Money-market funds saw massive inflows in the week-ending Jan 3rd, jumping $79BN to a new record high just below $6TN...

Source: Bloomberg

Both institutional and retail funds saw large inflows (+$40.7BN and +$38.9BN respectively) for the biggest combined inflow since the SVB crisis...

Source: Bloomberg

In a breakdown for the week to Jan. 3, government funds - which invest primarily in securities like Treasury bills, repurchase agreements and agency debt - saw assets rise to $4.878 trillion, a $64.7 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets rise to $961.7 billion, a $10.3 billion increase.

Interestingly, bank deposits are rising rapidly at the same time as money-market inflows are soaring...

Source: Bloomberg

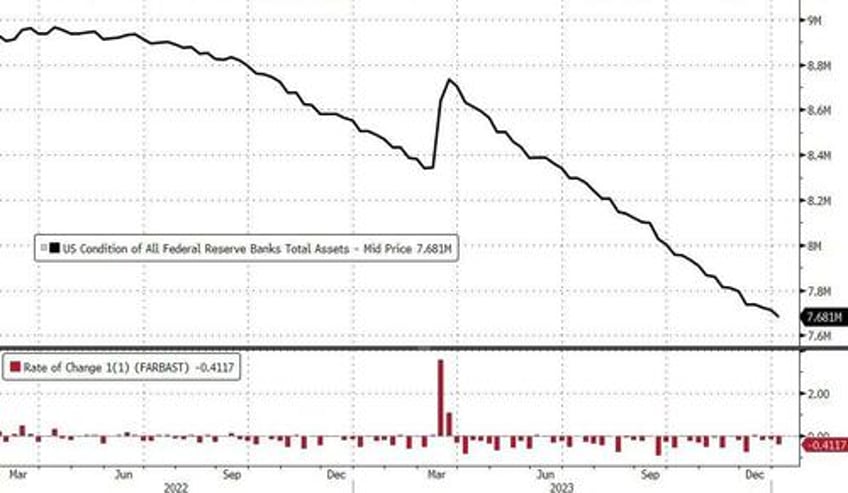

The Fed's balance sheet shrank by around $32BN last week to its smallest since March 2021 (down almost $1.3TN from its highs)...

Source: Bloomberg

US equity market cap has rolled over in the last few days but remains notably decoupled from the sliding bank reserves at The Fed (but we note that the RRP drawdowns have resumed since the new year, subsidizing any liquidity needs for now)...

Source: Bloomberg

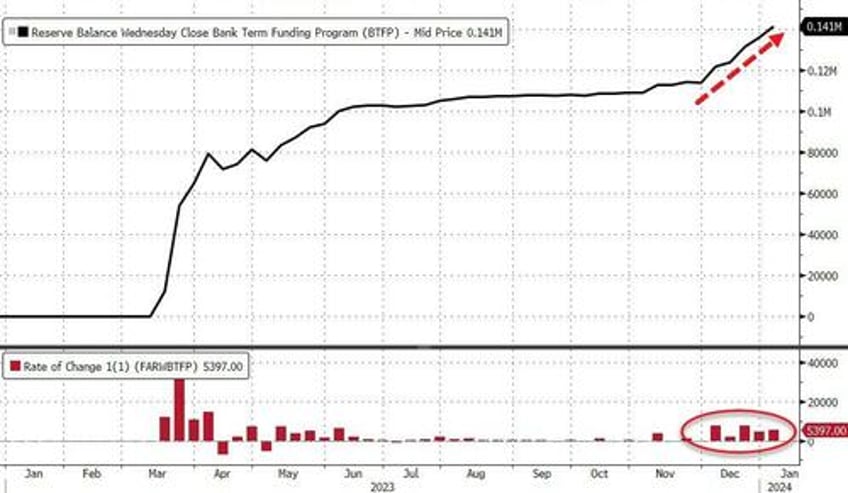

Usage of The Fed's BTFP bank bailout facility surged by over $5BN to a new record high of $141BN...

Source: Bloomberg

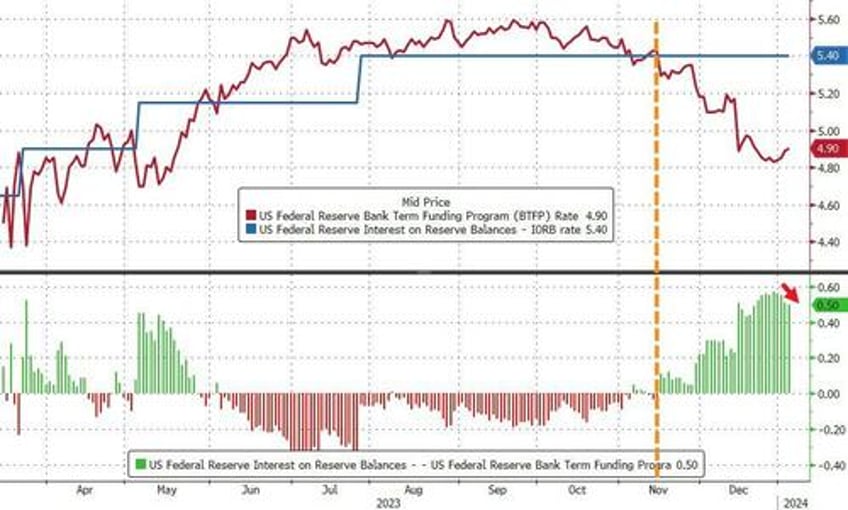

The BTFP-Fed Arb continues to offer 'free-money' (and usage of the BTFP has risen by $32BN since the arb existed), but the spread has narrowed a smidge from a peak near 60bps to 50bps today...

Source: Bloomberg

Which will make it hard for The Fed to defend leaving the facility open after March when its "temporary" nature is supposed to expire.

“In justifying the generous terms of the original program, the Fed cited the ‘unusual and exigent’ market conditions facing the banking industry following last spring’s deposit runs,” Wrightson ICAP economist Lou Crandall wrote in a note to clients.

“It would be difficult to defend a renewal in today’s more normal environment.”

Which makes us wonder, just WTF will the regional banks do to cover the $140BN-plus hole in their balance sheets that they are currently filling...

Source: Bloomberg

And what exactly does that mean for regional bank stocks which appear to exist in a world of their own for now.