Large banks in the US are positioned to take market share in commercial real estate, currently weighing down many banks in the regional sector.

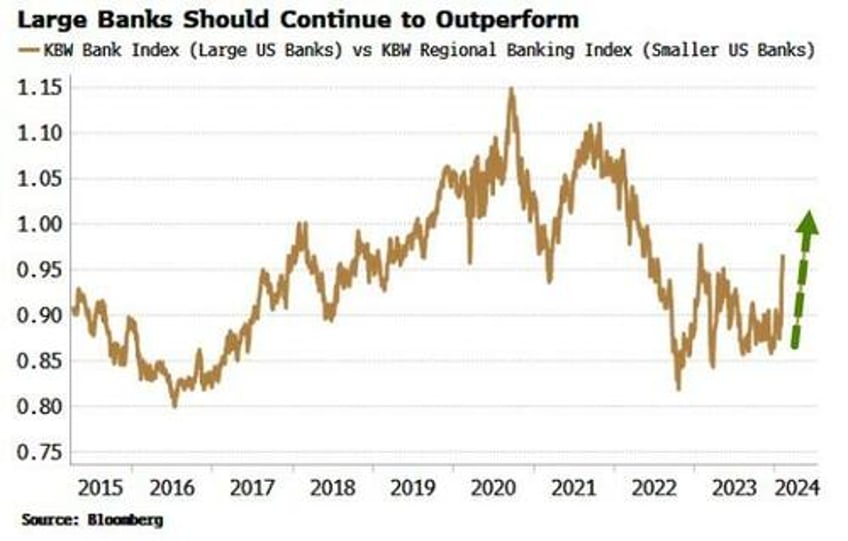

Larger banks’ recent outperformance of their smaller peers should gain momentum.

NYCB’s recent turmoil was a reminder that CRE is a problem for many regional banks in the US (even if some Federal Reserve officials are more sanguine).

According to the IMF, CRE prices have fallen 11% since the Fed started raising rates in March 2022.

Higher debt-servicing costs, falling property prices, a slowing in private-equity fundraising and changing work and shopping patterns have all contributed to CRE’s decline.

Smaller banks have always had a larger exposure to CRE than their larger counterparts. About 30% of small banks’ assets are CRE loans versus 7% for large banks. Moreover, small banks’ exposure has been rising versus their asset base, hitting an interim low of 25% at the beginning of 2022.

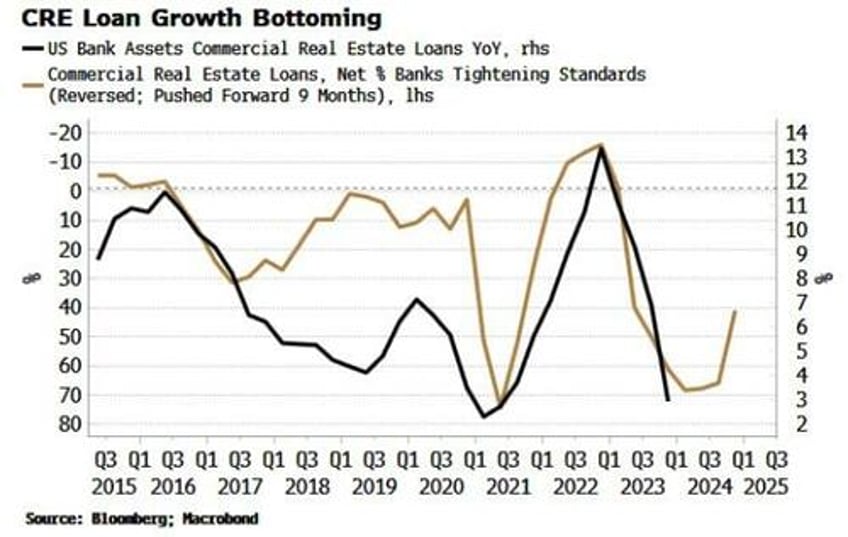

The Fed’s Senior Loan Officer Opinion Survey data, released on Monday for the quarter to the end of January, showed that loan standards for CRE are easing (averaging across the three categories of CRE in the SLOOS: construction and land development loans, loans secured on nonfarm, non-residential properties and loans secured on multi-family residential properties).

As the chart below shows, typically an easing in loan standards leads a rise in CRE loan growth by about nine months. (As a side point, for brevity I use “easing” here to mean “less tightening.”)

It would be unexpected if small banks in the aggregate were easing standards for CRE loans in this environment.

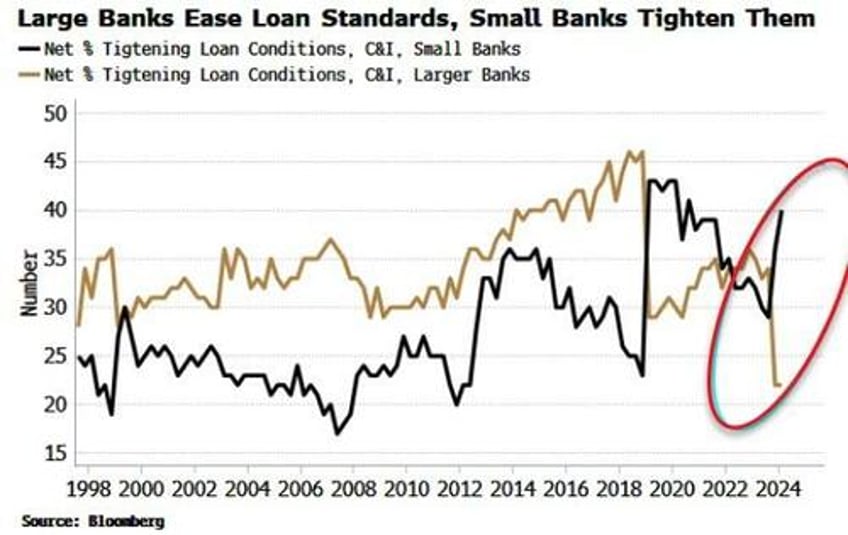

The SLOOS data do not split up responses for large and small banks for CRE, but they do for commercial and industrial loans.

C&I loans are generally a conservative benchmark for all types of bank lending, as their standards tend to be the most stringent because the loans are often unsecured.

Here we see a marked divergence, with large banks easing standards for C&I loans, and smaller banks tightening them.

It’s probably fair to infer therefore that it is the larger banks who are easing lending standards for CRE loans and may be in a position to capitalize from small banks’ distress and the low valuations in the CRE sector.

Either way, large banks have started to outperform regional banks, especially since NYCB hit the skids, and it’s likely that trend will continue in the coming months.

[ZH: And as we have noted numerous times, if the large banks don't 'take' share, they will 'buy' share at pennies on the dollar from the FDIC after the small banks fail...]

Source: Bloomberg

Don't believe us? Here's Jay Powell on Sunday:

"We looked at the larger banks' balance sheets, and it appears to be a manageable problem. There's some smaller and regional banks that have concentrated exposures in these areas that are challenged.

...

There will be expected losses.

It's a sizable problem... it doesn't appear to have the makings of the kind of crisis things that we've seen sometimes in the past.

I don't think there's much risk of a repeat of 2008. I also think, you know, we need to be careful about making proclamations about the.. future.

...

There will be certainly be some banks that have to be closed or merged out of, out of existence because of this. That'll be smaller banks, I suspect, for the most part.

You know, these are losses. It's a secular change in the use of downtown real estate. And the result will be losses for the owners and for the lenders, but it should be manageable."

Is NYCB the next canary 'mole' that needs to be 'whacked' by a Fed 'facility'?