Was that it for the Atlanta Fed recession (which as we described, managed to fool everyone into believing the US economy is crashing because of... surging gold imports)?

Two months after the December Beige Book (published in January) reported that in the last month of Biden's presidency, "economic activity increased slightly to moderately across the twelve Federal Reserve Districts in late November and December", moments ago - and with everyone expecting fire and brimstone and perhaps a confirmation that the US is now neck deep in a recession if not depression (at least based on how the 10Y and USD are trading) - the latest Fed Beige Book found that in February, or one month into Trump's 3rd 2nd presidency, economic activity actually "rose slightly since mid-January."

Reading the latest Fed report we find that six districts reported no change, four reported modest or moderate growth, and two noted slight contractions.

Here are the specific details:

- Consumer spending was lower on balance, with reports of solid demand for essential goods mixed with increased price sensitivity for discretionary items, particularly among lower-income shoppers.

- Unusual weather conditions in some regions over recent weeks weakened demand for leisure and hospitality services.

- Vehicle sales were modestly lower on balance.

- Manufacturing activity exhibited slight to modest increases across a majority of Districts.

- Contacts in manufacturing, ranging from petrochemical products to office equipment, expressed concerns over the potential impact of looming trade policy changes.

- Banking activity was slightly higher on balance among Districts that reported on it.

- Residential real estate markets were mixed, and reports pointed to ongoing inventory constraints.

- Construction activity declined modestly for both residential and nonresidential units.

- Some contacts in the sector also expressed nervousness around the impact of potential tariffs on the price of lumber and other materials.

- Agricultural conditions deteriorated some among reporting Districts.

Yet despite this mixed picture, overall expectations for economic activity over the coming months were slightly optimistic.

Taking a closer at the labor market, the Beige Book found that employment nudged slightly higher on balance, with four Districts reporting a slight increase, seven reporting no change, and one reporting a slight decline.

- Multiple Districts cited job growth in health care and finance, while employment declines were reported in manufacturing and information technology.

- Labor availability improved for many sectors and Districts, though there were occasional reports of a tight labor market in targeted sectors or occupations.

- Contacts in multiple Districts said rising uncertainty over immigration and other matters was influencing current and future labor demand.

- Wages grew at a modest-to-moderate pace, which was slightly slower than the previous report, with several Districts noting that wage pressures were easing.

Turning to inflation, not surprisingly (to anyone who shops) prices increased moderately in most Districts, but several Districts reported an uptick in the pace of increase relative to the previous reporting period.

- Input price pressures were generally greater than sales price pressures, particularly in manufacturing and construction.

- Many Districts noted that higher prices for eggs and other food ingredients were impacting food processors and restaurants.

- Reports of substantial increases in insurance and freight transportation costs were also widespread. Firms in multiple Districts noted difficulty passing input costs on to customers.

- However, contacts in most Districts expected potential tariffs on inputs would lead them to raise prices, with isolated reports of firms raising prices preemptively.

Here is a snapshot of highlights by Fed District:

- Boston: Economic activity increased slowly, boosted by a surge in home sales. Prices increased modestly on average, but contacts perceived that upward pressure on prices could emerge in response to tariffs. Employment declined slightly, and wages increased modestly. Expectations were mostly optimistic but marked by growing uncertainty.

- New York: Regional economic activity was little changed in early 2025. Employment grew slightly and wage growth was moderate, with labor supply and labor demand coming back into balance. Selling price increases picked up to a moderate pace after some slowing last period. Many businesses noted heightened economic uncertainty and expressed concern about tariffs.

- Philadelphia: Business activity declined slightly during the current Beige Book period after a slight increase last period. Employment continued to grow slightly; wages and prices grew modestly. Contacts noted that changes in fiscal and trade policies pose a risk of higher inflation. Generally, sentiment fell, but firms remain optimistic about future growth amid economic uncertainty.

- Cleveland: District business activity was flat in recent weeks, although contacts expected activity to increase in the months ahead. Consumer spending was down, and some contacts noted declining consumer confidence. Employment levels remained flat. Contact reports suggest that nonlabor input costs edged up, while reported price increases continued to be modest.

- Richmond: The regional economy grew modestly in recent weeks. Consumer spending increased modestly, down from the moderate rate previously reported. Nonfinancial services firms also reported modest growth while manufacturing activity was unchanged. Price growth remained moderate, but firms across sectors expressed concerns about overall uncertainty in the economy and about tariffs potentially leading to future price increases.

- Atlanta: The economy of the Sixth District expanded at a modest pace. Employment was steady. Wages, input costs, and prices increased modestly. Retail sales fell slightly. Travel and tourism were steady. Home sales declined somewhat. Transportation activity grew modestly. Loan growth was moderate. Manufacturing expanded slightly. Energy demand increased modestly.

- Chicago: Economic activity was little changed. Employment was up slightly; consumer and business spending were flat; nonbusiness contacts saw little change in activity; and construction and real estate and manufacturing activity decreased slightly. Prices increased modestly; wages rose moderately; and financial conditions were unchanged. Farm income in 2025 was expected to be similar to 2024.

- St. Louis: Economic activity and employment have been flat. Prices continued to increase moderately but were above expectations. Contacts noted that they were holding off investment due to policy uncertainty and indicated that tariffs would result in higher prices. The outlook has declined from slightly optimistic in our previous report to neutral.

- Minneapolis: Economic activity was steady. Employment grew but labor demand and hiring softened. Wage and price increases were moderate. Consumer spending was flat with improvements in travel and tourism. Manufacturing experienced modest improvements. Construction of nonresidential units slowed but accelerated modestly for residential units. Commercial real estate was mostly unchanged, and home sales improved. Agricultural conditions were flat.

- Kansas City: Economic activity was unchanged on balance, but consumer spending decreased moderately. Prices rose at a moderate pace. While higher prices deterred spending, business contacts indicated they were more likely to scale back rather than take a hit on margins by softening pricing. Employment levels remained steady, though contacts noted a rise in labor force churn.

- Dallas: The Eleventh District economy continued to expand moderately. Nonfinancial services activity grew while retail sales were flat, and manufacturing activity was rather volatile. Lending picked up notably and commercial real estate activity improved, though housing demand was tepid. Employment held steady, and little change was seen in wage and price growth. Contacts noted sharply higher uncertainty around the outlook.

- San Francisco: Economic activity ticked down. Employment levels were stable. Price levels and wages grew slightly. Retail sales fell modestly and demand for services weakened a bit. Manufacturing activity improved somewhat, while conditions in agriculture and residential real estate softened. Commercial real estate and lending activity were steady.

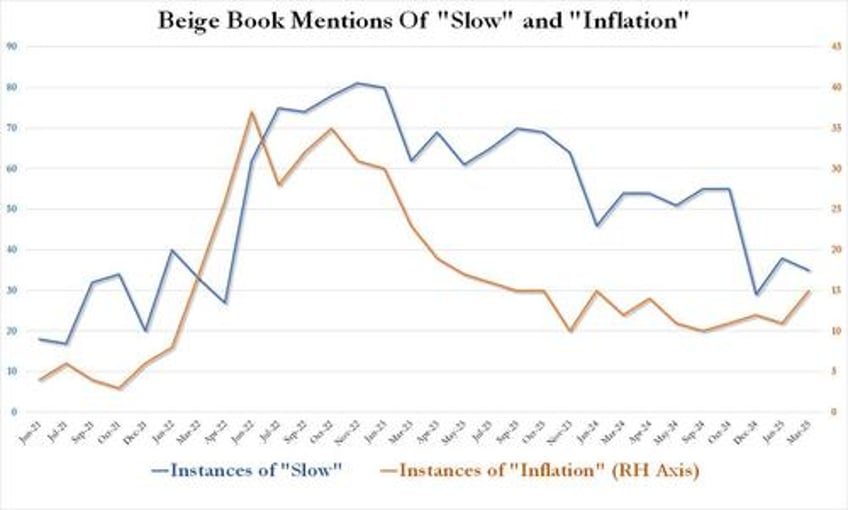

Confirming that contraray to conventional wisdom the economic picture improved notably since January, the latest February Beige Book saw just 2 mentions of recessions, down sharply from 6 two months prior. But more notably, while mentions of "slow" extended their decline to 35 from 38, mentions of inflation rose to a two year high of 15, up from 11 last month...

... suggesting that the US economy - while hardly on fire as it was during the hyperinflationary period of Biden's admin - continues to chug along and is hardly collapsing as so many Trump foes would like to see.

Source: Federal Reserve