The 'smart' money may not be...

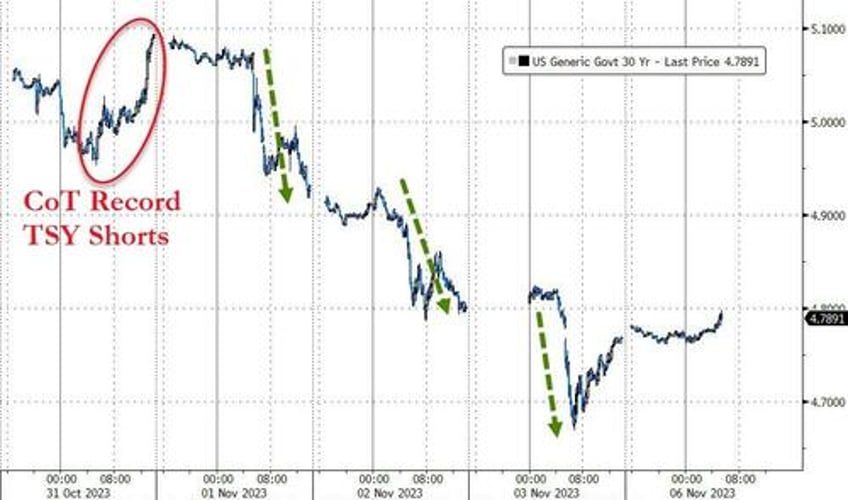

Just before US Treasury bonds saw their best week of 2023 (with the last 3 days seeing yields crash at the fastest pace since the COVID lockdowns of March 2020), hedge funds decided to add to their TSY Futures shorts (to a new record high).

Source: Bloomberg

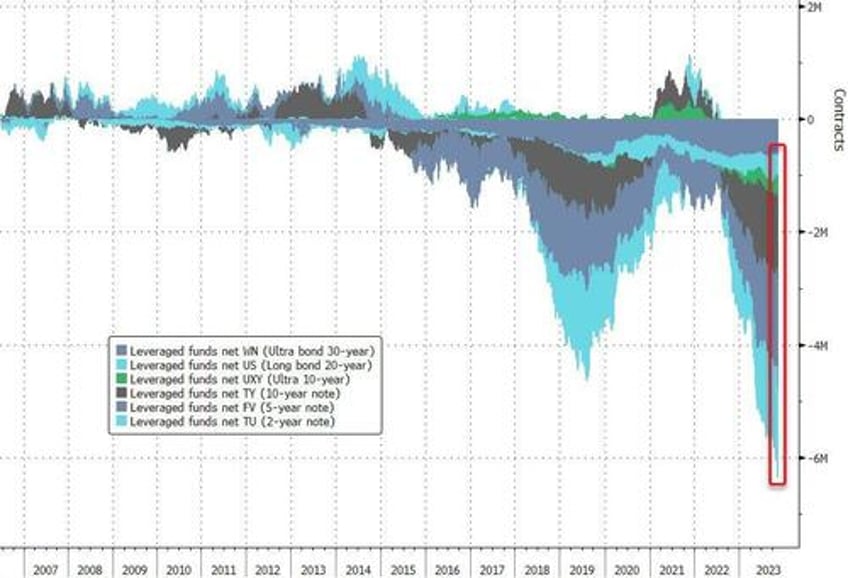

A trifecta of terrific news for treasuries - smaller-than-expected Treasury refunding, more dovish than expected Powell, weaker than expected jobs data - triggered three massive waves of buying in bond-land right as hedge funds ramped up their net short Treasury futures positions to the most in data going back to 2006, according to an aggregate of the latest CFTC as of Oct. 31.

Source: Bloomberg

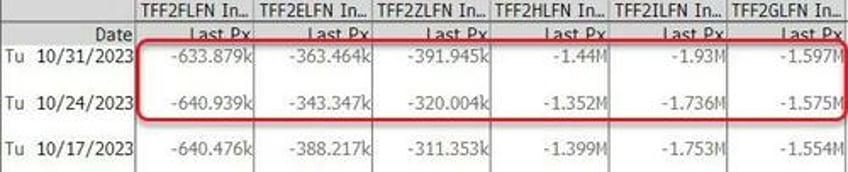

Under the hood, every Treasury future saw net short positioning increase...

Source: Bloomberg

Their timing could not have been any worse, and without doubt added to the velocity of the moves.

“It feels like short US Treasuries positioning was at an extreme last week, which was an accident waiting to happen,” said Gareth Berry, strategist at Macquarie Group Ltd. in Singapore.

“Price action in Treasuries for the past few months was a classic case of a persuasive story feeding the price action, until it went too far, leading to an overshoot which is now correcting.”

Bear in mind that a large number of those short-TSY Futs positions are tied to cash bonds via the 'basis trade' as we have discussed in great detail previously (here, here, and here). The scale of the moves last week in both cash and futures may have left some of those highly levered basis-traders with losses as the relative liquidity premia between the two markets gets exposed.

Source: Bloomberg

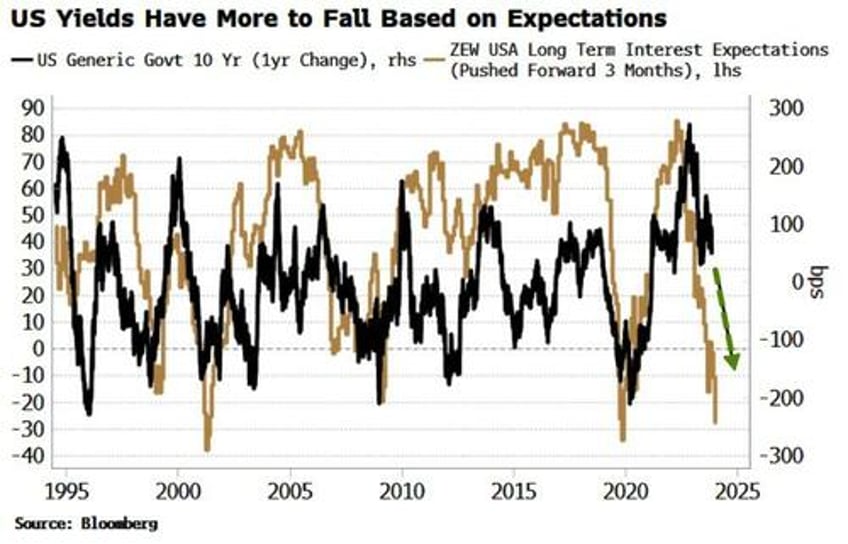

As the chart above shows, as hedgies extended their shorts, asset managers added to longs, as Bloomberg's Simon White reports that the ZEW Survey of US long-term long-term interest rate expectations anticipates more downside for yields.

Source: Bloomberg

Most surveys for asset prices aren’t too great, but ZEW’s one for US yields is better than most, leading the annual change in US 10y yields, especially at turning points.

One more thing of critical importance, after The Fed specifically highlighted the market's "tightening financial conditions" - doing it's job for it - last week saw almost one third of the tightening of the last three months removed as conditions eased...

Source: Bloomberg

This reflexive move - after Powell's comments - leads to the need for a more hawkish Fed to stabilize that over-easing of financial conditions which threatens to reignite asset inflation... and around we go.

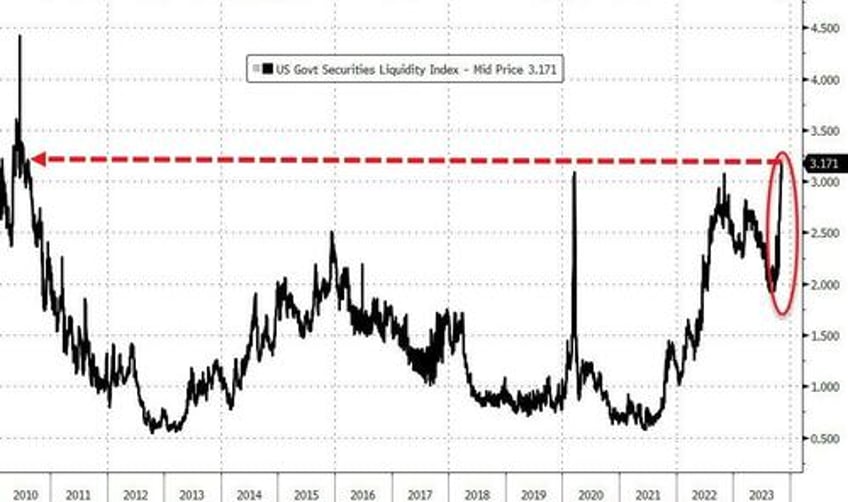

And finally, this is a major problem - and maybe the canary in the coalmine of problems with the highly-levered basis-trade discussed above.

US Treasury Liquidity is at its worst since 2010 (worse than at the peak of 2020's yield collapse when The Fed stepped in specifically to ensure liquidity)...

Source: Bloomberg

Will Powell be forced to react again?