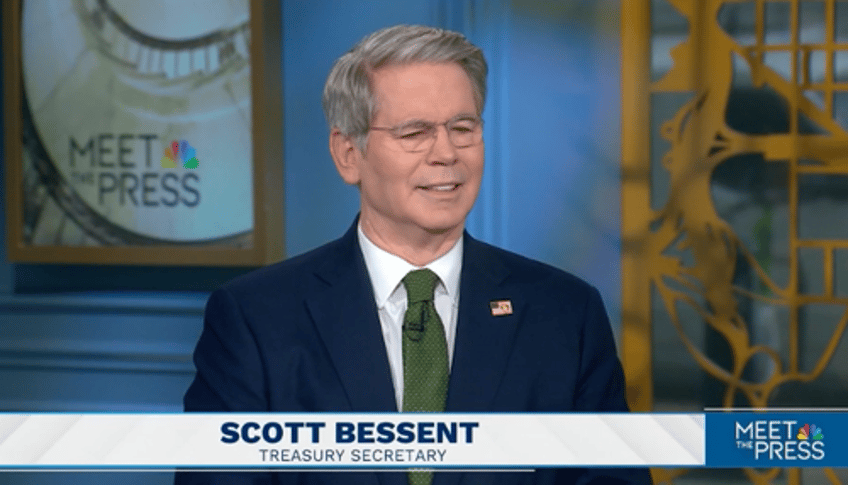

President Trump's "Liberation Day" tariff blitz and the resulting escalation in the trade war with China and other top trading partners fueled a downgrade in growth expectations that dominated the rates market last week. Goldman analysts now expect three interest rate cuts from the Federal Reserve this year—in July, September, and October—and have raised their 12-month U.S. recession probability to 35%, up from 20%. While a pivot toward tariff de-escalation remains plausible in the near term, market turmoil and potential trade disruptions amid the grand global economic reordering won't push the U.S. into a recession, Treasury Secretary Scott Bessent said Sunday.

NBC's Meet the Press with Kristen Welker told Bessent the stock market just experienced the biggest two-day crash since early Covid, asking: "How long will Americans hang tough" with current market gyrations?

"I see no reason that we have to price in a recession," Bessent responded to Welker.

We should also note that in a recent interview with Tucker Carlson, Bessent pointed out: "The distribution of equities across households—the top 10% of Americans own 88% of equities, 88% of the stock market."

So when Welker asked Bessent about Americans weathering the stock market turmoil, the question really applies only to a small segment of the population—those who have seen massive gains over the past couple of decades—while much of the Heartland, as some have noted, has been stuck in a recession and never fully recovered since the early 2000s.

Bessent told Welker, "What we're looking at is building the long economic fundamentals for prosperity, and I think the previous administration put us on a course for financial calamity."

"Again, this is an adjustment process - we saw with President Regan when he brought down the great inflation and brought down President Carter's malaise. There was some choppiness at that time, but he held the course," Bessent noted.

Bessent then described Trump's economic re-ordering of the global economy that will fulfill the 'America First' agenda and urgently resolve the "National Security problem" of critical supply chains in overseas economies run by foreign adversaries. He said there was one good outcome of Covid: "It was a beta test for what would happen if our supply chains were broken," adding that the president would fix and re-shore supply chains back to the Homeland for a "more stable future."

Welker, suffering from extreme "Trump derangement syndrome," tried to trap Bessent with a question about how last week's market turmoil resulted in Americans' "lifetime savings drop significantly."

Before we provide readers with Bessent's response, here's a chart of the WILSHIRE 5000 over 15 years versus Welker's claim that Americans were somehow financially paralyzed last week by the stock drop.

Bessent called Welker's comments a "false narrative" and said, "Most Americans have 60/40 accounts and have a long-term view."

He continued: "Oil prices went down almost 15% in two days, which impacts working Americans much more than the stock market does. Interest rates hit their low for the year, so I'm expecting mortgage applications to pick up."

So much for Welker's 'gotcha moment'...

Bessent downplayed the risk of tariff-driven inflation, describing the tariffs as one-time adjustments. He added that Trump is "raising wages for working Americans and reducing regulations," and noted that the upcoming tax cut bill, along with falling energy prices and interest rates, will benefit the working class

Pressed by Welker on tariff negotiations with trading partners, Bessent said, "I think we're going to have to see what the countries offer and whether it's believable," adding, "We are going to have to see the path forward. After 20, 30, 40 years of bad behavior, you can't just wipe the slate clean."

In a separate interview with Tucker Carlson, Bessent discussed similar topics to those he covered with Welker, suggesting that a reordering of the global economy is underway—one that will ultimately benefit American workers.

He pointed out that the stock market downturn didn't start with tariffs—in fact, it began with China's "DeepSeek" moment earlier this year, calling it "A MAG7 problem, not a MAGA problem."

Bessent pointed out that economic reordering is all about preventing a crash that would've happened given the explosion in government-fueled spending.

Why did "liberation day" blow up the stock market?

— Jim Bianco (@biancoresearch) April 5, 2025

We collectively misunderstood that this was more than tariffs.

It's an attempt to realign the global economy that comes around a few times a century.

---

Scott Bessent, Manhattan Institute 6/6/2024

"We're also at a unique… pic.twitter.com/Snjbi8cDlN

Correct course now, or continue down the path of destruction. Most Americans would agree that acting now to secure the nation and prevent a Marxist takeover is a winning strategy, especially when it comes to maintaining power and preparing for the China challenges of the 2030s.