The Fed's latest beige book released this afternoon was a rather boring affair, one signaling "little to no change in economic activity" since the September report.

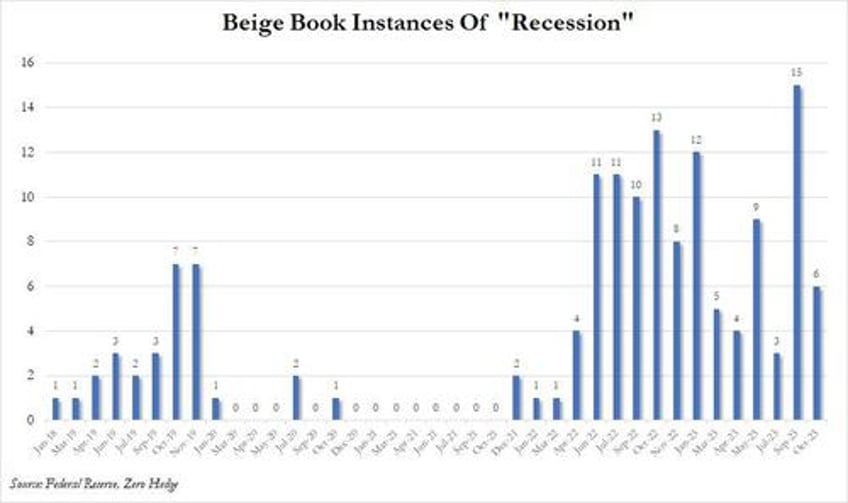

That said, one month after a rather downbeat Beige Book warned that consumers had "exhausted" their savings and recession mentions surged to a 5 year high, a more jovial tone has returned with the Beige Book indicating that while consumer spending was "mixed, especially among general retailers and auto dealers, due to differences in prices and product offerings", tourism activity "continued to improve, although some Districts reported slight slowing in consumer travel, and a few Districts noted an uptick in business travel."

At the same time, Banking contacts reported "slight to modest declines in loan demand" even though consumer credit quality was "generally described as stable or healthy, with delinquency rates still historically low but slightly increasing." Real estate conditions were little changed - meaning they remained catastrophic - and the inventory of homes for sale remained low. The report found a silver lining in manufacturing activity, which it deemed mixed, although "contacts across multiple Districts noted an improving outlook for the sector."

Turning to the bigger picture, the Beige Book concludes that "the near-term outlook for the economy was generally described as stable or having slightly weaker growth" and expectations of firms for which the holiday shopping season is an important driver of sales were mixed, suggesting continued confusion about the real state of the consumer.

Here are some more details from the Beige Book starting with labor market where "tightness continued to ease across the nation."

- Most Districts reported slight to moderate increases in overall employment, and firms were hiring less urgently.

- Several Districts reported improvements in hiring and retention as candidate pools have expanded and those receiving offers have been less inclined to negotiate terms of employment.

- However, most Districts still reported ongoing challenges in recruiting and hiring skilled tradespeople.

- A few highlighted that older workers are remaining in the labor force, either staying in their existing position or returning in a part-time capacity.

- Wage growth remained modest to moderate in most Districts.

- Contacts across many Districts reported less pushback from candidates on wage offers.

- There were multiple reports of firms modifying their compensation packages to mitigate higher labor costs, including allowing remote work in lieu of higher wages, reducing sign-on bonuses or other wage enhancements, shifting compensation to more performance-based models, and passing on a greater share of healthcare and other benefits costs to employees.

Prices

- Prices continued to increase at a modest pace overall.

- Districts noted that input cost increases have slowed or stabilized for manufacturers but continue to rise for services sector firms.

- Increases in fuel costs, wages, and insurance contributed to growth in prices across Districts.

- Sales prices increased at a slower rate than input prices, as businesses struggled to pass along cost pressures because consumers had grown more sensitive to prices. As a result, firms struggled to maintain desired profit margins.

- Overall, firms expect prices to increase the next few quarters, but at a slower rate than the previous few quarters.

- Several Districts reported decreases in the number of firms expecting significant price increases moving forward.

Turning to the specific regional Feds, we found these summaries notable:

- Boston: Both business activity and employment expanded only slightly, and price increases were modest. The rainy summer yielded mixed results on Cape Cod. Tourism contacts in Boston expect strong demand in 2024, while real estate contacts remained rather pessimistic. Hiring plans were relatively subdued, and so were planned price increases.

- New York: Regional economic activity weakened modestly, though labor market conditions remained solid. Consumer spending increased at a slightly slower pace, with declines in spending on experiences offset by increases in spending on goods. Financial conditions weakened somewhat. Inflationary pressures moderated slightly.

- Philadelphia: Business activity continued to decline slightly during the current Beige Book period. Consumer spending declined overall, as did manufacturing and nonmanufacturing activity. Employment again rose slightly as labor availability improved further. Wage growth and inflation slowly subsided but continued at a modest pace. Expectations for economic growth remained subdued.

- Cleveland: Economic activity in the Fourth District was little changed in recent weeks. Manufacturers noted an uptick in activity but expressed concerns over potential adverse impacts of the UAW strike. Hiring activity was flat, and firms more frequently reported holding wages steady following sizeable increases over the past few years. Input costs stabilized for many manufacturers, while service providers reported rising vendor costs.

- Richmond: The regional economy contracted slightly this period. Consumer spending grew slightly but reports varied across spending categories. Manufacturers noted a decrease in demand. Transportation volumes remained steady. Residential real estate was constrained by limited inventory. Commercial real estate activity and lending declined. Employment increased moderately and price growth was unchanged in recent weeks.

- Atlanta: Economic activity grew slowly. Labor markets improved, and wage pressures eased. Some nonlabor costs stabilized. Retail sales slowed. New auto sales were strong. Domestic leisure travel declined, while international and business travel rose. Housing demand fell. Transportation activity decelerated. Energy demand was flat. Agriculture conditions were mixed.

- Chicago: Economic activity was up modestly. Employment increased moderately; consumer and business spending were up slightly; nonbusiness contacts saw little change in activity; and manufacturing, construction, and real estate activity decreased modestly. Prices and wages rose moderately, while financial conditions tightened slightly. Expectations for farm incomes in 2023 were little changed.

- St. Louis: Economic conditions have remained unchanged since our previous report. Labor markets remained tight, and employers reported that where applications had increased there were frequent difficulties finding the skills desired. Prices increased modestly due to higher input costs, though the rate of increases slowed. Businesses reported softer consumer demand and difficulty passing on input costs.

- Minneapolis: Regional economic activity increased slightly. Employment grew modestly and labor demand softened. Wage pressures were stable as job seekers pursued higherpaying jobs. Price pressures eased modestly. Consumer spending was modestly higher and auto sales rose moderately. Most contacts said that higher long-term interest rates had weakened their economic outlooks for next year.

- Kansas City: Economic conditions softened slightly across the Tenth District in recent weeks, driven by lower energy, agriculture, and commercial real estate activity. Several bankers characterized their appetite for lending as being on a “loan diet.” Employment levels were stable, but wage growth slowed, particularly among entry-level jobs. Prices continued to grow at a moderate pace generally, but growth in housing rental rates slowed substantially.

- Dallas: Modest economic expansion continued, with growth moderating in the service sector but rebounding in manufacturing and energy. Retail and financial services activity declined. Employment growth was modest, and wage growth continued to normalize. Outlooks generally weakened slightly, with contacts expressing concern over worsening business conditions, high interest rates and the political environment.

- San Francisco: Economic activity was stable on net. Labor market tightness eased, and both wage and price pressures moderated. Retail sales were robust, and manufacturing activity remained largely unchanged. Activity in the services and real estate sectors eased. Financial sector conditions moderated further over the reporting period. Local communities faced continued challenges with affordable housing.

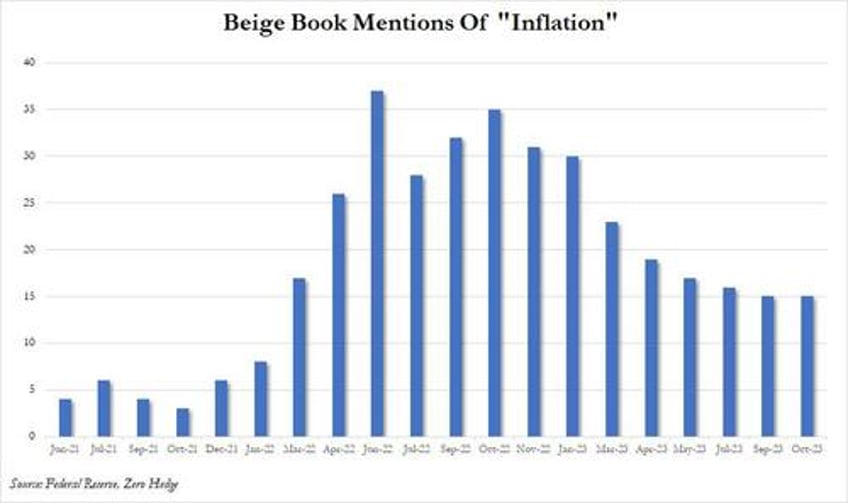

Finally, taking a visual approach to the data, we find that the mentions of inflation were the fewest since Jan 2022...

... although the chart above correlates perfectly, if with a 3 month lag, to the price of oil. So expect a jump in inflation mentions next month when the Beige Book participants realize that crude is just shy of 2023 highs and the middle-east is blowing up.

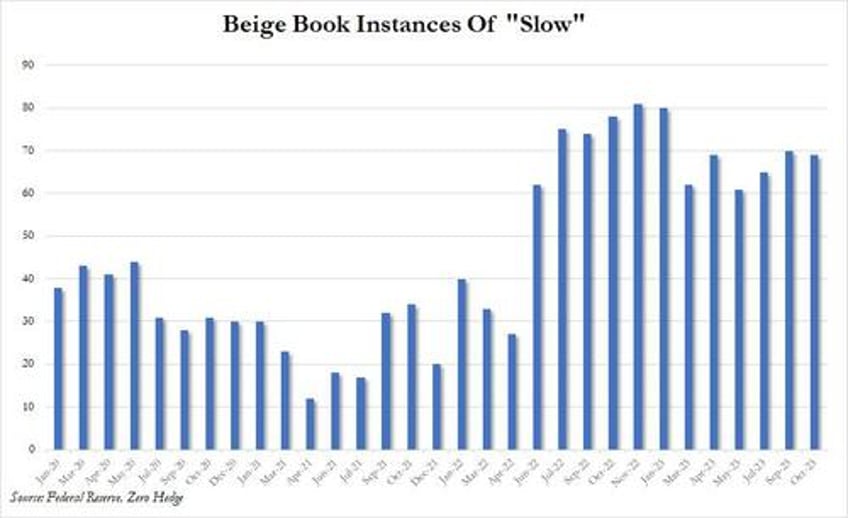

And while mentions of "slow" persisted at a far higher rate...

... what we found most interesting is that one month after mentions of recession jumped to the highest level since at least 2018, in October recession mentions tumbled by more than half, sliding to just 6, or smack on the average line for the past years.

More in the full Beige Book (link).