest of world outperforming US stocks. Obviously, an aggressive cut that is delivered as being proactive and pre-emptive is more bullish for stocks and bearish for bonds than one that is accompanied by a sense of panic or intensified concern.

Conversely, if the Fed reduces by 25 basis points, it will be a major risk-aversion event, as it would disappoint all major markets at once (stocks, bonds, credit, emerging markets) while upsetting the recent trend for dollar weakness. Volatility will surge, as a tightening shock is always more impactful than an easing surprise.

However, if the smaller-than-expected hike is accompanied by dovish forecasts and dot plot, then dollar strength won’t sustain for long, due to the hit to policy credibility. If the rate move is validated by optimistic forecasts and dot plot, then bonds suffer badly, the volatility impact sustains and dollar surges on combination of risk aversion and yield support. US stocks would suffer immensely in subsequent days/weeks but the longer-term bull market shouldn’t be derailed if the message is that the economic cycle isn’t over.

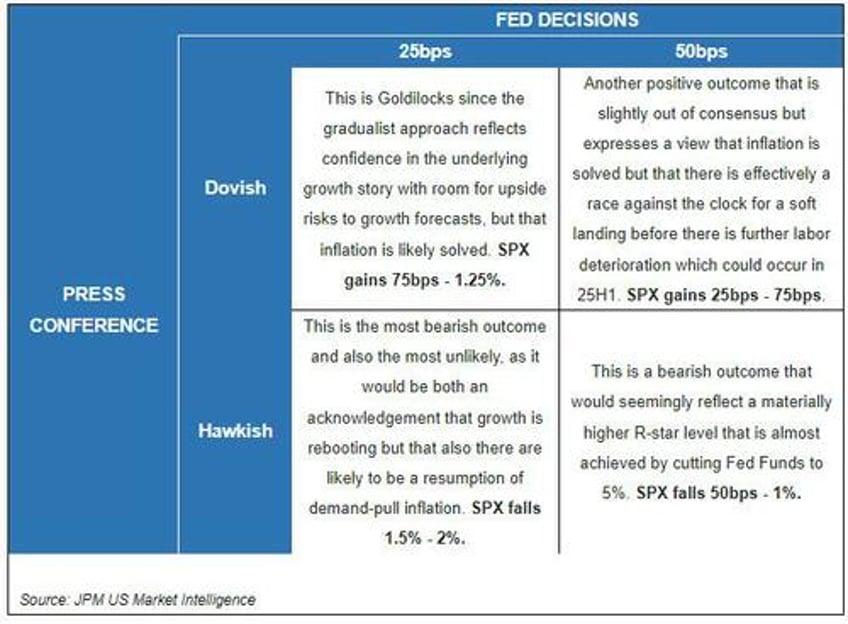

Cudmore is correct in that the Fed's dot plot may be just as important, if not more, than the actual cut, and as the following reaction matrix from JPMorgan shows, a 50bps rate cut in conjunction with a hawkish press conference, would be worse for stocks (S&P up 0.25% to 0.75%) than if the Fed cuts 25bps and Powell unleashes his inner dove at the presser (S&P +0.75% to 1.25%).

In other words, the 25bp cuts/dovish presser is the most favorable outcome for stocks, so if stocks dump in kneejerk reaction after the Fed cuts 25bps, buy the dip.

* * *

Lastly, Nomura's Charlie McElligott writes in a brief note today that despite still being “priced for 50bps” into today, hence risking a “de facto tightening” in FCI if they can’t match "the world likely doesn’t end if Powell goes “dovish 25bps,” as I’d expect any kneejerk dips in STIRS / UST Front-End and Equities to eventually be bot and a USD rally to be sold in-due-time, because the market will just ultimately slide cuts out to forward meetings with Powell’s notoriously “dovish” tilts in Pressers."

That said, in the very low probability scenario where the Fed only goes 25bps, and then Powell pairs it with a surprisingly optimistic US Economic forecasts as justification - hence leading to a market-disappointing Dots Plot vs current “dovish” path priced -McElligott would then "expect a larger market tantrum, as legacy “dovish” positioning get stopped-out, ESPECIALLY with their credibility really being battered after their seemingly incoherent messaging guidance these recent weeks"

That said, any “tantrum” response and stop-out flow here too would ultimately lead to an eventual reversal –dynamic thereafter, as the implied probability of the “Fed policy error” Left-Tail bucket is then certain to again surge, with the market taking another stab in anticipating that “delays” to a deeper cutting cycle NOW “out of the gates” will only then lead to deeper “corrective cuts” down the road

Finally, equities options dynamics remain the same as previously the Nomura strategist messaged: A lot of Positive Delta out there which could be de-risked (yet only seeing real “Negative Gamma” to the Downside through 5600 then 5550), but plenty of potential “zoom” from Customers reaching into “Stock Replace” Upside Calls in recent weeks, with “gravity” pulling us potentially upwards to the 5750 strike with all that Dealer Long Gamma there from the Customer sold Call.

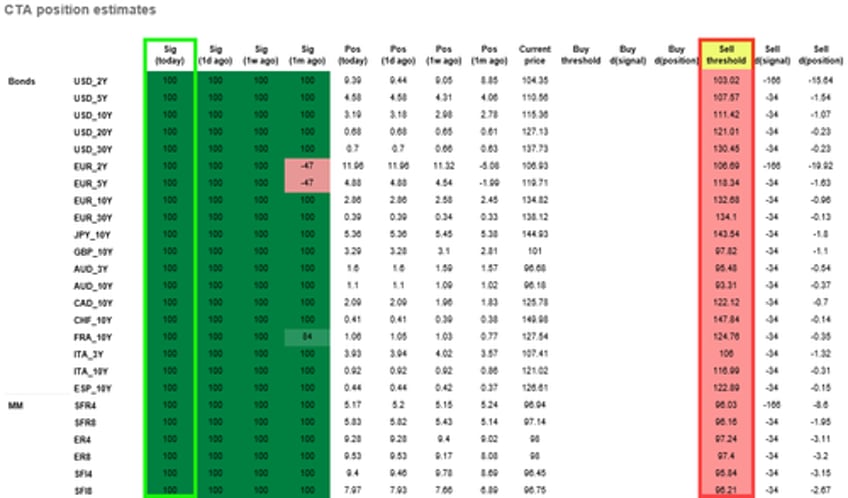

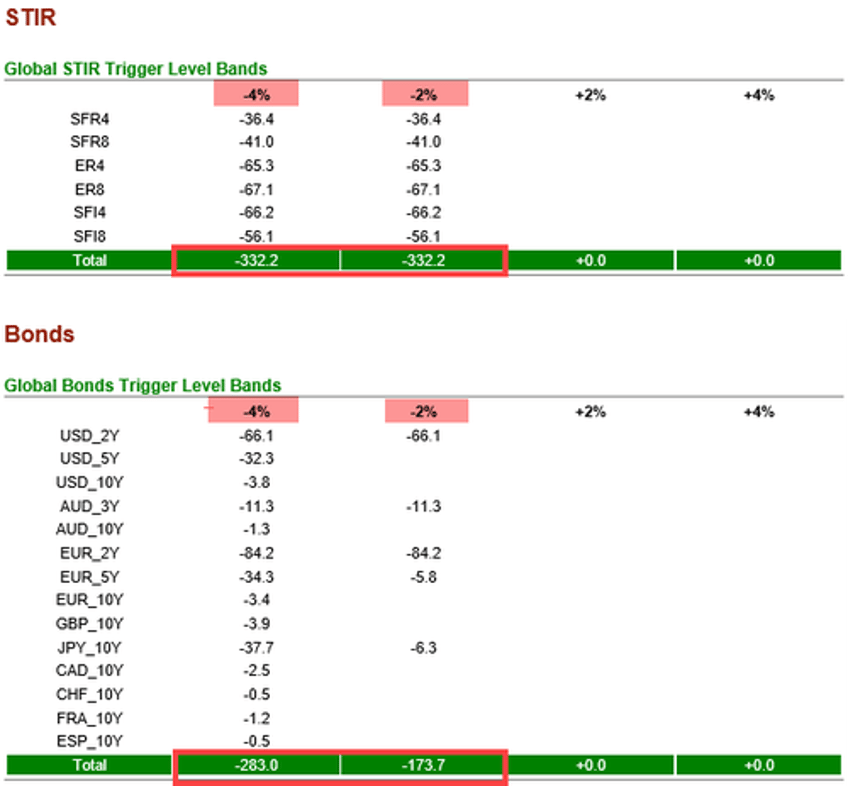

For Bonds / STIRS, a look at the CTA Trend positioning and triggers: