The Bank of Japan’s incessantly loose monetary policy is stoking underlying imbalances in global markets that are poised to lead to a sudden and rapid increase in asset volatility. The yen is likely to rally hard, US versus Japanese short-term yield spreads tighten, and domestic equities rise.

The BOJ never misses an opportunity to miss an opportunity. Once again, the bank chose not to exit its ultra-loose policy stance and allow the huge market imbalances building up to ease. Instead, we got a technocratic tweak to yield curve control (YCC) and no increase in the only negative policy rate left in the world.

But the superficial stability in Japanese yields is stoking enormous instability in markets around the world.

The longer this persists, the greater the ultimate reckoning. The asset moves are likely to be considerable when the BOJ finally tightens. In this column, I’ll focus on where we could see some of the most asymmetric reactions:

a yen rally likely to exceed expectations in its speed and extent as lapsed FX-hedging ratios are re-established, and some foreign capital is repatriated

rises in US and other DM longer-term yields

a rapid increase in short-term rate expectations in Japan versus the US

Japanese equities to rise

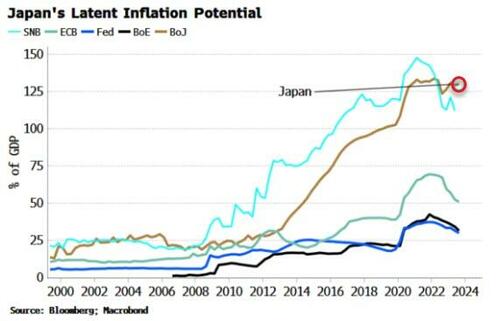

The BOJ cannot fight against the global tightening tide indefinitely. Financial instability risks are rising, both abroad and at home. Most overtly, we can see that in the size of the BOJ’s balance sheet - at almost $6.5 trillion, it is the largest in the world in GDP terms, and substantially higher than the Fed’s or the ECB’s.

Furthermore, the BOJ owns more than half of JGBs outstanding, increasingly blurring the lines between fiscal and monetary policy, and adding to financial instability risks.

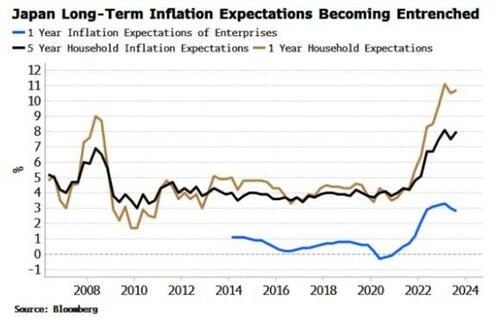

Core inflation is running at a 30-year high and is looking sticky despite headline CPI beginning to roll over.

Moreover, household inflation expectations are showing signs of becoming embedded after turning back up after a brief drop, and remain at their series highs.

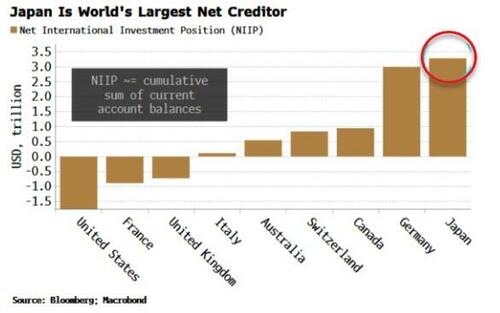

What makes all of this so important for the rest of the world is Japan’s huge net creditor position. Decades of current account surpluses have accumulated to create the world’s largest NIIP (net international investment position): $3.3 trillion of investments held abroad. When it comes to assets, Japan sneezing means the rest of the world catches a cold.

That sneeze will come when the BOJ begins to significantly tighten policy, with the yen the main adjustment mechanism. USDJPY has been pulled higher by the attraction of carry trades backstopped by the BOJ. The currency pair sailed through 150 this week when the central bank left its policy stance largely unchanged.

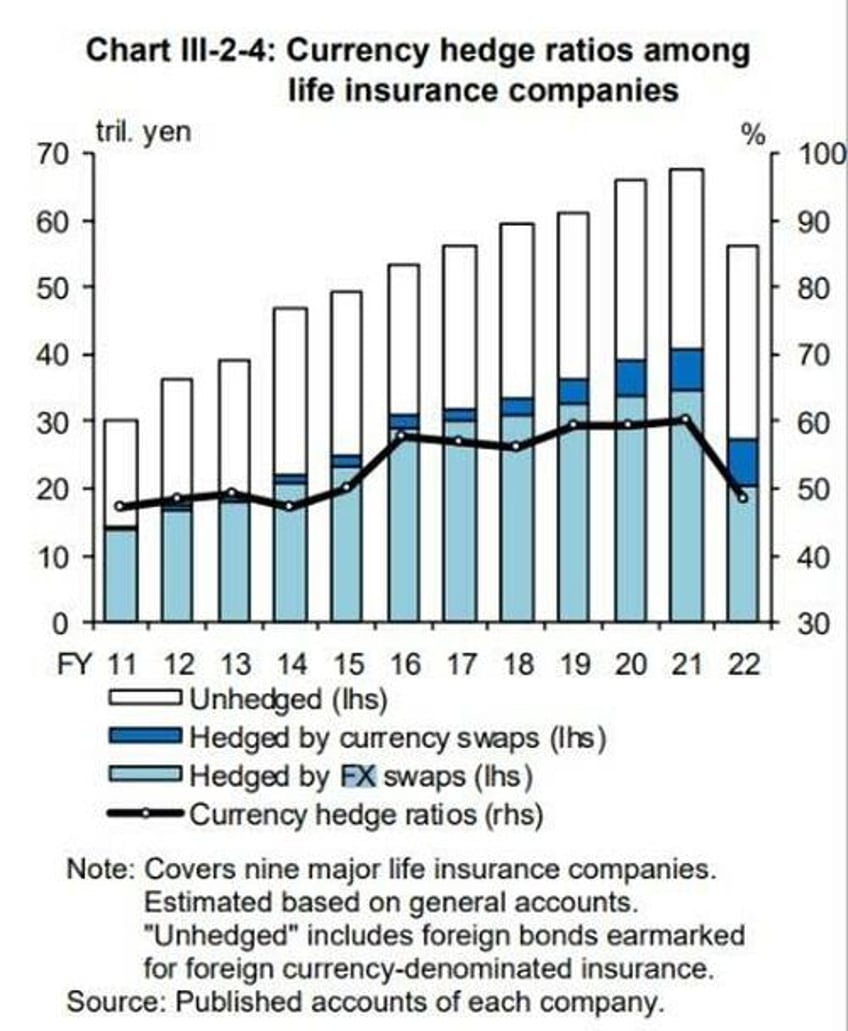

But when the BOJ tightens, the capital flows will reverse and the yen will rally – with force and speed likely to catch most unawares. The main driver will be FX hedge ratios. These have been allowed to fall or lapse altogether by Japanese investors as the yen has weakened.

The chart below from last month’s BOJ Financial System Report (FSR) shows that in 2022 there was a big drop in the currency-hedge ratios of life insurance companies, one the largest hedged buyers of foreign assets, and representative of other hedged investors. We have no data for 2023, but given the continued weakening in the yen it’s likely currency-hedge ratios are even lower for investors across the board.

Source: Bank of Japan, Financial System Report

When the yen starts rising - and it’s clear that the BOJ is meaning to tighten policy significantly - the rally will feed on itself as a rising yen will make it even more essential to reset hedging ratios by buying yen.

The yen is likely to rally hard against the dollar, and the Swiss franc. A one-touch USDJPY option with a 130 strike expiring end of 1Q24 pays out over 25-1.

If inflation has become an entrenched problem in Japan, the yen will eventually succumb to it, but in the first instance capital repatriation and currency hedging are primed to drive it considerably higher.

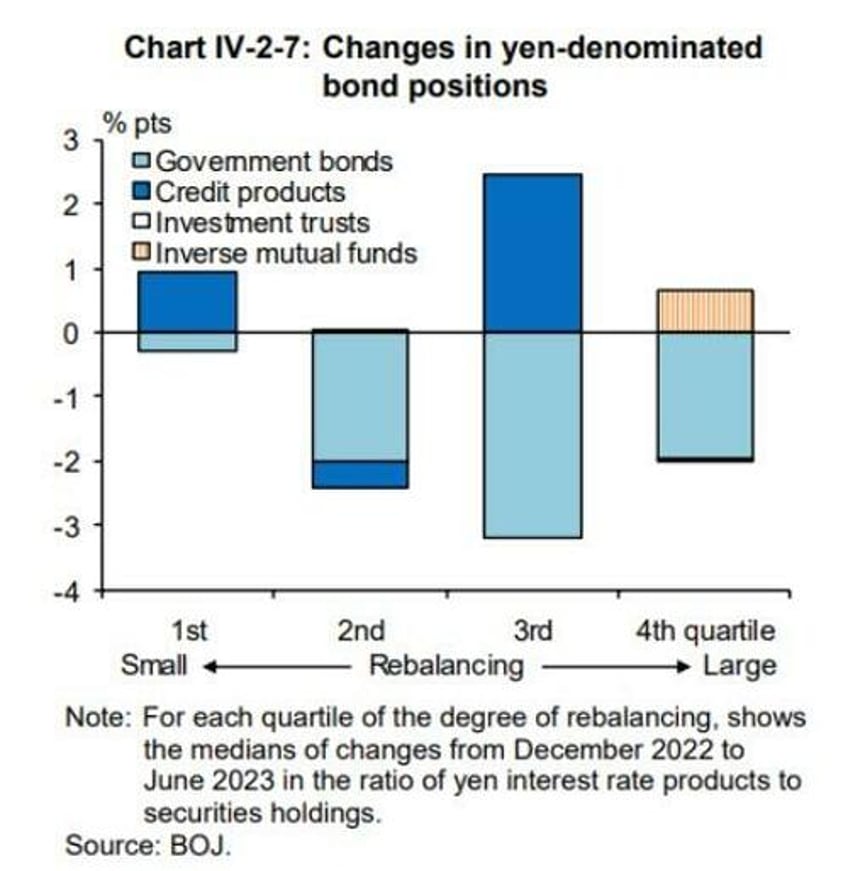

A dropping of the yield-curve control policy would also lead to a rise in Japan’s bond yields. The capped 10-year rate has risen rapidly to near to the 1% yield now seen as the “reference point” for the BOJ. The FSR shows that pension firms and banks have reduced their holdings of yen-denominated bonds leaving them underweight (light blue bars in chart below show changes in domestic government bond holdings of Japanese banks).

Source: Bank of Japan, Financial System Report

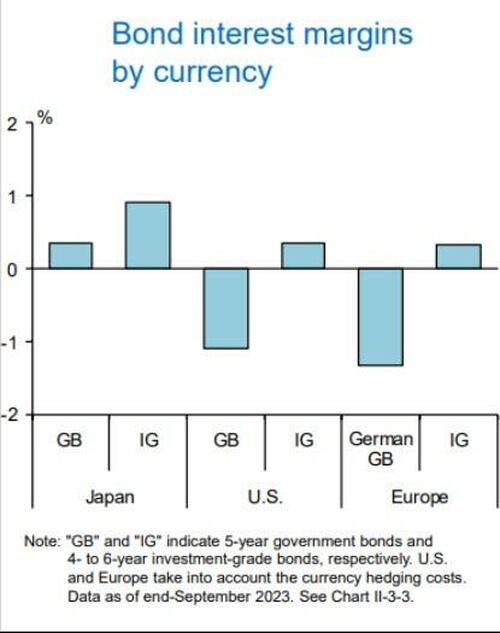

Higher yields at home are likely to trigger the unwind of some underwater foreign sovereign-bond positions, due to rising global yields and spiralling hedging costs in USD, EUR, AUD, etc. That capital inflow will further fuel the rally in the yen, and trigger more currency hedging. (Selling of foreign positions may entail some yen-negative currency-hedge unwinds, but the net impact should still be yen positive as, as is likely, positions have become underhedged.)

Source: Bank of Japan, Financial System Report

Japan holds over $1.1 trillion of Treasuries, as well as US corporate debt, and non-trivial amounts of European, UK and Australian government and corporate debt, which means the impact of its capital decisions will pressure global yields higher at the margin.

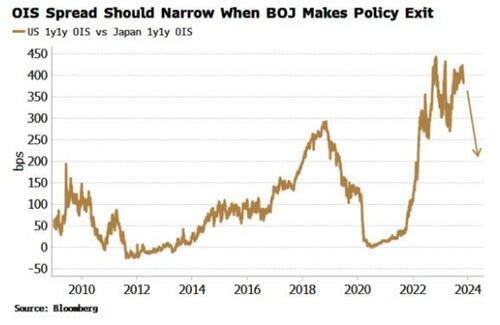

It’s harder to say what will happen to yield spreads, e.g. the 10y US versus Japan spread, as capital repatriation should limit the rise in JGB yields. However, at the shorter end spreads should narrow, perhaps substantially.

The chart below shows the spread between the 1y1y OIS for US versus Japan. As Japan exits its negative-rate policy, the market should price a much higher BOJ policy rate, especially as inflation remains elevated, while in the US the market will increasingly look to price rate cuts, leading to a narrowing of the spread. (Currency hedging unnecessary if one believes the yen will keep rallying.)

A BOJ policy exit is also poised to benefit domestic stocks. If the equity market begins to think that Japan has an inflation problem, and the BOJ is belatedly trying to deal with it, then equities are likely to be seen as a more attractive destination for repatriated funds. More so as the household sector and most of corporate Japan is underweight domestic equities relative to history.

On top of that, foreign holders of Japanese equities, who are the single-biggest holders at ~30% of the total, might see them as even more attractive if they can juice their returns with a rallying yen.

The trillion dollar question is: when will the BOJ exit its policy? The market expects the first 25 bps policy-rate rise by July, but given the mounting imbalances and financial instability, it could come sooner than that. Either way, the longer the bank waits, the more likely it is the market will make the decision on its behalf.