A rebound in macro data, relative to expectations this week, was notable, but it was driven mostly by 'soft' data upside surprises (and worse still, inflation-expectations rose amid slowing growth signals)...

Source: Bloomberg

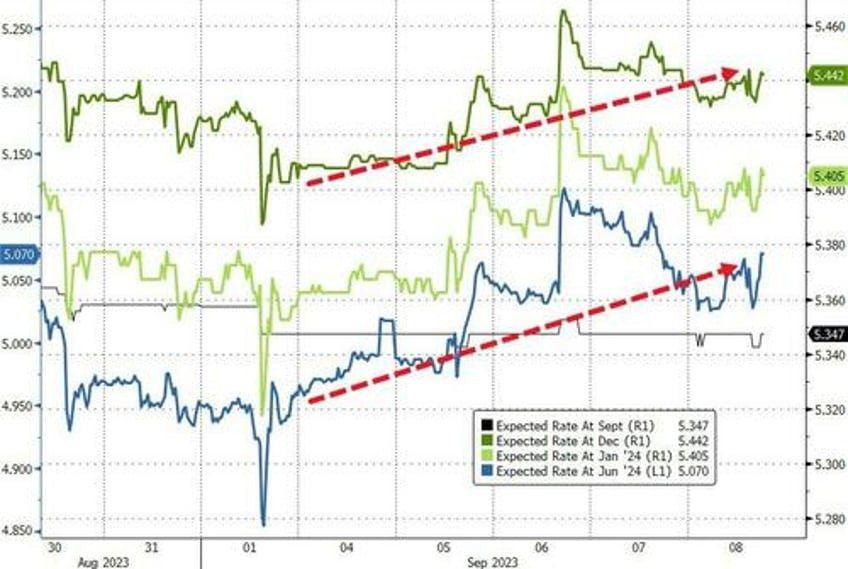

Nevertheless, the market saw strength and repriced STIRs hawkishly higher on the week...

Source: Bloomberg

And that weighed on risk-assets.

Small Caps were clubbed like a baby seal this (holiday-shortened) week but all the majors ended lower...

Energy stocks dominated the week (and are up for the 9th day in the last 10) and along with Utes were the only sector in the green. Industrials and Materials were the laggards...

Source: Bloomberg

Apple suffered its second worst week since November (down 10% from highs in July) as Beijing started to clampdown on iPhone use...

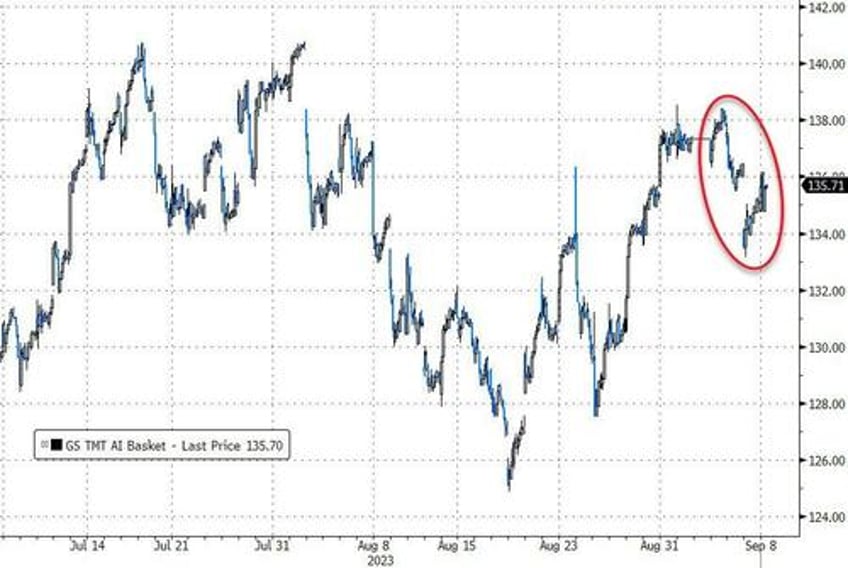

AI Beneficiaries suffered this week as they failed to make a new cycle high and slipped lower...

Source: Bloomberg

...led by a big drop in NVDA, back below pre-earnings levels..

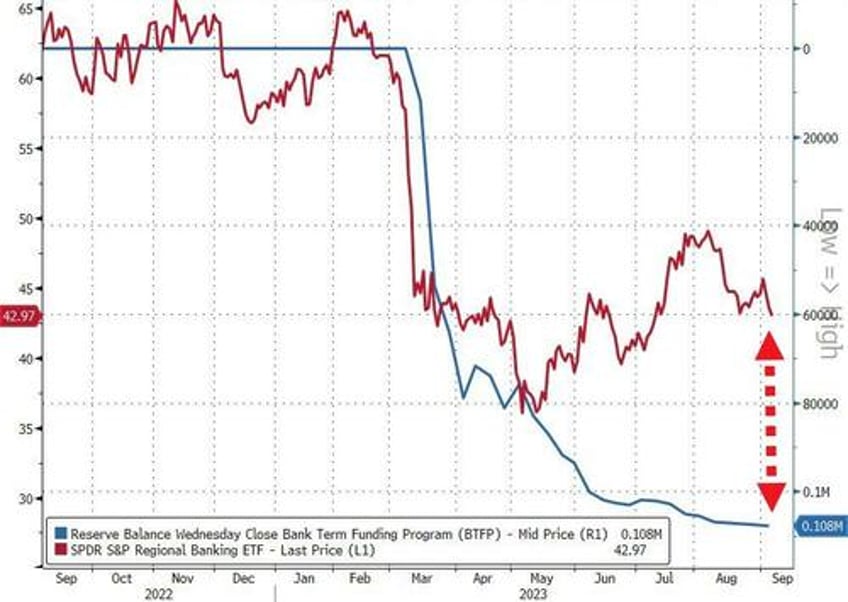

Regional bank stocks are down for the 5th week in the last 6...

...and judging by the continued surge in their usage of The Fed's emergency funds, there could be more to go to the downside...

Source: Bloomberg

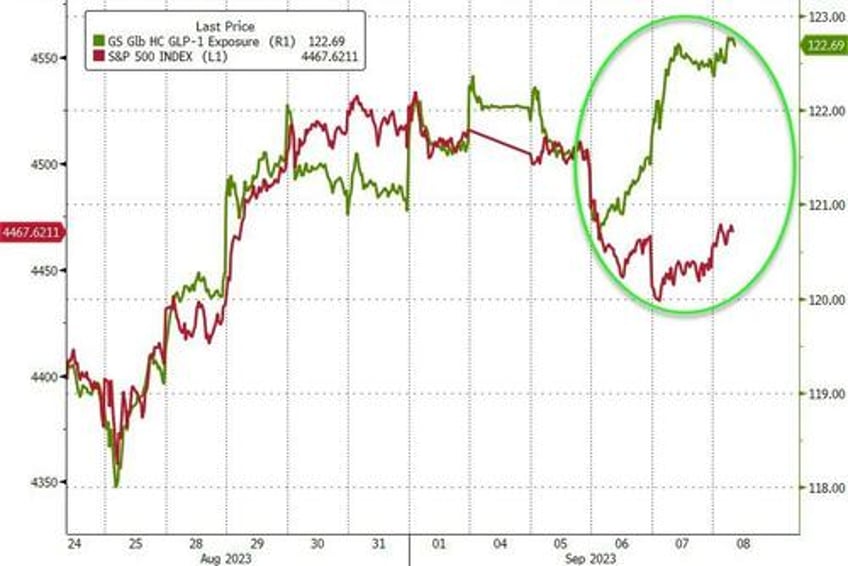

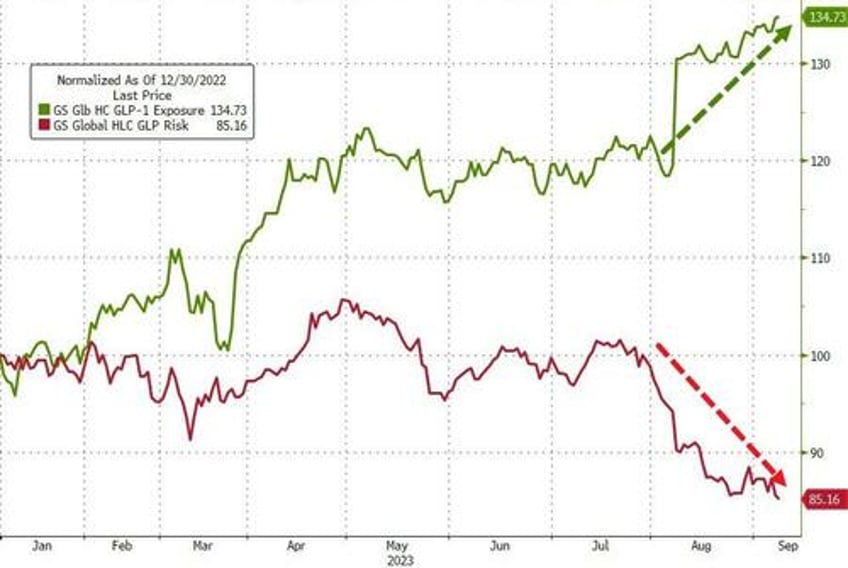

The big winners of the week were fat-loss-drug-peddling companies (GLP-1) which outperformed the market and so-called 'at-risk' companies (healthcare-related firms face pressure from lower obesity, reduced cardiovascular events)...

Source: Bloomberg

It has been a big trade YTD...

Source: Bloomberg

Treasuries were mixed again today with the long-end outperforming (30Y -1bps, 2Y +3bps). On the week, all yields were higher, led by the short-end...

Source: Bloomberg

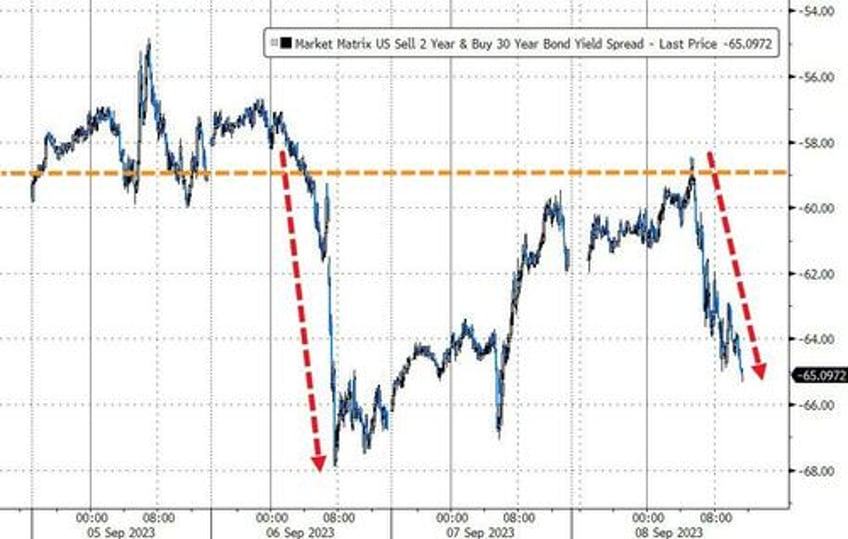

2Y Yields spiked back above 5.00% early in the week but ended back below it as the the yield curve flattened significantly...

Source: Bloomberg

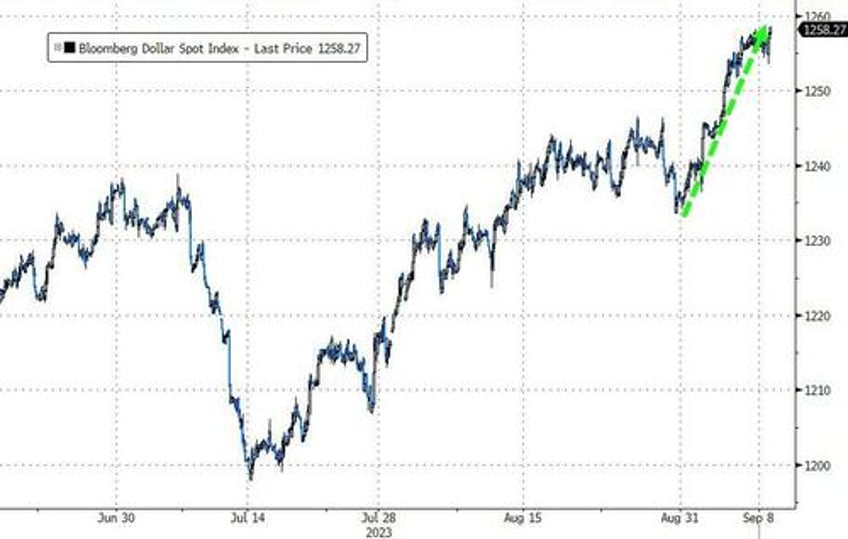

The dollar surged to its best week since February and its highest weekly close since December. The dollar has risen for 8 straight weeks...

Source: Bloomberg

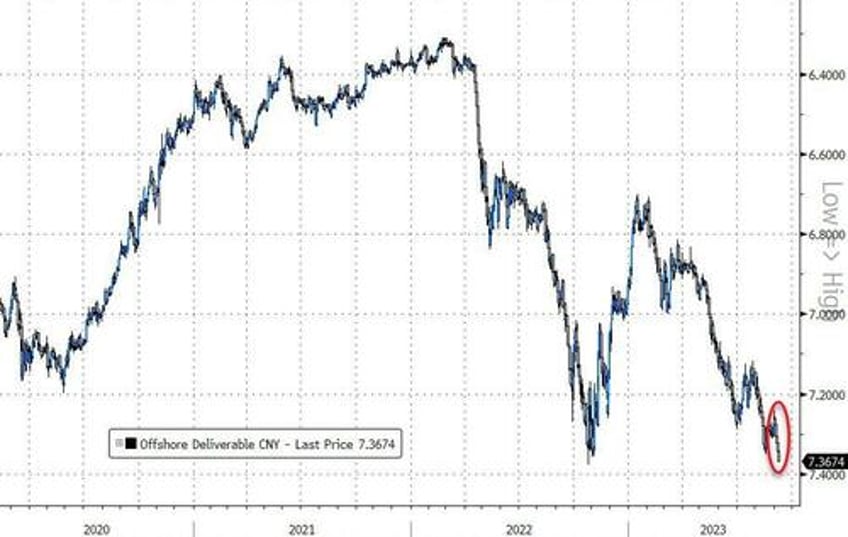

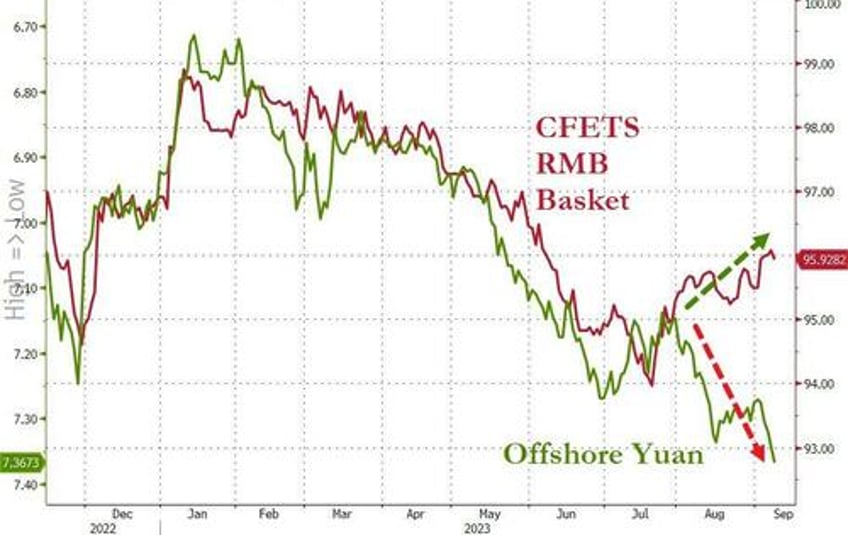

China's offshore yuan fell for 5 straight days against the dollar for its worst week since February to close at a record low against the greenback...

Source: Bloomberg

Notably though, the renminbi has traded stronger relative to its trade-weighted peers (i.e. against everyone but the dollar, the yuan is strengthening)...

Source: Bloomberg

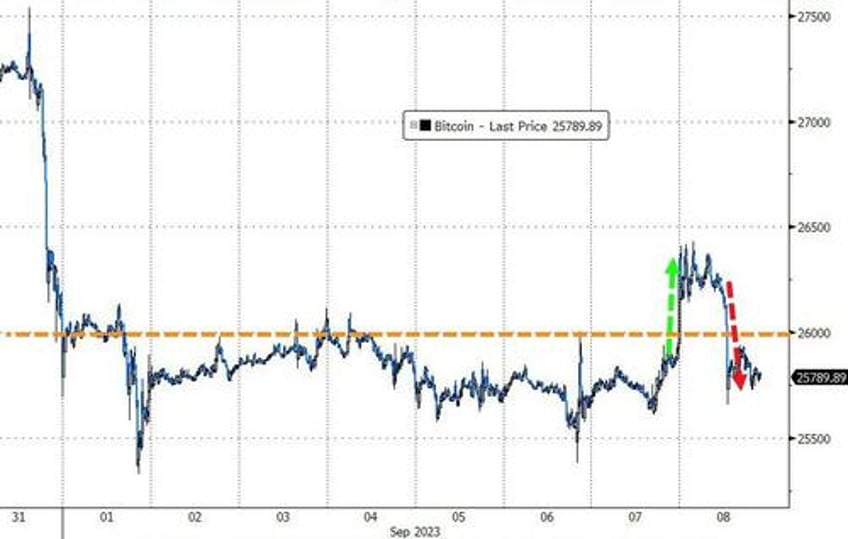

Crypto had a quiet week, interrupted by yesterday's pump and dump, with Bitcoin hovering just below $26,000...

Source: Bloomberg

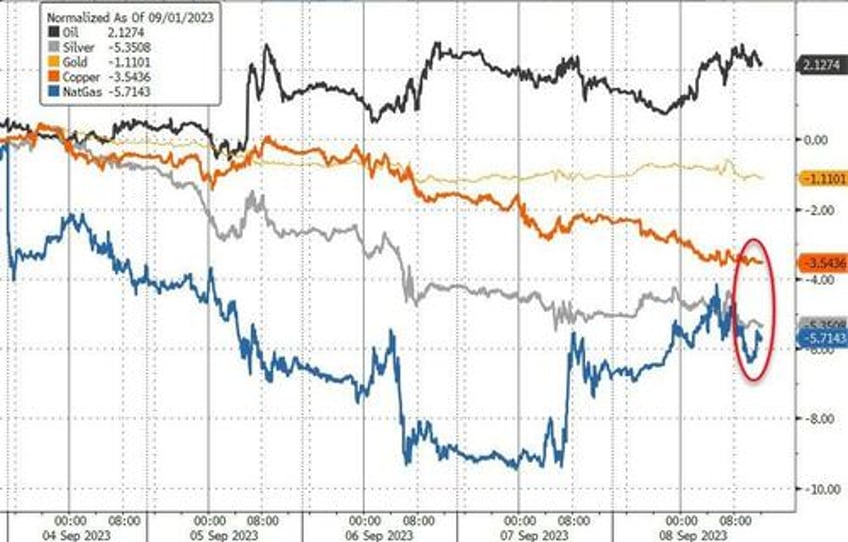

Oil prices rallied for the 9th week of the last 11 with WTI pushing up towards $90 (its highest weekly close since November)

Gold was modestly lower on the week (using the same time period as the chart above for some context)...

NatGas, Silver, And Crude were all down hard on the week...

Source: Bloomberg

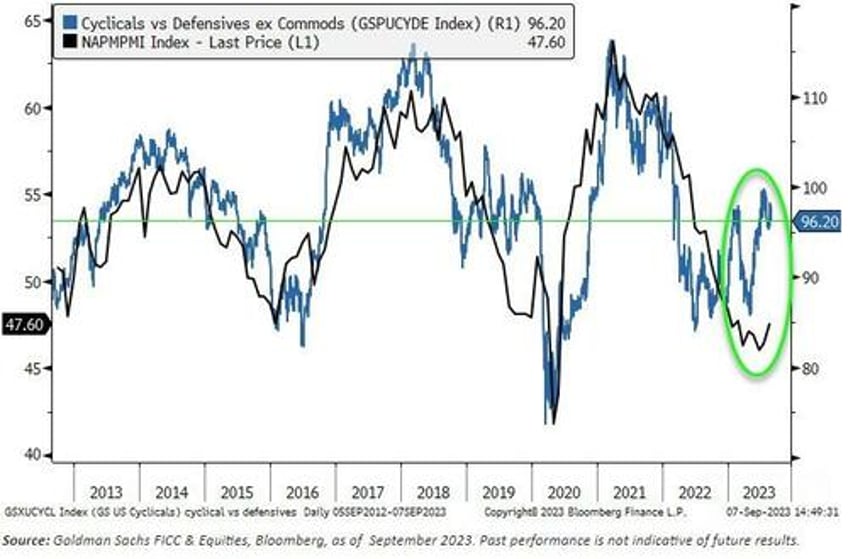

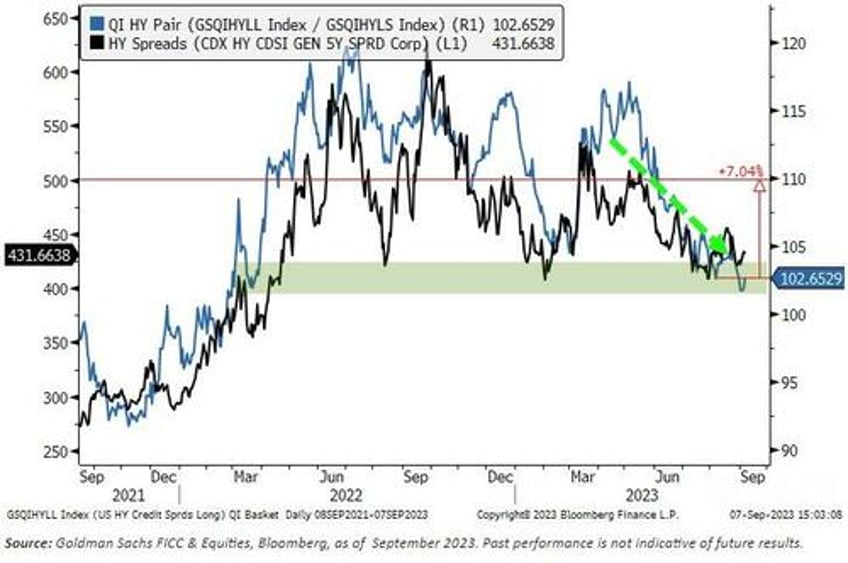

Finally, we point out comments from Goldman's trading desk that Cyclical stocks and High-Yield credit (and credit-sensitive stocks) are priced extremely optimistically with the 'soft-landing' narrative now consensus...

However, as they highlighted, goldilocks is required as 'too-strong' data could lead to higher real rates (bad for risk assets), and 'too weak' data could severely disappoint current cyclical pricing.