Ahead of today's payrolls report consensus was already ugly enough, with some of the largest banks expecting a number well below expectations (JPM was at 125K, Citi at 130K, Goldman at 149K vs median consensus of 170K). And while moments ago we got a number which was at least nominally stronger than expected, the report in general was weak enough to suggest that - as we expected - the wheels are finally coming off the US labor market (as this week's JOLTS report strongly hinted).

With that preamble out of the way, moments ago Biden's BLS (Bureal Of Lies and Statistics) reported that in August, the US added 187K jobs, and beating the consensus estimate of 170K...

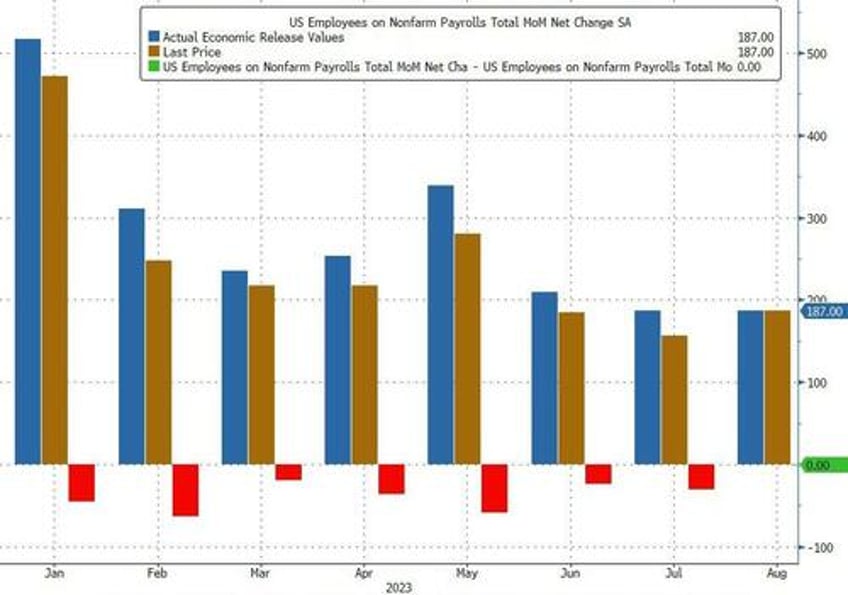

Superficially this would have meant an unchanged print from last month when the BLS also reported 187K jobs, however in keeping with recent trends that number was revised - drumroll - lower again, to 157K, meaning that every single monthly payrolls print in 20-23 has been revised lower (see chart below), a 12-sigma probability and virtually impossible unless there was political pressure to massage the data higher initially and then revise it lower when nobody is looking.

But wait there's more: while July was revised down by 30K from +187,000 to +157,000, June was revised even more, by 80,000, from +185,000 to +105,000, which means that a number that was originally reported as 209K has been reivsed 50% lower, to 105K and a collapse vs original expectations of 230K. Here, the BLS was proud to report that "with these revisions, employment in June and July combined is 110,000 lower than previously reported."

In other words, we now wait for the August payrolls number to be revised sharply lower as well because that's how Biden's handlers roll.

Turning to the unemployment rate, things here get really ugly: instead of the 3.5% expected print, in August the unemployment rate jumped to 3.8%, up sharply from 3.5% in July, and the result of 514K newly unemployed workers as the total civilian labor force increased by 736K individuals. The jump in the unemp rate means that the economy was only able to absorb a net 77K of them in August. At the same time, this surge in new workers also suppressed wage growth (as noted below).

Among the major worker groups, the unemployment rates for adult men (3.7 percent), Whites (3.4 percent), and Asians (3.1 percent) rose in August. The jobless rates for adult women (3.2 percent), teenagers (12.2 percent), Blacks (5.3 percent), and Hispanics (4.9 percent) showed little change over the month

The silver lining was that the participation rate actually rose from 62.6% to 62.8%, and gradually catching up to where it was before the pandemic.

Next, turning to wage growth, August payrolls rose 0.2% MoM, down from 0.4% last month and missing expectations of 0.3%. On an annual basis, the 4.3% print came in as expected, and down modestly from 4.4% last month.

Some more details: In August, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents, or 0.2 percent, to $33.82. Over the past 12 months, average hourly earnings have increased by 4.3 percent. In August, average hourly earnings of private-sector production and nonsupervisory employees rose by 6 cents, or 0.2 percent, to $29.00.

The average workweek for all employees on private nonfarm payrolls edged up by 0.1 hour to 34.4 hours in August. In manufacturing, the average workweek was 40.1 hours for the fifth month in a row, and overtime edged down by 0.1 hour to 3.0 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls edged up by 0.1 hour to 33.8 hours.

Of note, as the WSJ fed whisperer Nick Timiraos reminds us, "July had two more weekend days than June, which tends to bias upwards the monthly wage print. August went the other way (two fewer weekend days than July). It doesn't affect the YoY number, but it likely overstates July m/m wage gains and August wage softness." In other words, wage growth was even lower.

Looking at the goalseeked data in more detail we find the following sector breakdown:

- In August, health care added 71,000 jobs, following a gain of similar magnitude in the prior month. Over the month, job growth continued in ambulatory health care services (+40,000), nursing and residential care facilities (+17,000), and hospitals (+15,000).

- Employment in leisure and hospitality continued to trend up in August (+40,000). The industry had gained an average of 61,000 jobs per month over the prior 12 months.

- Employment in social assistance increased by 26,000 in August, in line with the prior 12-month average gain (+22,000). Over the month, job growth continued in individual and family services (+21,000).

- Construction employment continued to trend up in August (+22,000), in line with the average monthly gain over the prior 12 months (+17,000). Within the industry, employment continued to trend up over the month in specialty trade contractors (+11,000) and in heavy and civil engineering construction (+7,000).

- Transportation and warehousing lost 34,000 jobs in August. Employment in truck transportation fell sharply (-37,000), largely reflecting a business closure. Couriers and messengers lost 9,000 jobs, while air transportation added 3,000 jobs.

- Employment in professional and business services changed little in August (+19,000) and has shown essentially no net change since May. Professional, scientific, and technical services employment continued to trend up over the month (+21,000).

- Information employment changed little in August (-15,000). Within the industry, employment in motion picture and sound recording industries decreased by 17,000, reflecting strike activity. Job losses continued in telecommunications (-4,000).

- Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; manufacturing; wholesale trade; retail trade; financial activities; other services; and government.

Developing.