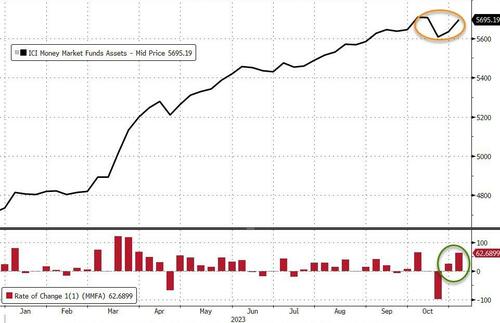

US money-market funds saw inflows for the second week in a row, jumping $62.7BN back near record highs around $5.7TN...

Source: Bloomberg

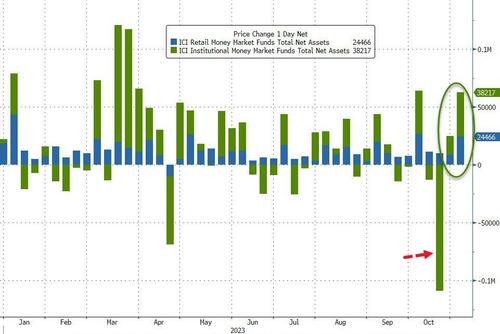

Institutional funds saw the more dramatic inflows ($38.2BN) but retail funds saw an impressive $24.5BN inflow also (still no retail fund outflows since April)...

Source: Bloomberg

But bank deposits remain completely decoupled from money market fund assets still...

Source: Bloomberg

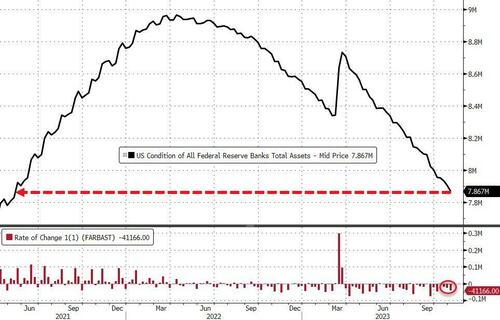

The Fed balance sheet continues to contract, dropping $41.2BN last week...

Source: Bloomberg

QT saw a big jump with securities-held dropping $39.6BN, the most since mid-August...

Source: Bloomberg

And once again, usage of The Fed's emergency funding facility for the banks increased to a new record high above $109BN...

Source: Bloomberg

US equity market capitalization has tumbled back to its senses and recoupled with the level of bank reserves at The Fed - restoring, for now, a multi-year relationship...

Source: Bloomberg

Finally, we note that Bill Gross apparently 'called the bottom' in regional banks today. Their share prices all jumped assuredly. We just remind those buyers that bond yields have exploded higher since SVB...

Source: Bloomberg

...and they are still borrowing over $109BN from The Fed at an expensive rate to fill the holes in their balance sheets. Does that sound like the bottom is in?