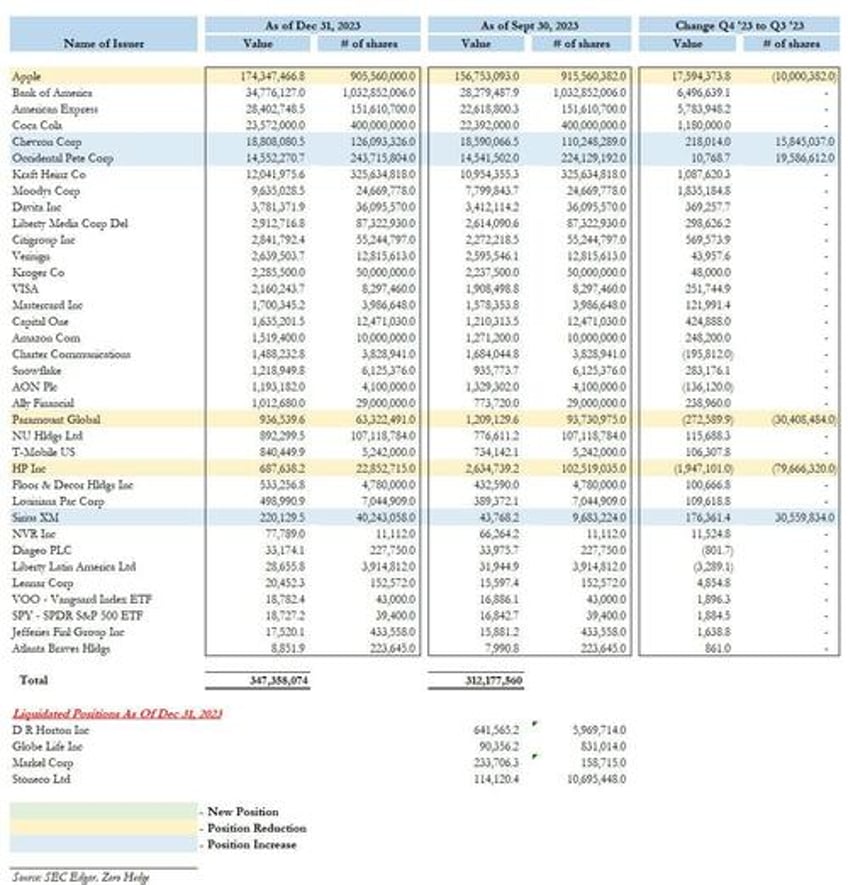

In what was a rather uneventful quarter for Warren Buffett's Berkshire Hathaway, the massive hedge fund made only a few modest changes to its portfolio in Q4 2023, which as of Dec 31, 2023 was valued as $347.4 billion (at least the long book, short positions don't have to be disclosed).

Among the notable changes, Berkshire sold out of its entire stake in homebuilder DR Horton (valued at $641MM in Q3), Markel ($234MM), StoneCo ($114MM) and Globe Life ($90MM).

The fund also reduced its holdings in its top position Apple, by 10 million shares, cutting the total stake from 915.6MM to 905.6MM shares, although since the value of the underlying shares actually rose from $157 billion to $174 billion, the reduction was probably due to size limitations.

Berkshire also trimmed its holdings of Paramount Global by 30 million shares, or 32.4%, from 93.7 million to 63.3 million shares (which sent the stock down 6% after hours), and slashed its stake in HP Inc by 77.7% (or 80 million shares), from 102.5 million to 22.9 million shares.

Finally, while Berkshire did not reveal any new positions, it added to its holdings in energy giants Chevron - an increase of 14.4% to 126 million shares - and Occidental, which rose by 8.7% to 243.7 million shares. The fund also added 30.6 million shares to its existing small stake in Sirius XM, bringing it to a total of 40.2 million shares, or $220 million as of Dec 31.

The full Q4 breakdown is shown below.

Source: SEC 13F.