With 'hard' data collapsing in the last month, 'soft' survey data from ISM and S&P Global this morning was 'mixed' as usual:

S&P Global US Manufacturing PMI rose from 51.3 in May to 51.6 for the final June print (down very modestly from the 51.7 flash print).

ISM US Manufacturing PMI dropped from 48.7 to 48.5 in June (well below the 49.1 expected)

So WTF...

Source: Bloomberg

Need more confusion...

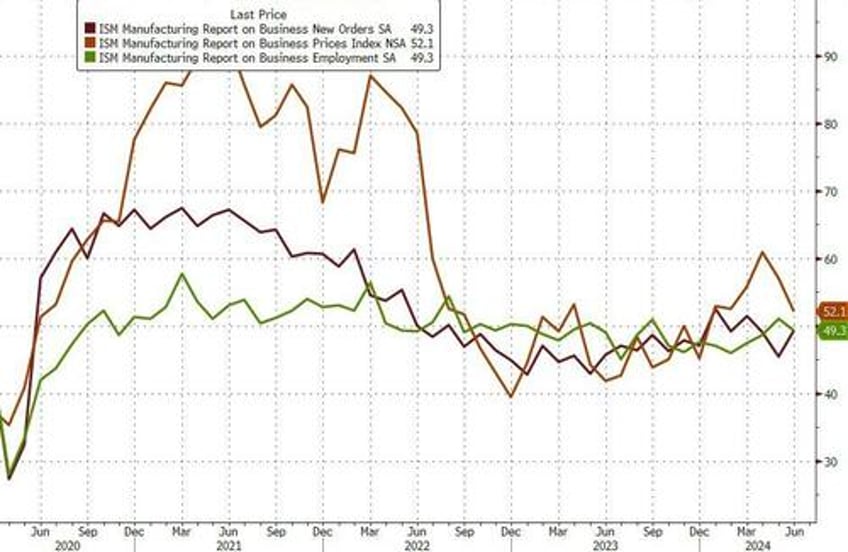

S&P Global noted that higher supplier charges were signaled in June. Alongside rising labor costs, this resulted in a further marked increase in input prices. But, ISM saw Prices Paid plunge from 57.0 to 52.1, well below the 55.8 expected...

Source: Bloomberg

New orders rebounded in June but employment dropped back into contraction. On the bright side, Orders/Inventories (typically a leading indicator), ticked up in June...

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“The S&P Global PMI survey shows US manufacturers struggling to achieve strong production growth in June, hamstrung by weak demand from domestic and export markets alike. Although the PMI has now been in positive territory in five of the first six months of 2024, up from just one positive month in 2023, growth momentum remains frustratingly weak.

“Factories have been hit over the past two years by demand switching post-pandemic from goods to services, while at the same time household and business spending power has been diminished by higher prices and concerns over higher-for-longer interest rates. These headwinds persisted into June, accompanied by heightened uncertainty about the economic outlook as the presidential election draws closer."

Finally, despite the uptick, Williamson admits the truth under the surface of the survey:

"Business confidence has consequently fallen to the lowest for 19 months, suggesting the manufacturing sector is bracing itself for further tough times in the coming months.”

However, we are sure business owners everywhere were reassured by the commander-in-chief's commanding performance in the debate last week.