China has appointed capital markets veteran Wu Qing to head the nation's securities regulator just one day after the country's sovereign wealth fund said it would ramp up buying shares in the open market amid a three-year rout that has wiped out a staggering $7 trillion in value off stock markets in Hong Kong and China.

Qing, who served as the head of the Shanghai Stock Exchange from 2016 to 2017, has been named the new chairman and party secretary of the China Securities Regulatory Commission (CSRC), taking over from Yi Huiman, who held the post since 2019, according to South China Morning Post, citing state media Xinhua on Wednesday.

SCMP pointed out Qing was the deputy party chief of the financial center of Shanghai. He once oversaw the 2015 meltdown in China's capital markets.

The appointment comes after regulators planned to brief President Xi Jinping on the financial market as soon as Tuesday. There was news that sovereign fund Central Huijin (translation: the plunge protectors) vowed to purchase more ETFs. And CSRC vowed to 'guide' (translation: coerce) institutional investors and funds to increase their A-share holdings.

The jawboning by Chinese officials is temporarily working, with the CSI 300 surging 6.5% so far this week.

For context, that lifts the broad index to one-week highs...

However, the broad index is at 2016 and 2019 lows.

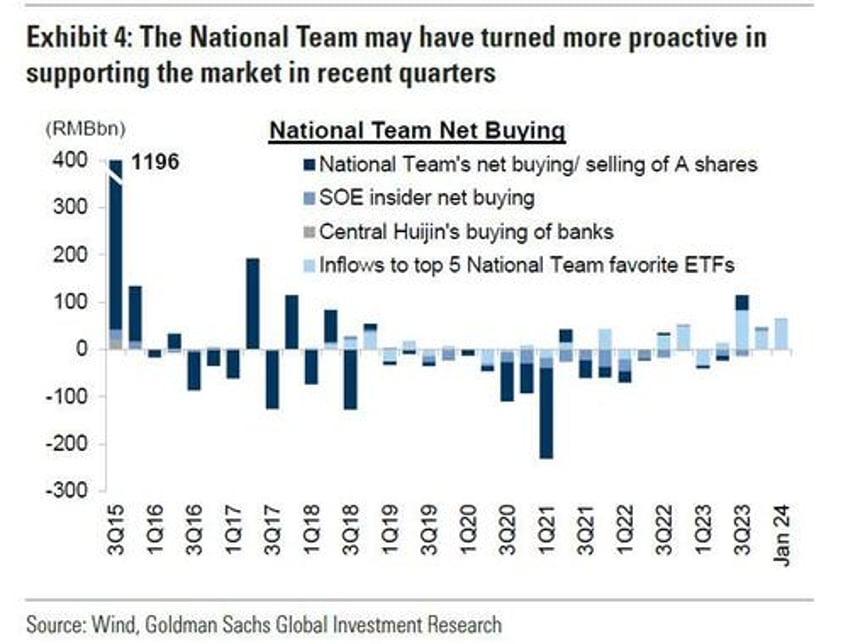

Goldman's China strategist Kinger Lau told clients this week that the country's plunge protection team has bought approximately 70 billion yuan ($9.7 billion) of onshore Chinese shares in the past month (full note available here).

According to Fu Weigang, executive director at the Shanghai Institute of Finance and Law, Beijing's latest measures have been "mood-boosting" and said these actions usually happen in a downturn.

Wu is immediately tasked with rebuilding trust among the country's 220 million investors, the largest group of its kind globally, and international investors, following a three-year downturn.

Did investors short China and go long India?

Meanwhile...

When does Beijing unleash another stimulus bazooka?