Vehicle sales started to slow at the end of last year as "sticker shock" has been taking its toll on would-be U.S. consumers, according to Bloomberg.

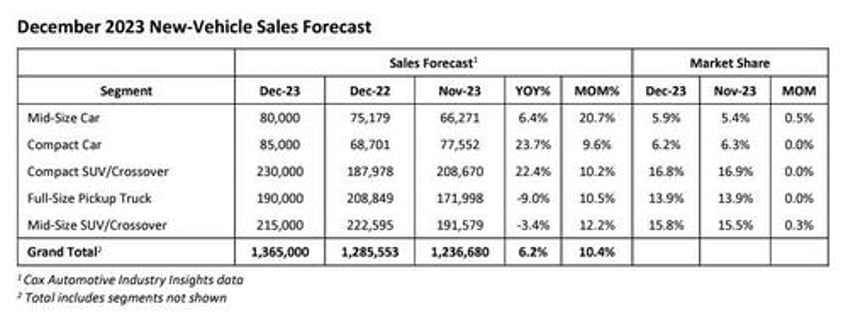

Potential buyers are now "balking" at the idea of 10% interest rates on car loans, the report says. The average price of a vehicle now sits at about $48,000 and sales fell to an SAAR of 15.4 million vehicles for the last month of 2023, the report says.

This number is down from 15.5 million the previous two quarters.

Jonathan Smoke, chief economist for researcher Cox Automotive told Bloomberg: “We’ve seen a big reduction in median- and lower-income households” buying new cars, which now “almost exclusively go to the top 20% of income households.”

He continued: “The new norm for the industry because of reduced affordability is closer to 16 million. We’ve lost about 10% of the buying pool.”

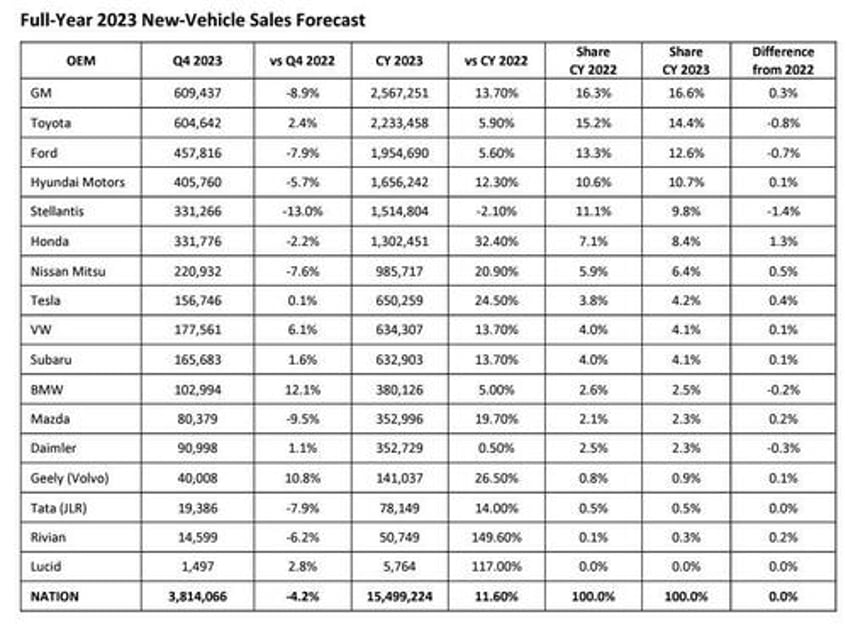

The tough end to 2023 is expected to continue into 2024, the report says. Cox predicts that auto sales would be up less than 2% in the forthcoming year, meaning that the U.S. won't top its 17 million sales figure, which it posted 5 years prior to the pandemic, anytime soon.

And the report notes that automakers aren't in a rush to cut prices because they are happy moving less metal at higher margins:

Consumer spending on new vehicles reached a record $578 billion in 2023, its third consecutive year exceeding a half-trillion dollars, according to researcher J.D. Power. Consumers’ average monthly car payment in December was estimated to be $739, up $9 from a year earlier, J.D. Power said.

Smoke added: “Unless the industry finds a way to get back to more-affordable price points, we will see products that cater to higher income, higher credit-quality consumers. And that ultimately limits sales volumes.”

You can read Cox's full December 2023 press release and sales forecast here.